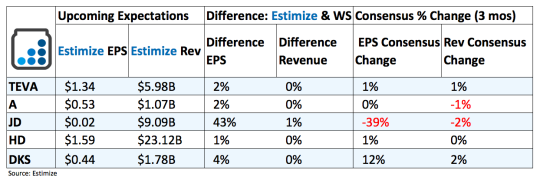

5 Stocks To Watch That Report Earnings Tomorrow - Tuesday, Nov. 15

Teva Pharmaceutical (TEVA): Teva is in a position of strength heading into its third-quarter report thanks to the results of the election and a continued shift towards generics. Teva recently purchased Allergan’s generics brand for $500 million and Actavis Generics in August , both of which are expected to help support top-line growth moving forward. Analysts expected revenue to grow by 24% this quarter as it strengthens its position in the generic market. Teva is also seeing traction in its branded segment which features specialty products such as Copaxane for use in treating multiple sclerosis. Weakness in international generic markets, particularly in the EU, will put partially offset the positive initiatives of the quarter.

Agilent Technologies (A): an Agilent broad portfolio of products ranging from forensics to pharmaceuticals have performed remarkably well in recent quarters. In the second quarter, the company delivered better than expected performance which featured 11% growth on the bottom line and 3% on the top. The company’s three core reporting segments were up between 4% to 8% and helped deliver results above its previous guidance range. Agilent’s continued focus on high growth markets through product launches are considered positives for moving forward.

JD.com (JD): Shares are trading down 27% this year on the back of decelerating revenue growth and plummeting profitability. JD.com operates in a highly concentrated Chinese e-commerce space that is currently dominated by Alibaba and its subsidiares. That said, JD is proving that it can compete in this environment as it continued to see active users and order fulfillment growth. Consistent market initiatives have been placed to ensure long-term growth and increase brand awareness. Meanwhile, a strategic product mix and expanded fulfillment capabilities are helping to drive traffic trends and support the top line. JD recently launched its commercial drone delivery service during China’s annual Single’s Day shopping event. Additional efforts like this will help close the gap between Alibaba and hopefully propel the stock higher.

Home Depot (HD): Low-interest rates and a bounce back in the housing market have led to robust earnings in recent quarters. Not only does Home Depot benefit from an increase in new home sales, but as home prices stay high, consumers tend to invest heavily in their properties. Strong job growth has also supported this ongoing trend, allowing consumers to spend on home improvement projects. In the second quarter, the home improvement retailer posted a 4.7% increase in comparable sales and 5.4% in United States stores. The company should continue to deliver encouraging results but faces a number of near-term headwinds including intense competition and significant international exposure. Besides Lowe’s, consumers are starting to look towards online retailers like Amazon for their home improvement needs. This shift to e-commerce could have a lasting impact on Home Depot if it is not taken seriously in the immediate future.

Dick’s Sporting Goods (DKS ): Dick’s has been gaining strength in recent quarters despite a pullback from apparel brands like Nike and Under Armour. Its efforts to expand online capabilities along with strategic marketing and merchandising have helped drive traffic trends and sales. Dick’s has also benefited from a consolidation in the industry following the bankruptcy of Sports Authority stores. Dick’s now owns the intellectual property and much of the branding of the former retailer. Tomorrow’s report is forecasted to maintain its current trajectory but will more importantly shed some light on the pivotal holiday season to be reported in early 2017.

Disclosure: None.

Thanks for sharing