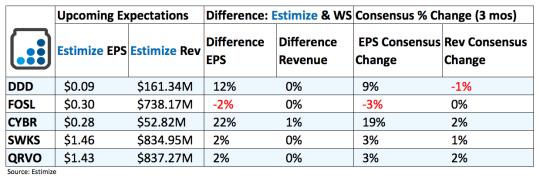

5 Stocks To Watch That Report Earnings Tomorrow - Thursday, Nov 3

3D Systems (DDD): While 3D printers have lost most of their mainstream appeal, it doesn’t mean they’ve been completely forgotten. 3D Systems is still thriving by selling printers to both commercial and recreational customers. Its portfolio of healthcare solutions is expected to drive longer-term growth. These include end-to-end simulation, training and planning and practicing surgical instruments and devices for personalized surgery. Precision surgical equipment is often very expensive which is why investors are so enthusiastic about these new affordable alternatives. Additionally, DDD unveiled its newest systems, Figure 4, earlier this year, which is being promoted as faster and more efficient than previous models. Heightened competition from heavy hitters like HP and Stratasys will continue to be near-term threats to earnings and revenue.

Fossil (FOSL): Shares of the watchmaker are down over 50% from a year earlier despite topping analysts estimates in 2 of the past 3 quarters. Fossil’s foray into wearable technology is proving to be a smart one, aiding in the near-term turnaround. Some of this should also help offset the downturn in traditional timepieces that has occurred over the past few quarters. The Estimize consensus is forecasting a rebound in comps this quarter to reflect an improving consumer spending environment and growing wearable tech sector.

CyberArk (CYBR): Outside of Fortinet, the cyber security space is expected to continue growing at a rapid clip. The new and ongoing threats to our digital sovereignty will keep demand for these products rising higher. CyberArk is in a favorable position to tap these opportunities supported by frequent investments in its product suite and several strategic acquisitions. As the industry continues to grow, competition will also heighten. Already, space is nearing saturation with a glut of names like Cisco, FireEye, and Symantec to name a few.

Skyworks Solutions (SWKS): The chipmaker was dealt a blow last week after Apple reported weaker than expected earnings. iPhone sales continued to slow down during the third quarter which is a poor sign for the companies that produce chips in the phone. Shares are still up 15% in the past 3 months as analysts expect the chipmaker to post a marginal improvement this quarter. The company remains well positioned to capitalize on the IoT on other higher growth technologies.

Qorvo (QRVO ): Qorvo is in a similar position as Skyworks following Apple’s weaker third quarter results. The chipmaker currently generates a majority of total revenue from the iPhone which is seeing demand fall. Fortunately, like Skyworks, Qorvo is positioned in many high growth markets to diversify its portfolio beyond the iPhone. Qrvo recently released two new products to its cable networking business that will help support the top line.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more