5 Stocks To Watch This Week - Monday, January 23

(Photo Credit: iweatherman)

Monday, January 23

![]()

![]()

Wednesday, January 25

![]()

Thursday, January 26

McDonald’s (MCD)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports January 23, before the open.

The Estimize consensus is looking for earnings per share of $1.45, four cents above the sell-side consensus and 13% higher than the same period a year earlier. That estimate has increased 2% since McDonald’s last quarterly report. Revenue is anticipated to decrease 5% to $6.05 billion, $62M above Wall Street.

What to Watch: McDonald’s success in 2016 was largely the result of two key promotional campaigns that drove earnings and sales higher; the McPick 2 and all day breakfast. Both initiatives helped attract a wider audience and were more appealing to value-focused consumers. This year the focus shifts to growing the McCafe brand, expanding internationally, and revamping some of its classic menu items. Many of these initiatives, which are already underway, provide a much needed level of support to McDonald’s fourth quarter report scheduled to take place early Monday morning.

McDonald’s strategy to boost sales in the last year included greater marketing promotions, newer menu items, expanding the mobile app, and improving the customer experience. In the third quarter same store sales rose by 3.5% with across the board improvements in both the global and domestic sector. Sales in the United States gained 1.3%, mostly from the 3 menu promotions.

Looking forward, McDonald’s faces tougher comparisons as McPick 2 and All Day Breakfast sales dry up. To offset any lost sales, McDonald’s plans on expanding its McCafe brand by opening standalone stores and offering $1 any size coffee. These changes directly challenge Starbuck and Dunkin Donuts long held dominance in the coffee space.

Boeing (BA)

Industrials - Aerospace & Defense | Reports January 25, before the open.

The Estimize consensus is looking for earnings per share of $2.48, 14 cents above the Wall Street consensus and up 55% from the same period last year. That estimate has stayed flat since Boeing’s most recent report in October. Revenue is anticipated to be inline YoY at $23.59 billion, as compared to the sell-side’s consensus of $23.45 billion.

What to Watch: After a rough start to 2016, Aerospace & Defense stocks ended the year on a high note, with president Trump vowing to increase spending. However, the president has thrown the industry some curveballs, often pitting defense companies Boeing and Lockheed Martin against each other, and tweeting about the high cost of products made by the two.

In one such tweet, Trump proclaimed “cancel order” in reference to the Boeing Air Force Ones meant to be delivered in 2022 for $4B and caused the stock to fall, but it quickly rebounded. At the end of the year another tweet addressed the high cost of the Lockheed Martin F-35, in favor of the Boeing F-18 Super Hornet. Again LMT stock dropped, only to rise back to previously-held levels.

Boeing continues to show strong order bookings and order backlog, recording a defense backlog of $53B at the end of Q3 2016. For 2017, Boeing is focused on expanding internationally, recently penning a $16.6B deal with Iran Air for 80 jetliners.

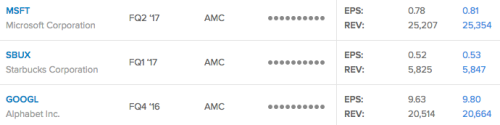

Microsoft (MSFT)

Information Technology - Software | Reports January 26, after the close.

The Estimize consensus calls for EPS of $0.81, 3 cents above the Wall Street consensus. The Revenue expectation of $25.35 billion is $147M above sell-side consensus. Expectations have increased 2% since last quarter, putting YoY growth expectations at 2% for EPS and -1% for sales.

What to watch: Microsoft posted impressive results in its most recent report, recording a 5 cent beat on the bottom line and nearly $600 million on the top. A majority of these gains came from its cloud computing and productivity segments. MS Azure is now firmly the second best cloud computing platform only behind Amazon Web Services. Personal Computing only declined 2%, most of which came from waning phone and gaming demand. A shocking 38% increase in tablet sales during the first quarter have Apple investors questioning what the company can do to jumpstart iPad sales.

The Q3 report also caused a huge breakout in its technicals which could be the start of a lengthy run. A new peak in the on balance volume, bullish crossover in the MACD and 20 day moving average all indicate positive upside.

More recently, the company released two new products, Microsoft Teams and the large studio tables, both of which are expected to compete with established players in their respective spaces, Slack and Apple. If Microsoft can establish any sort of foothold that would be enough to justify shares moving higher.

Starbucks (SBUX)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports January 26, after the close.

The Estimize consensus calls for EPS of $0.53, 1 cent above the Wall Street consensus. Revenue expectations of $5.85 billion are in-line with the sell-side consensus. Expectations have decreased 3% since last quarter, putting YoY growth expectations at 16% for EPS and 9% for sales.

What to watch: Starbucks was dealt a massive blow last month when its renowned CEO Howard Schultz decided to step aside from his position for a smaller role in the company. Many believe this will turn out to bite the coffee chain as it did nearly 10 years ago. Despite the shakeup in management, the company is still moving forward with it’s massive expansion plans, with the main focus on China. In their fiscal Q4 Starbucks opened 690 net store, bringing the store total to 25,085 in 75 countries worldwide. The quarter also features a SSS increase of 4%, and an even higher 6% in China.

A revamped customer loyalty program earlier this year is proving to be the most successful initiative. In April, Starbucks updated its reward program which now rewards customers for every dollar spent instead of the number of visits, making it one of the most popular loyalty programs of any retailer. The coffee chain also has introduced wildly popular mobile initiative, such as mobile order and pay which reached 5% of US transactions last quarter.

However, competition is stiff, McDonald’s recent initiative to expand its McCafe brand will put pressure on the near term outlook of Starbucks. The golden arches is claiming it will sell coffee anywhere between $1 and $2, roughly half the price of any Starbuck’s beverage.

Alphabet (GOOGL)

Information Technology - Internet Software & Services | Reports January 26, after the close.

The Estimize consensus is looking for earnings per share of $9.80 on $20.66 billion in revenue, above Wall Street by 17 cents on the bottom-line and $150M on the top. Compared to a year earlier, this reflects a 12% increase in earnings and a 19% increase on sales. Earnings estimates have remained flat since the last quarter, while revenues increased 2%.

What to Watch: Google started off the second half of 2016 on a strong note, topping analysts’ expectations by a whopping 38 cents in the third quarter. Investors are hoping the tech giant can keep the momentum going in the fourth quarter after stalling some what in the first half of 2016 as losses from its moonshot investments piled up.

Those concerns appear to have been put to rest after the most report which featured a surge in their core mobile search and video businesses. Paid clicks increased 42% from a year earlier, roughly 10% higher than the industry average of 32%. New devices, Youtube and other strategic initiatives are expected to help diversify Google’s revenues and enrich its capabilities. So far the Google Home and Pixel have been well received and should shift the heat back to Amazon and Apple which offer comparable products.

Be sure to get your estimates in here!

Disclosure: None.

Thanks for sharing