5 Stocks To Watch This Week - Tuesday, Nov 8.

Tuesday, November 8

Wednesday, November 9

Thursday, November 10

![]()

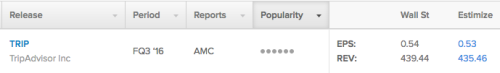

TripAdvisor (TRIP) Consumer Discretionary - Internet & Catalog Retail | Reports November 8, after the close.

The Estimize consensus is looking for earnings per share of $0.53, one cent below the sell-side consensus and in-line with the same period a year earlier. That estimate has decreased 7% since TRIP’s last quarterly report. Revenue is anticipated to increase 6% to $435.5 million, slightly lower than Wall Street’s consensus.

What to Watch: Stronger travel trends are emerging as evidenced by robust results from the airlines, Expedia, Las Vegas Sands and Priceline this earnings season. This should bode well for often beaten down TripAdvisor. Shares are down 25% in 2016 on two consecutive weaker than expected quarterly results. TripAdvisor operates in a very competitive online travel agency market that is largely a two horse race between Expedia and Priceline. TRIP is beginning to close the gap though with the acquisition of CityMaps and a new more user friendly website, as well as a focus on mobile and Instant Booking. Expectations have still edged lower in the past 3 months with analysts calling for flat earnings growth and a 6% increase on the top line. Foreign currency translate remains a big concern for Q3.

Shake Shack (SHAK) Consumer Discretionary - Hotels, Restaurants & Leisure | Reports November 9, after the close.

The Estimize consensus is looking for earnings per share of $0.16, one cent higher than Wall Street and up 35% from the same period last year. That estimate has increased 2% since SHAK’s most recent report. Revenue is anticipated to increase 31% YoY to $69.95 million, slightly higher than the sell-side consensus. The stock is down 18% YTD.

What to Watch: In its early days on the market, many investors were convinced that Shake Shack was well on its well to replacing Chipotle as the new face of fast casual. Thanks to a string of slower than expected quarters those notions have receded. The burger chain has struggled to sustain high growth and rapid expansion as it goes through the maturation process. These growing pains are likely to continue for the near future until revenue and margins are commensurate with its value. Despite high growth expectations for the quarter, those have declined significantly when compared to the fact that Q2 2015 - Q1 2016 produced YoY profit growth rates in the triple digits. Same-Shack Sales have also fallen, to 4.5% last quarter from 9.9% in the first quarter of 2016. At the moment the stock is considered well overvalued given what they deliver quarter after quarter. Shake Shack shares have fallen 18% year to date.

Macy’s (M) Consumer Discretionary - Multiline Retail | Reports November 10, before the open.

The Estimize consensus is looking for earnings per share of $0.43 on $5.66 billion in revenue, above Wall Street by 2 cents on the bottom-line and by $37M on the top. Compared to a year earlier, this reflects a 18% decrease in earnings and a 3% decrease on sales. Earnings estimates have increased by 8% since the last quarter, while revenues have stayed flat. The stock is up 8% since the beginning of the year.

What to Watch: Macy’s is the first of the department stores to report on Thursday morning, followed by Nordstrom and J.C. Penney later in the week. The company is poised to report its 7th consecutive quarterly decline on both the top and bottom-line. Macy’s management has already indicated that the quarter to be reported could see sluggish growth on weak sales and excess inventory. The company is still recovering from its Q1 report which recorded the largest decline in comparable store sales since the Financial Crisis, of -5.6%. Macy’s cut its full year guidance after the report, setting the bar even lower for the department store in the coming months. SSS improved to -2% in Q2, but was still negative. The slowdown has pushed the retailer to be more aggressive with markdowns despite its impact on margins. Weak international tourism trends and currency headwinds have also added another layer of uncertainty around potential profit growth.

Disney (DIS) Consumer Discretionary - Media | Reports November 10, after the close.

The Estimize consensus calls for EPS of $1.19, 4 cents above the Wall Street consensus. Meanwhile, revenue expectations of $13.56 billion are $10M below the sell-side consensus. Expectations have fallen 3% since last quarter, putting YoY growth expectations at 0% for EPS and 1% for sales. The stock is down 10% for the year.

What to watch: Disney has been at the forefront of takeover talks for both Netflix and Twitter. It’s clear that Disney media networks have struggled due to wider adoption of cord cutting behavior. ESPN has been the biggest of its problems as subscriptions and revenue continue to decline. Twitter and Netflix would provide Disney with a non-traditional platform to display its original content. The company’s movie portfolio didn’t include any huge hits in the quarter about to be reported, and may show a decrease due to a tough comparison from a year ago which featured blockbusters such as Ant-Man. Parks & Resorts is still expected to be a big winner for the media giant, with robust visitors numbers from the summer.

Michael Kors (KORS) Consumer Discretionary - Textiles, Apparel & Luxury Goods | Reports November 10, after the close.

The Estimize consensus is looking for earnings of $0.92 per share on $1.095 billion in revenue, 4 cents higher than Wall Street on the bottom line and $13 million above on the top. Compared to a year earlier, earnings are expected to decrease 8% with revenue falling 3%. EPS estimates have been pushed down by 8% since the last quarterly report, and revenue estimates have come down 1%. Even so, the stock is still up 26% YTD.

What to Watch: After weak revenue results from Kate Spade and Coach already this season, luxury brands appear to be unraveling. This doesn’t bode well for Michael Kors who reports its third quarter results on Thursday. With a large exposure to volatile international markets and currency headwinds, both earnings and revenue could see their first downturn in over a year, after just getting by with flat growth in Q2. Estimates are seeing downward revisions activity ahead of its report, typically a sign of a miss on the horizon.

The main focus for KORS will be comps which in the past were driven by new store openings, expanding existing outlets and building out its omnichannel capabilities. But the retail environment is more challenging these days. Luxury brands and longtime status symbols are simply not resonating with consumers like they have in the past. As a result we have seen a great deal of discounting from key brands including Michael Kors. Discounting may very well drive sales but it also puts pressure on margins.

Disclosure: None.