5 Stocks To Watch - Earnings Reports Due Week Of Aug. 3

Reports Tuesday, August 4

![]()

Report Wednesday, August 5

Report Thursday, August 6

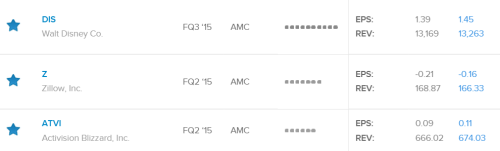

Walt Disney (DIS)

Walt Disney reports its FQ3 ’15 results after the closing bell on Tuesday. Currently, the Estimize community, consisting of 49 analysts, is predicting an EPS figure of $1.45 compared to Wall Street consensus of $1.39. EPS YoY growth has registered double digit figures for seven out of the past eight quarters. Estimize is also predicting higher revenues of $13.251B relative to Wall Street’s $13.169B consensus, up from $12.461B last quarter.

Disney has demonstrated a pattern of positive earnings per share growth over the past two years. Market commentary leading into the result points to the belief that this trend should continue. During the past fiscal year, Disney increased its bottom line by delivering an EPS figure of $4.25 versus $3.38 in the prior year. This year, the market expects an improvement in earnings to reach $5.05.

Despite all the positive fundamentals associated with Disney at present, the company’s bottom line is expected to be affected by the strong U.S. Dollar. Once converted back to the greenback, Disney’s offshore revenues will be negatively affected and could have a material impact on earnings.

Zillow (Z)

Zillow also reports its FQ2 ’15 figures on Tuesday and unlike Disney, Zillow is expected to report falls YoY in EPS and revenue. Estimize are predicting an EPS figure of -$0.16 and Wall Street is predicting -$0.21. In terms of revenues, Estimize are predicting a figure of $165.97M and Wall Street comes in slightly above this figure at $168.85.

Peak housing season should be kind to Zillow’s monthly unique visitors, which in January 2015 hit 36M, but the Q1 acquisition of Trulia will add a significant amount more. The company has been doing well on both sides of its business: marketplace revenues, which consists of local real estate agent subscriptions, ad display revenues from advertising.

The report on Tuesday will be very important for Zillow as management attempt to stimulate the company’s stock price after continual decline.

Activision Blizzard (ATVI)

After Electronic Arts (EA) posted stronger than expected quarterly results earlier this week, Activision Blizzard will follow suit, reporting its FQ2 ‘15 results on Tuesday. With Wall Street EPS estimates coming in at $0.09 and revenue at $666M, it appears that the company will beat estimates for the 9th straight quarter. The Estimize EPS consensus of $0.11 and revenue consensus of $687M present slightly more bullish numbers than that of the Street, expecting YoY growth of 120% for EPS and 5.2% for revenue.

Recently, Activision Blizzard added two new members to its board of directors. The first is a former Activision employee and the current CEO of Brynwood Partners, a private equity firm that specializes in consumer goods. The second is the CEO of Wasserman Media Group, a marketing and management agency that specializes in sports and entertainment. Activision Blizzard is hoping that the addition of these two new members to its board will provide some valuable insight into their business.

In terms of their products, Activision Blizzard has a few releases in the pipeline. As revealed at Comic Con in early July, a World of Warcraft movie is currently in production. Although no trailers were released, posters unveiled at Comic Con have peaked both investor and consumer attention. Also, the newest addition to the Call of Duty series, Call of Duty Black Ops 3, is scheduled to be released sometime in the upcoming months.

Tesla (TSLA)

Tesla, the electric vehicle manufacturer is also reporting this week. Year-to-date (YTD), Tesla has performed well for investors providing a capital return of 19.98% relative to the NASDAQ index which has appreciated 6.34%.

Leading into Tesla’s FQ2 ’15 results, Estimize are predicting a fall in earnings YoY and a slight fall QoQ. Estimize are predicting a negative EPS figure of -$0.51 which is higher than Wall Street’s prediction of -$0.57. Estimize predict $1.164B and Wall Street have a consensus of $1.153B.

Investors and analysts will be interested to hear from Elon Musk with respect to the announcement the company made on Wednesday introducing a referral program for Tesla owners. The referral program allows Tesla owners to earn $1,000 for each referral they get from other buyers of Tesla vehicles. The referral program has received a mixed reaction from the market, with some analysts excited about the idea and some analysts taking this as a bearish precursor to sales. Market participants will be looking to obtain more guidance on the decision and what the expected benefits are.

Another key update will be expected on Tesla’s development of its autopilot technology for its Model S car. Currently, the autopilot allows drivers to automatically change lanes on a highway with a touch of a button. The current autopilot can also read speed-limit signs and detect pedestrians. Elon Musk recently announced through Twitter that the new autopilot feature will allow drivers to travel distances on highways “without touching any controls at all.” This development is obviously exciting for investors and analysts and will be focused on during the company’s quarterly report.

Michael Kors (KORS)

It’s no surprise, Michael Kors (KORS) has had a dreadful year, their stock price YTD has collapsed over -43% compared to the broader S&P 500 which has risen 2.6%. The Estimize community is predicting better EPS and revenue figures than Wall Street for Michael Kors. According to Estimize, Michael Kors will produce $0.79 in EPS and $955.51M in revenues, whereas Wall Street analysts are predicting $0.75 in EPS and $942.99B in revenues.

Michael Kors’ struggles are a result of many factors, all of which should be a serious concern for investors leading into the company’s upcoming result. Michael Kors’ watch business continues to experience weakness, foreign exchange headwinds and a slowdown in North American traffic have all been detrimental to Michael Kors’ underlying business.

Investors will want to hear from management with respect to their store opening strategy. The company’s store count experienced an explosion of growth from 2013 where its products were available in circa 2,913 globally compared to today’s figure of over 4,133 locations. Although more stores typically results in increased revenues, it can harm the brand and cause long term problems as growth slows, which is what is currently being experienced. Investors will likely react negatively if management continue to open stores at a rapid rate.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.