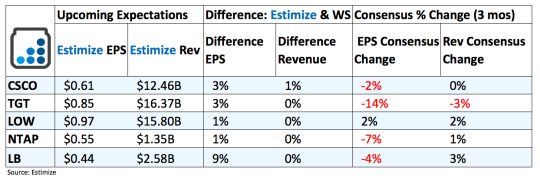

5 Stocks To Watch That Report Earnings Tomorrow - Wednesday, Nov. 16

(Click on image to enlarge)

Cisco Systems (CSCO): Cisco has a history of beating analysts estimates and is looking to extend its winning streak tomorrow as it opens up its fiscal 2017. Cisco’s winning strategy includes expanding its product portfolio beyond switching and routing products to high growth markets such as cyber security and Internet of Things. Partnerships with Salesforce and Pure Storage along with the acquisitions of CloudLock will help secure greater market share and support top line growth. Unfortunately, Cisco still derives a large portion of revenue from networking switches and routers which continue to show limited growth and upside. As this continues to show weakness Cisco’s other products will be relied on more heavily to carry the performance. Analysts are expecting this quarter to worsen from previous quarters on the back of weakness in its legacy business. Additionally, increasing competition, weak IT spending, and currency headwinds should play a role in sluggish growth this upcoming quarter.

Target (TGT): Target has struggled to establish its foothold in a retail sector dominated by Walmart and Amazon. The past 4 quarters have delivered negative sales growth with expectations of extending it in its upcoming quarterly report. Target has focused on a handful of new initiatives to reverse this ongoing slowdown including expanding its grocery business, e-commerce capabilities, and well-performing categories while also implementing more strategic marketing campaigns. Lately an assortment of Style, Baby, Kids, and Wellness have been the top performing categories that Target is looking to build on. Late last year Target also divested its pharmacy business to CVS which will now be featured within Target stores.

Lowe’s Companies (LOW): The home improvement space has benefited in recent quarters from low-interest rates and a broader bounce back in the housing market. To top it off, a better than expected report from Home Depot earlier today sets a favorable tone heading into Lowe’s quarterly report tomorrow morning. That said, Lowe’s typically doesn’t fare as well as Home Depot during earnings season. Home Depot’s dominance market position puts a great deal of pressure on Lowe’s financial performance. Meanwhile, greater adoption of e-commerce platforms like Amazon has started to threaten top line growth.

NetApp (NTAP): Revenue has been one of the biggest concerns for NetApp these last few quarters. In last 4 reports, sales have posted negative growth, a testament to the company’s weak products. Increasing competition from companies like Western Digital and HP along with tepid IT spending are expected to add to the company’s woes. Future refreshes, launches, and more stringent cost controls will help drive revenue and margins in the coming quarters. In the meantime, the company appears to be on its way to another weak report.

L Brands (LB ): L Brands’ focus on cost cutting, inventory management, strong product mix and boosting online sales are what will carry future growth. This is generally the same story found at most retailers. However, the company’s industry lead makes it far more likely that they can leverage these initiatives into sales. Its innovative prowess and exclusive assortments are what will really separate them from the competition. The biggest problems L Brands faces come from the need to offer more frequent discounts to push inventory and foreign currency headwinds. These may weigh on margins for the quarter to be reported.

Disclosure: None.

thanks for sharing