5 Strong Reasons To Overweight Big Biotech

If you have little to no exposure to the biotech sector right now, you are making a big mistake. With some of the best valuations and growth prospects in the entire stock market, your portfolio will perform much better with exposure to any one of the four stocks Bret Jensen is recommending today.

“People who make no mistakes lack boldness and the spirit of adventure. They are the brakes on the wheels of progress.” – Dale Turner

The markets had a nice little rally on Friday, but January is still heading towards being the worst performing month for investors since February 2009; the tail end of the financial crisis. We are starting to get into the meat of fourth-quarter earnings season. Expect a lot of commentary around a weak global economy and the impact of the strong dollar during earnings results and guidance issued during the conference calls that follow.

Right now, estimates generally range from approximately $117.00 to $130.00 for earnings from the S&P 500 in 2016. With the S&P 500 trading right near 1,900 that gives us a forward multiple range of approximately 14.6 to 16.2 times projected earnings this year. Consensus earnings estimates always start out high to begin a year and generally drift lower the further we get into the year. Given the anemic world economy and deep problems in energy, commodities, and emerging markets, a more conservative and likely range is probably $110.00 to $115.00 in earnings from the S&P 500 this year. This provides a forward price to earnings range of 16.5 to 17.3 times this year’s S&P 500 profits.

This is not cheap by historical standards nor is it tremendously expensive. However, given the challenging global backdrop, one should be cautious here. An investor cannot count on profit growth or even earnings from either the energy or commodity sectors this year. Manufacturers, Industrials, and American Multinationals will be challenged to show profit growth given tepid overseas demand and a dollar that continues to grow stronger against major currencies.

This is the first reason I like the biotech sector right now, especially the large cap growth names within the area. This is one of the few industries that the major names within will be able to churn out both revenue and earnings growth in 2016 despite a pretty dismal global demand backdrop. Currency impacts also matter less when you have 80% to 90% gross margins which many of the large drug and biotechs produce from their product portfolios.

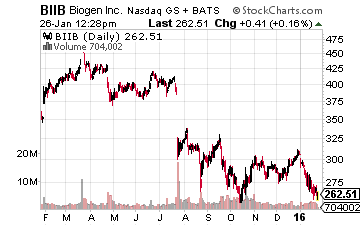

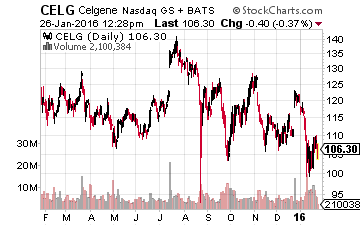

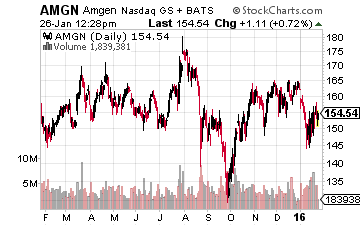

The second reason I like large biotech concerns is they have held up well in a very rocky market. The five large cap core positions within the Biotech Gems portfolio are down less than two percent on average since the launch of that service in April, not including dividends. In addition, these names start to report next week when Amgen (NASDAQ: AMGN), Biogen (NASDAQ: BIIB) and Celgene (NASDAQ: CELG) kick off the earnings parade in the biotech and pharma sector. I expect results to largely exceed expectations like they do almost every quarter. Guidance may not be robust given the cautious global environment, but I do expect it to be solid.

The third reason you want to overweight large biotech concerns within your portfolio is their balance sheets. As the volatility in the high yield or “junk bond” markets has spiked in recent months, there has been a huge divergence in performance between stocks with pristine balance sheets and those with a great deal of debt on their books. This is a key reason industrials, manufacturers, transports,

myriad small caps and even real estate investment trusts which usually do well when the 10-year treasury yield is falling have cratered of late.

Almost every large pharma and biotech company with the exception of the occasional

Valeant Pharmaceuticals (NYSE: VRX)

has a rock solid balance sheet. Many have more cash than debt on their balance sheets and most produce a tremendous amount of free cash flow.

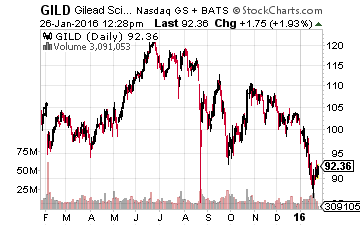

Gilead Sciences (NASDAQ: GILD)

for example should deliver some $15 billion in free cash flow in FY2016 thanks to sales from its blockbuster hepatitis C drugs Sovaldi and Harvoni. That is better than a 10% free cash flow yield at current prices.

The fourth reason you want to own these large cap names is valuation. Usually, this sector trades at a premium to the market. Thanks to the recent bear market in the sector, many of the stalwarts in the space are priced at a significant discount to the overall market. Gilead is priced at under eight times earnings. Amgen is selling at 14.5 times forward earnings and has a 2.6% yield thanks to a recent 27% dividend hike. AbbVie is selling at just over 11 times forward earnings and yields right at four percent. Additionally, earnings should grow at a 15% to 20% clip this year.

Finally, despite the slow start to the New Year I expect M&A activity to remain robust after 2015’s record dollar amount of deals. Shire (NASDAQ: SHPG) recently succeeded with its over $30 billion buyout offer of Baxalta (NASDAQ: BXLT). With many small and mid-cap concerns down 30% to 60% due to the recent carnage in the market, values are much more attractive for suitors than they were just this summer.

Look for Gilead to be active in this space in 2016 due to its financial firepower and recent comments from management. The biotech juggernaut has not made a major acquisition since it bought Pharmasset for $11 billion in 2011. This transaction brought it Sovaldi and Harvoni which are doing approximately $5 billion a quarter in sales currently. The purchase will one day be a Harvard Business Review case on one of the most accretive purchases in the history of the sector.

The bottom line is that big biotech will be able to replenish and enhance their pipelines and product portfolio on a much cheaper basis than at the valuations that existed six months ago. Look for the sector to do just that and this completes the five reasons you want to overweight these large cap growth positions in this sector within your portfolio at the current moment.

Position: Long CELG, AMGN, BIIB, GILD