5 Stocks To Watch This Week - October 31, 2016

(Photo Credit: Christopher)

Tuesday, November 1

![]()

![]()

Wednesday, November 2

![]()

Thursday, November 3

![]()

Coach (COH) Consumer Discretionary - Textile, Apparel and Luxury Goods | Reports November 1, before the open.

The Estimize consensus is looking for earnings per share of $0.45, one cent above the sell-side consensus and 11% higher than the same period a year earlier. That estimate has decreased 6% since Coach’s last quarterly report. Revenue is anticipated to increase 4% to $1.066 million, in-line with Wall Street. The stock is up 9% since the beginning of the year.

(Click on image to enlarge)

What to Watch: For the last two quarters, Coach has been able to produce double-digit growth on both the top and bottom-line as it undergoes a major brand revitalization. While revenue growth is expected to slow this season, there are still some bright spots as the luxury goods maker heads into its best quarter of the year, the holiday season. The acquisition of Stuart Weitzman in 2015 has been very positive as the Coach strives to expand its portfolio of brands. New campaigns featuring ‘it girl’ Gigi Hadid have played well with younger millennial consumers, a demographic that Coach has struggled to attract in the last few years. Headwinds for the quarter still include a stronger US dollar as the company expands globally, and a value-conscious consumer that isn’t necessarily spending on high-end items right now.

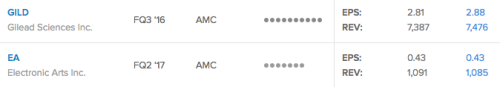

Gilead Sciences (GILD) Health Care - Biotechnology | Reports November 1, after the close.

The Estimize consensus is looking for earnings per share of $2.88, 7 cents higher than Wall Street and down 9% from the same period last year. That estimate has decreased 9% since Gilead’s most recent report. Revenue is anticipated to decrease 9% YoY to $7.48 billion, as compared to the sell-side’s consensus of $7.39 billion.

(Click on image to enlarge)

What to Watch: Gilead Sciences has turned a fruitful 2015 into a troublesome 2016 after a string of weaker than expected earnings reports. Shares are down 27% year to date as investors jump ship to better performing companies. A large portion of this draw-down has been driven by weaker sales of its flagship Hep C products; Harvoni, Sovaldi and the recently launched Epculsa. These treatments were primarily credited with the company’s double digit gains in 2014-15 and are now being blamed for negative growth in fiscal 2016. In the second quarter, the group of drugs recorded a 18.5% decline primarily due to lower sales of Harvoni. Harvoni sales were down a resounding 29% as new competition, mainly from Merck, seize its market share. Weak performance from the Hep C franchise was not only disappointing in the U.S. but Europe as well.

This sharp downturn caused management to cuts its outlook for the year in the range of $29.5 to $30.5 billion from $30-31 billion. Nevertheless some of these losses should be somewhat offset by its growing HIV business which includes a handful of already established treatments. Also, a robust pipeline positions Gilead for an easy bounceback in the near future. Setbacks from HCV will nonetheless be the primary talking point from this quarterly report.

Electronic Arts (EA) Information Technology - Software | Reports November 1, after the close.

The Estimize consensus calls for EPS of $0.43, in-line with Wall Street’s consensus. Meanwhile, revenue expectations of $1.085 billion are $6M below the sell-side consensus. Expectations have fallen 30% since last quarter, putting YoY growth expectations at -31% for EPS and -5% for sales. Despite negative expectations for Q3, shares are up over 16% for the year.

(Click on image to enlarge)

What to watch: Electronic Arts started the year on a hot streak thanks to the overwhelming success of Star Wars: Battlefront. That has since cooled off and Electronic Arts is coming off a weaker than expected FQ1 2017 printing a 53% decline on the bottom line and 2% on the top. The second quarter unfortunately doesn’t fully cover the annual release of FIFA and Madden video games. These games are often two of highest grossing games year after year and typically carry quarterly results, but investors will have to wait until the third quarter

Meanwhile, smartphone owners can expect to see new versions of FIFA, Madden and even a Star Wars based game. This is a new facet that Electronic Arts had previously never recognized but is now a huge source of revenue. The biggest factor, however, is growth in digital sales and in-game purchases. This new wave of digital offerings are not only convenient they also generate the highest margins. If Electronic Arts can continue to see strong growth in digital offerings then expect to see more favorable price movement.

Facebook (FB) Information Technology - Internet Software & Services | Reports November 2, after the close.

The Estimize consensus is looking for earnings of $1.03 per share on $7.01 billion in revenue, 5 cents higher than Wall Street on the bottom line and $91 million above on the top. Compared to a year earlier, earnings are expected to increase 78% with revenue jumping 55%. EPS estimates have been pushed up by 7% since the last quarterly report, and revenue estimates have come down 4%. The stock has risen 25% YTD.

(Click on image to enlarge)

What to Watch: Facebook continues to top earnings and revenue expectations driven by strength in its mobile platform and strategic acquisitions. The upcoming quarter will be the first to feature sales figures from the highly anticipated Oculus Rift. Virtual reality is expected to be one of the fastest growing sectors, providing a new source of revenue moving forward. This should help offset the blow Facebook is about to take after years of over-inflating its video metrics. This type of mistake will certainly have a short-term impact on advertising revenue.

Additionally, SnapChat is on pace to become a legitimate threat to Facebook’s core business, sooner rather than later. The Evan Spiegel run company currently boasts 60 million daily users in the U.S. and Canada, about a third of what Facebook has in these markets. Even so, FB still recorded 1.71 billion monthly active users (MAUs) last quarter, an impressive 15% YoY increase despite a maturing business here in the US. Daily active users (DAUs), an even better measure of user engagement, came in at 1.03 billion, or a 22% increase.

Starbucks (SBUX) Consumer Discretionary - Hotels, Restaurants & Leisure | Reports November 3, after the close.

The Estimize consensus is looking for earnings per share of $0.56 on $5.69 billion in revenue, above Wall Street by 1 cents on the bottom-line and in-line on the top. Compared to a year earlier, this reflects a 29% increase in earnings and a 16% increase on sales. Earnings estimates have increased by 2% since the last quarter, while revenues have fallen by 1%. The stock is down 11% since the beginning of the year.

(Click on image to enlarge)

What to Watch: Comments around Starbucks global expansion are expected to take centerstage during Thursday’s report. The company currently has 24,000 stores in 70 countries worldwide, with increasing store counts in China being the main focus. Last quarter featured a 4% gain in comparable store sales, and an even higher 7% in China. A revamped customer loyalty program earlier this year is proving to be the most successful initiative. In April, Starbucks updated its reward program which now rewards customers for every dollar spent instead of the number of visits, making it one of the most popular loyalty programs of any retailer. The coffee chain also has introduced wildly popular mobile initiative, such as mobile order and pay which reached 5% of US transactions last quarter.

Disclosure: None.