5 Stocks To Watch This Week 2/20

Tuesday, February 21

![]()

![]()

Wednesday, February 22

![]()

Friday, February 24

![]()

Macy’s (M)

Consumer Discretionary - Multiline Retail | Reports February 21, before the open.

The Estimize consensus is looking for earnings per share of $1.97, in-line the sell-side consensus and 3% lower than the same period a year earlier. That estimate has decreased 3% since Macy’s last quarterly report. Revenue is anticipated to decrease 2% to $8.57 billion, $56M below Wall Street.

What to Watch: When Macy’s reports fourth quarter results tomorrow morning, it’s facing a very real prospect of posting its 8th consecutive quarter of negative earnings. In just the last 3 months the retailer’s shares have slipped by 23% after indicating holiday sales fell short of expectations. Comparable sales on an owned plus licensed basis fell 2.1% while owned basis decreased 2.7% during the final two months of 2016.

Macy’s efforts to lift financial performance include focusing on price optimization, inventory management, merchandise planning and private label offerings. But the primary drivers lately have been its e-commerce and off price business, Macy’s Backstage, that continue to keep the Macy’s brand afloat. Furthermore the company plans on shutting the door on over 100 unprofitable stores to maintain modest margins. Meanwhile, there is ongoing pressure for Macy’s to spin off its real estate into a REIT, a move believed to be worth billions and provide an injection of capital.

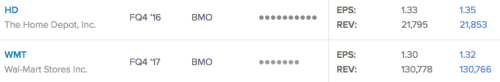

Home Depot (HD)

Consumer Discretionary - Specialty Retail | Reports February 21, before the open.

The Estimize consensus calls for EPS of $1.35, 2 cent above the Wall Street consensus. Revenue expectations of $21.8 billion, $58M greater than the sell-side consensus. YoY EPS growth expectations are for 15% and revenue growth is anticipated to come in at 4%.

What to watch: Home Depot continues to benefit from the persistent housing market recovery along with a greater focus on improving the customer experience and expanding its omni channel capabilities. Many of these moves have supported financial performance in the past few years, despite ongoing difficulties in the retail space created by Amazon. Home improvements have remained resilient from Amazon’s onslaught compared to clothing or electronics retailers. The biggest concerns moving forward include currency headwinds, soft consumer spending, and the ongoing rhetoric coming out of the Trump administration.

Wal-Mart (WMT)

Consumer Staples - Food Staples & Retailing | Reports February 21, before the open.

The Estimize consensus is looking for earnings per share of $1.32, 2 cents above the Wall Street consensus and down 11% from the same period last year. That estimate has decreased 2% since WMT’s most recent report in November. Revenue is anticipated to come in at $130.8B, 1% higher than the year-ago results, and in-line with the sell-side’s consensus.

What to Watch: In the past 6 months shares of Walmart tumbled about 5.5% owing to Trump’s rhetoric surrounding immigrant workers and a border tax, both of which would severely hamper financial performance. Walmart currently employs 2.3 million associates worldwide, many of which hold an immigrant status, while also offering everyday low prices, largely due to overseas production and manufacturing. Any comments or insights on the new administration’s impact on future quarterly results will break investors historically indifference to an earnings report.

Otherwise, Walmart continues to work tirelessly to modernize its brick and mortar stores and expand the online platform. The acquistion of Jet.com in the past 6 months should theoretically close the gap on Amazon’s dominance in online retail. On a constant currency basis, ecommerce sales grew 20.6% with gross merchandise value up 16.8% in the third quarter, both reflecting a continued acceleration from previous quarters. This contributed to a 2.5% increase in domestic Walmart sales while international volume decreased by nearly 5%. The combination of macroeconomic volatility, weaker brand recognition overseas and currency headwinds play a considerable role in lackluster international sales. As for Sam’s Club, Walmart’s wholesale arm, net sales grew 1.1% to $14.27 billion from $14.08 billion with comp sales up 100 basis points.

Tesla (TSLA)

Consumer Discretionary - Automobiles | Reports February 22, after the close.

The Estimize consensus calls for EPS of -$0.06, seven cents above the Wall Street consensus. The Revenue expectation of $2.24 billion is $49M above sell-side consensus. Expectations have decreased 140% since last quarter, putting YoY growth expectations at 102% for EPS and 30% for sales.

What to watch: Tesla blew out expectations for the third quarter, with EPS coming in 67 cents higher than the Estimize consensus and $1.25 higher than what Wall Street was expecting after recording record deliveries and production. Management indicated these record numbers could move higher in the fourth quarter, despite the ongoing challenges during winter months.

Tesla’s third quarter gains consisted of 22,000 deliveries, down 10% sequentially, 12,700 of which were Model S vehicles and 9,500 Model X. This puts total deliveries for 2016 at 76,230, slightly below the goal of 80-90k. The company blamed the transition to new Autopilot hardware to the hold up in production from October through early December. One strong spot was demand, with Q4 net orders for the Model S and Model X at an all time high, and 52% higher than Q4 2015.

Foot Locker (FL)

Consumer Discretionary - Specialty Retail | Reports February 24, before the open.

The Estimize consensus is looking for earnings per share of $1.31 on $2.1 billion in revenue, above Wall Street by 1 cent on the bottom-line and in-line on the top. Compared to a year earlier, this reflects a 14% increase in earnings and a 6% increase on sales. Earnings estimates have decreased 1% the last quarter, while revenues have remained flat.

What to Watch: Much of its success can be credited to the growing popularity of basketball shoes. Foot Locker has established itself as the preeminent mall-based supplier of basketball shoes, leaps and bounds ahead of close competitor Finish Line. This distinct segment accounts for a large portion of its sales with yearly releases of Michael Jordan’s and LeBron James’s signature shoes driving those gains. Foot Locker is more than proficient in several of the other lines it carries as well, mainly running and casual footwear. Despite an influx of direct to consumer efforts from Nike and Under Armour, Foot Locker hasn’t seen a material impact on financial performance. Near term threats still persist including heavy international exposure and increasing competition.

(Photo Credit: Mike Mozart)

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.