8 Reasons Why We're Not Snapping Snap's IPO

Contributing Authors: Zach Mitchell, John Freeman

Snap Inc (NYSE:SNAP) closed yesterday’s trading session at $24.48, +44%, vs. its initial pricing of $17, concluding the most anticipated tech IPO since Alibaba’s in September 2014. +44% on opening day is great, but it’s worth noting that the opening trade took place at $24.00, and stayed within a range of $23.50 – $26.05. Today, SNAP closed at $27.07, up +10.6%.

The $27.07 share price gives SNAP an impressive (we might say overvalued) $31.3b market cap — about 2.5x the value of Twitter, and greater than the $26b Microsoft paid to acquire LinkedIn last December. To be fair, however, we consider TWTR a bit overvalued as well, and believe the best mechanism for TWTR to realize shareholder value is through an acquisition.

SNAP’s small float — estimated around 12.8% of total shares outstanding — played a significant role in facilitating the large initial jump at the open that persevered all day. The underwriters did a phenomenal job of: 1) ensuring demand, 2) minimizing volatility, and 3) earning healthy commissions.

In the wake of the IPO, it has been reported that NBCUniversal, owned by Comcast (CMCSA), is reported (by CNBC, which is also owned by CMCSA) to have taken a $500m position in SNAP through the IPO, with a pledge to hold the shares at least one year. Other strategic investors in SNAP include Alibaba and Tencent. NBCUniversal has history with SNAP, particularly in the area of reworked content for delivery through Snapchat.

The dynamics behind large IPO allocations are always interesting, and we look forward to SEC filings including SNAP’s 10-Q and high-profile 13-Fs to see who else besides NBC has put their money on yellow.

From a Street perspective, coverage is about as expected:

- Pivotal Research initiated SNAP with a Sell, and a price target of $10;

- Nomura initiated SNAP with a rating of Reduce; and

- Atlantic Equities and Susquehanna both initiated SNAP with a Neutral (which agree with).

So, where does yesterday’s IPO place SNAP relative to its closest peer in the social networking space? (We’re not convinced SNAP is a camera company as they claim.)

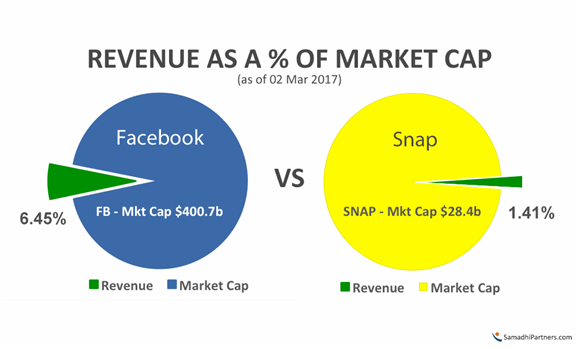

Comparing Market Cap to Revenue for SNAP and Facebook highlights one of our concerns with SNAP: valuation. SNAP’s 2016 revenue represents only 1.41% of its $28.4b post-IPO market cap. In comparison, FB’s 2016 revenue weighs in at 6.45% of its $400.7b market cap. Granted, FB is a considerably more mature, and diverse, firm than SNAP. But — and here’s the important part — they are both competing for a finite pool of advertising dollars for the younger generation of social users.

Despite SNAP’s strong IPO, we’ve got 8 good reasons why we’re not biting on SNAP:

1) Demographic Challenges. We love the stickiness factor of Snapchat, and its solid grip on its target demographic. But that grip is perhaps too tight. SNAP states that the majority of its users are in the 13-34 year old range. But how big is that pool, and how saturated is it today?

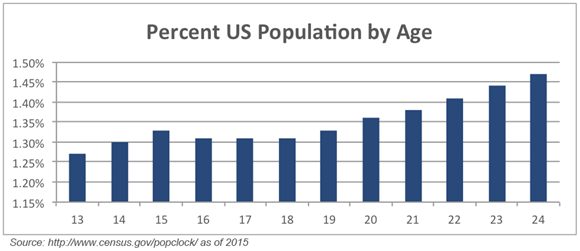

According to SNAP, around 36% of its daily average users in the US (its primary market today) are in the 18-24 year old demographic. Based on 69m North American daily average users, of which we estimate 62.1m are in the US, that works out to roughly 22.36m users between the ages of 18 and 24 – or 71% of the entire US population between those ages. That’s an incredibly high saturation rate, which means that advertising growth (in the US) has to primarily come from increased advertising spend per user, and not additional user growth.

Its second largest segment in the US is the 25-34 year old bracket, which accounts for 27% of its US user base. Moving to the up-and-coming bracket, 13-17 year olds, that only accounts for 22% of its US user base. Here’s the troubling part (for a firm that is primarily targeting the younger generation): the younger user in the US is a declining demographic.

2) Contextual Data. From a market perspective, we are cautious about the “private” nature of SNAP’s appeal and its focus on the millennial segment. SNAP’s initial selling point was its privacy: Users create and share personal moments that automatically disappear after they’ve been viewed. At the time, it was a singularly unique feature, and it appealed to those younger users who were looking at a way to communicate but potentially not remember (or be held accountable for) what they were sending to others. It was a more robust, and fun, form of Instant Messaging (SMS, Text, etc.).

But that privacy-first focus (as well as its “seven most important people” approach) also limits discovery within SNAP’s network. Finding new friends (and expanding the context-rich data available by an ever-growing social graph) is inherently more difficult than on other “open/public” social networks (such as TWTR and FB), and yields a far narrower range of advertising demographics. We feel this lack of discoverability (even as SNAP aggressively moves to expand its target demographic) is still a limiting factor on growth.

3) Voting Rights. There are none. In a bold move, SNAP is issuing non-voting shares for its IPO. The only close analogy that comes to mind is Alphabet, which created two classes of publicly traded shares with different voting rights. In the case of SNAP, this will help protect the firm against activist investors, but it also brings to mind ultimate issues of control and the “lifestyle” nature of the firm.

4) Limited Float. SNAP offered an estimated 12.8% percent of the firm in this initial offering, and while that can help drive up interest in the equity, it can also be viewed as a “we need max cash now” approach that can also bring with it a great deal of beta moving forward (note: FB’s initial float was ~18%).

5) Limited Alternatives. SNAP is coming to market at a point in time where investors are hungry to participate in the “social” market but have increasingly few options. This level of interest could result in any positive earnings results being viewed overly optimistically, resulting in initially inflated values (and we’re all about long-term growth).

6) Valuation. SNAP’s market cap places it at a 50-60x trailing revenue valuation, significantly higher than FB (at 14.0x) and TWTR (at 4.5x) today. Further, both FB and TWTR had significantly lower valuation ratios at IPO despite having social services that appeals to a much broader (larger) target user base.

7) Cloud Commitments. Cash generated from SNAP’s IPO is only slightly higher than its five-year commitments to Amazon, $1b, and Google, $2b, for cloud-based infrastructure (note: SNAP has stated it may additionally pursue building out its own infrastructure).

8) Drones. Word is circulating in the media that SNAP has (or is) experimenting with drones, a potential add-on to its Snaptacles hardware line. Putting aside the many trials and tribulations of GoPro, we actually believe this could be a viable extension of the SNAP brand, particularly if it focuses on smaller, low-cost “party favor” type devices that feed off the personal and happiness factors of SNAP’s “camera” users (and avoids the larger, commercial drone market entirely). However, at this point, the issue of drones is more representative of the larger question of “what’s next” for SNAP, a question for which we do not have an answer at this point.

Looking forward with SNAP

To better understand SNAP, we’ve evaluated the “camera company” (as they have labeled themselves) against our Samadhi Fundy Indexes, which we use as a framework to better understand all companies in our Samadhi Capital client portfolios, as well as those, like SNAP, on our watch list.

MLX (Moore’s Law Index)

We consider the degree with which we believe SNAP can add value from future Moore’s Law-driven increases in computing performance, memory, storage, and network throughput (i.e., leveraging technology’s exponential y/y advances).

Pro: In the case of SNAP, it’s not about creating tech but leveraging tech, which it has done fairly well by continually developing sticky new features. Chief among these have been videos, stories (a string of photos/videos that last for precisely 24 hours), lenses and filters (which allow users to overlay funny or flattering graphics over their photos), Discover (showcased content from a select handful of advertisers), group messaging, and hardware integration (namely Spectacles).

SNAP’s frequent updates have steadily established the company as a trendsetter in social tech. Since usage of Snapchat necessitates a strong Internet connection, SNAP’s user growth should benefit in underdeveloped countries by advances in Wi-Fi and 4G availability (where it is presently bandwidth-constrained). Perhaps even more promising going forward, 5G deployments in developed markets, likely to be economical in smartphones within two Moore’s Law cycles (4-5 years), hold the potential for the manipulating of and/or otherwise adding more value to picture and video content that can be more easily transmitted over 5G but is still challenging with 4G speeds.

Con: SNAP is not doing anything special here. Yes, ongoing incremental upgrades to features have generated attention from new demographics and, consequently, user growth, but we consider most of SNAP’s updates to be gimmicky and, ultimately, incapable of generating long-lasting earnings growth. The bottom line is that we don’t believe that SNAP is taking any greater advantage of Moore’s Law-driven processor/memory/storage/throughput improvements than other social networks, messaging apps, etc.

We rate SNAP’s leveraging of technology a 7 out of 10.

SMX (Samadhi Management Index)

We consider the SNAP management team in areas such as strategy, execution, and transparency.

Pro: From an overall vision and strategy perspective, we believe SNAP’s management is spot on. It has been able to stay on the leading edge of the social media curve and has continually set new trends since its inception – a particularly admirable achievement, given the notorious fickleness of the demographics most active and interested in social media. In the process, SNAP transformed itself from a niche/novelty application to an increasingly mainstream platform that even the most traditional media brands have shown interest in and have been forced to pay attention to.

Management’s own stated goal is to “make people happy” when they use the service, and make its products a place where the users connects with the “seven most important people” in their lives. It may seem minor, but this type of disciplined approach is increasingly rare in the digital world where more eyeballs are generally considered better eyeballs.

Con: The difference between running a private company and a post-IPO company is extreme – just ask the management team at Twitter. SNAP’s executives are clearly talented, but still green on what it takes to be a completely transparent publicly traded company. Achieving profitability – or anything close to it – has also eluded management thus far, despite notable top line growth.

We’re also not sure the distributed “beach-side” corporate office structure (which appears a bit “lifestyle” focused) is ultimately stable enough to fuel fast growth in a very quick-moving, and competitive, market. SNAP grew its employee count by 210% in 2016, and has already begun snapping up larger, yet distributed, office space through the Venice Beach area.

Yes, the management culture is innovative and attracts talent, but even the company itself highlights the shortcomings and risks of this model (they highlight issues of talent in the S1, but we’re not sure risks don’t also include execution as intra-team interaction becomes increasingly difficult).

Going back to SNAP’s “happiness” theme (a point reinforced by what we call the “silly factor” of Snapchat), while this worked well for Coca-Cola with its Happiness Factory campaign, here it runs a risk of turning off older users, a demographic it desperately needs to support as its younger users age up.

We rate SNAP’s management team an 8 out of 10.

CMX (Competitive Market Index)

We consider the type, strength, and sustainability of SNAP’s competitive advantages, including talent, technology, and competitive differentiation.

Pro: From a cultural and target market perspective, SNAP is clearly differentiated against other social networking companies. It is clearly NOT TWTR (nor the now comatose Google+). Its “self-destructing” message feature is the antithesis of Facebook, and it is a universe apart from LinkedIn (or any type of enterprise/business app). It has great talent on board (from executive to dev), and has demonstrated that it can create (and maintain) a unique “cultural aspect” to its offerings that do offer some level of market protection (SNAP is significantly stronger in the younger demographics).

SNAP’s user base is incredibly active, and desired by advertisers.

- The average daily user spends 25-30 minutes per day in the app.

- The average user visits the app 18 times per day.

- 60% of SNAP’s community creates a snap every day.

We also believe that SNAP’s recent shift towards features, such as Live Stories, that enable multi-perspective engagement will further broaden its stickiness with users (over 60% of SNAP ads are watched with sound, a point that we believe greatly increases engagement and, ultimately, brand awareness and conversion).

SNAP’s monetization scheme is based on leveraging its sticky user base in four areas: Ad Products, Ad Delivery, Measurement, and Sales Channels.

Con: SNAP is one of the more vulnerable companies we’ve seen of late from a competitive perspective. Yes, it has great talent, but that talent is quickly becoming commoditized as the “uniqueness factor” of software development gives way to the realities of ongoing software operations. Its tech infrastructure, while solidly in the cloud, performs extremely well but doesn’t appear to have any unique special sauce that can’t be replicated elsewhere.

Further, as we recently wrote in Facebook Slaps at Snap’s IPO, FB has been able to replicate several of Snapchat’s features on a significantly larger scale (and to a much larger audience) across its social media platforms, and FB has also had considerably more success monetizing its user base (although in the higher age brackets above SNAP’s core demographic). While we admire SNAP’s demonstrated ability to trend set, the often-gimmicky nature of its new features and the inability to turn innovations into bottom line growth lead us to temper our praise.

Today, SNAP’s user base, activity, and features aren’t wildly differentiated or more easily monetized when compared to FB (or FB’s Instagram and WhatsApp offerings). In fact, FB’s WhatsApp (with 1.2b monthly active users and +20% y/y growth), recently launched Snapchat-like features including overlaid drawing, captions, and emojis. FB’s Instagram recently launched a Snapchat-like “stories” feature (for pictures and video), while its Messenger service has driven hard into the commerce and marketplace segments).

We rate SNAP’s competitive position a 6.5 out of 10.

BMX (Business Model Index)

We consider SNAP’s means of production, revenue generation, and bottom line efficiency (again, it’s all about users and advertising while controlling costs).

Pro: We like models that can achieve operating leverage fast, and SNAP’s SaaS (Software-as-a-Service) model provides exactly that. As the company grows, we’d expect to see a series of semi-inflection points, where the company takes advantage of its infrastructure and accumulated user behavioral data to open new revenue streams and achieve greater operating leverage.

Con: While we like the core business model, we’re concerned about the slice of the TAM (total addressable market) that SNAP can lock up and continue to grow against FB (and other to-be-developed, social apps). We’re also not convinced that SNAP’s business model is unique enough to maintain a competitive edge, nor are we convinced the company can expand into adjacent market opportunities that readily given its focused user base.

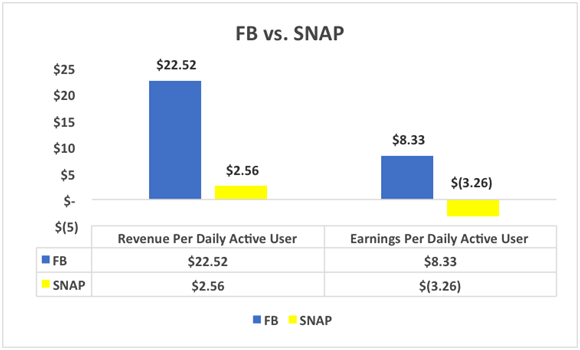

When we look at the financials of SNAP, the picture doesn’t look as robust as the core business model would indicate. SNAP has managed to increase its revenue (generating $404m in FY2016), but it continued to run deeper into the red, with $514m in losses.

*Calculated by dividing FY16 revenue and earnings by DAUs

Unlike FB, which helped launch the social networking market, SNAP is entering an already crowded market and does not have the luxury of slowly growing its revenue per daily active user. Its present $2.56 ARPU (average revenue per use) is still low, and we have doubts as to the size of the addressable market (given SNAP’s current demographic focus) coupled with the lack of attack vectors (mobile only, single app only at this time).

SNAP must quickly demonstrate it can provide a better ROI for its advertising clients, something we consider possible, but challenging in the near-term (our own informal queries to Snapchat users and advertisers have convinced us that FB is the more popular ROI monster in this market).

We rate SNAP’s business model a 6.5 out of 10.

Bottom Line

We believe SNAP has the building blocks to grow its user base and advertising revenue, and admire how SNAP has been able to trend-set in a hyper-competitive social media space, turning heads in the process and often forcing competitors to scramble and catch up. Further, we are not dismissing the possibility of a post-IPO run over the next couple of quarters, as SNAP’s model, while far from proven at this point, could result in relatively moderate ad-revenue growth that would appeal to investors fixated on a “FB alternative” (particularly now that TWTR is, well, TWTR). We’re also intrigued by the blend of low-cost commodity hardware as a mechanism to encourage user engagement.

At this time, however, we’re not convinced that SNAP can achieve the breakout growth in new users and advertising revenue necessary to justify its inflated valuation. SNAP’s lofty P/S, in addition to the enormous magnitude and probability of downside cases, have led us to pass on taking a position at this time. We will instead keep an eye on SNAP’s performance (both financial and management) for reevaluation later this year.

more

I had just read about #Snap's no voting rights in Time Magazine, yet in all the articles I've read online, yours was the first to actually mention this point. It seems rather unprecedented. I believe the article said it was the first time in history this has ever been done. $SNAP

Harry, thank you for the feedback! This is the only IPO of its kind that I'm aware of with zero voting rights for shareholders. The closest in this sector is the split between GOOG and GOOGL, but even that is not so close.

While this insulates SNAP from activist shareholders or potential takeover/acquisition movement, it could punish investors and limit institutional and index appeal.

While this alone would not stop us from adding SNAP to our Samadhi Capital client portfolios, it does make that investment case all the more difficult.

Good article about not buying into the $SNAP hype.

#Snap is going to very quickly replace #Twitter. Change always comes from the next generation - among my friends, I don't know anyone who still uses Twitter; they've all moved over to #Snap. Just like with #Facebook, all you old folks will eventually follow suit. $FB $TWTR $SNAP

Thanks for sharing