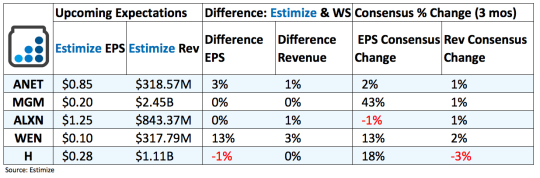

5 Stocks To Watch That Report Earnings Tomorrow - Thursday, Feb. 16

(Click on image to enlarge)

Arista Networks (ANET): Arista Networks roared through 2016 only to hit a massive snag at the start of the new year. In late January, the CBP revoked an earlier court ruling over an ongoing patent infringement case between Arista and Cisco. Shares subsequently took a sharp dive but since recovered most of the losses. For the most part, analysts expect the company to continue its trend higher in the fourth quarter, with forecasts for a 30% jump on the top line and 5% on the bottom. A 5% increase in earnings would mark the first quarter since the company went public that earnings failed to reach double digit growth. From a product standpoint Arista continues to find support from cloud networking ports and switches, which topped nearly 10 million cumulative shipments in the third quarter.

MGM Resorts (MGM): Shares of MGM soared 61% in 2016 largely on the back of improving travel trends in key markets such as Las Vegas. Improving employment rates and increasing tourism numbers in the region helped MGM record strong occupancy rates and RevPAR, thereby supporting top line growth. That said, ongoing volatility in Macau over the past few quarters wound up offsetting some of the gains at other resorts. Analyst’s believe a revival is underway in Macau and will boost performance in the quarter to be reported. But Las Vegas Sands weak fourth quarter results at the end of January suggests otherwise. The success of tomorrow’s report hinges on whether travel to Macau improved or simply stayed the same during the fourth quarter.

Alexion Pharmaceuticals (ALXN): Biotech companies are some of the biggest crapshoots of earnings season, with Alexion being no different. Top line growth exceeded double digits for 6 consecutive quarters but that couldn’t help investors who experienced an 8% decline in share value over the past 12 months. Alexion’s two main drugs, Soliris and Strensiq continues to gain traction in core territories including U.S., European and Japanese markets on the back of an increasing patient population. Its newest drug, Kanuma, showed progress throughout its early stage launch in U.S. and German markets. Investors will be keen on management’s comments of the Trump administration’s hardened stance on the industry and its potential impact on future performance.

Wendy’s (WEN): Analysts are asking “Where’s the Growth” after Wendy’s posted 3 consecutive quarters of double digit losses and nearly 8 quarters of negative sales growth. And yet the stock soared 50% in the past 12 months due to a string of positive same store sales growth, ongoing efforts to overhaul the menu, and an emphasis on value offerings like the 4 for 4 deal. A large portion of the overall revenue declines come amid a system wide optimization effort intended to reduce the number of company operated restaurants. Furthermore soft consumer spending and a broad shift away from greasy burgers puts greater pressure on financial performance and may hurt traffic trends.

Hyatt Hotels (H): Hyatt stands to build on the success of the past 3 quarters owing to increased demand in U.S. markets and improving travel trends. Revenue per available room (RevPAR), hotel operators key performance metric, grew 3.8% in domestic markets and 2.5% systemwide during the third quarter. The company continues to open new hotels in its broader goal of expanding to global markets like China and India. In Q3, the company opened 11 locations and intends to tack on 20 more in the quarter to be reported. Nonetheless, increasing competition, macroeconomic turmoil and consumer’s preference for value channels puts pressure on performance, namely margins.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.