5 Stocks To Watch For This Week

Reports Tuesday, July 28

![]()

Report Wednesday, July 29

Report Thursday, July 30

Gilead Sciences (GILD)

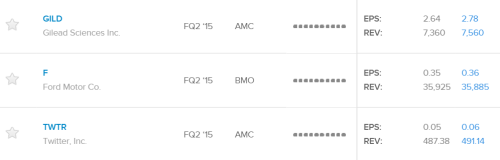

Gilead Sciences (GILD) reports its FQ2 ’15 results on Tuesday after the market close. Both Estimize and Wall Street are predicting a fall in EPS and revenues QoQ. Estimize are forecasting an EPS figure of $2.78 and a revenue target of $7.570B. Wall Street estimates EPS to come in at $2.64 and revenues to be $7.360B.

The success of Gilead over the past 36 months can be attributed to the company’s strong revenue growth figures which have blown expectations out of the water consistently over the past 2 years. However, this metric has recently experienced a slowdown and is expected to only further decline. As payers begin to balk at the high price tags of Gilead’s Hepatitis C drugs including Sovaldi and Harvoni, sales are expected to be negatively affected.

Despite the potential negatives associated with falling revenue growth, Gilead is in a very strong position in terms of its balance sheet. Gilead has the ability to use its balance sheet to its advantage and potentially acquire desirable businesses in an attempt to bolster growth over the coming years.

Investors will be eager to hear from management with respect to both increasing competition and also their M&A strategy moving forward. Investors have become accustomed to Gilead outperforming analyst expectations, therefore if there is a miss on Tuesday, the stock could potentially experience a significant pull back depending on the severity.

Ford Motor Co (F)

Ford Motor (F) will report its FQ2 ’15 results before the opening bell on Tuesday and both Estimize and Wall Street are predicting an uptick in revenues and EPS QoQ. The struggles have continued YTD for the car manufacturer with the company posting a negative capital return of -7.16%. For FQ2 ’15, the Estimize community predicts an EPS value of $0.36, just one cent above Wall Street’s estimate of $0.35. Dissimilar to EPS, Wall Street actually predict a higher revenue figure of $35.925B compared to Estimize’s forecast of $35.886B.

Ford Motors are currently in the process of deploying a substantial amount of capital across the globe in an attempt to expand and boost top line revenue growth. Despite the expected positives associated with its global expansion, Ford is under pressure for a number of reasons including enhanced competition restricting margin expansion, a devalued Russian currency hurting USD denominated earnings, and a weak Eurozone economy continues to hurt sales in the region.

With the recent report from General Motors being overwhelmingly positive, market participants are relying on Ford to also post a similar result.

Twitter (TWTR)

Twitter (TWTR) will also report its FQ2 ’15 results after the market close on Tuesday. The Estimize EPS estimate is set at $0.06, a penny above Wall Street’s consensus of $0.05. In terms of revenue forecasts, the Estimize community forecast $490.91M compared to Wall Street which predict $487.38M.

Twitter’s share price has still not recovered since management announced the FQ1 ’15 result in which the company reported falling revenues and earnings QoQ. The main concern however drawn from the report was the poor user growth number which resulted in the share price collapsing circa 25% the next day.

Investors will want more guidance on how Twitter’s management aim to penetrate the social media advertising market in a more meaningful way. To date, Twitter has continued to lag behind key competitors such Facebook who have much more sophisticated targeting techniques with respect to marketing campaigns. If Twitter can leverage off its user base to create more desirable targeted marketing techniques for advertises, this will ultimately translate to increased revenues in the future.

Facebook (FB)

Facebook (FB) reports its FQ2 ’15 figures on Wednesday after the closing bell. Year-to-date (YTD) Facebook’s stock has outperformed the NASDAQ with a capital return of 24.08% compared to the index which has appreciated by 8.54%.

For the upcoming quarter, the Estimize community is predicting an EPS figure of $0.49 compared to Wall Street’s forecast of $0.47. Estimize also has a higher revenue prediction of $4.028B versus Wall Street’s estimate of $4.001B.

Market participants continue to be enthusiastic about Facebook’s Instagram business. With over 300M users currently using Instagram, the opportunity for this business segment to deliver strong revenues for Facebook is very real. Advertisers are now able to access data from Facebook profiles in order to fully tailor their advertising campaign depending on each individual. In a world where customized advertising and programmatic advertising buying is becoming integral to the marketing landscape, this offering is highly desirable to advertisers.

With mobile generating circa 73% of all revenues for Facebook, the continuation in innovation of product offerings is critical for the ongoing success of Instagram and Facebook. Investors will be interested to learn more about the upcoming offerings Facebook intends on launching.

LinkedIn Corporation (LNKD)

LinkedIn Corporation (LNKD) reports its FQ2 ’15 results after the closing bell on Thursday. The Estimize community is predicting an EPS figure of $0.36 and a revenue number of $684.16M. Wall Street analysts however, assume an EPS figure of $0.30 and forecast revenues of $681.56M.

The most important part to LinkedIn’s business is clearly its talent solutions segment. This segment was most recently recorded to account for 62% of total revenues for LinkedIn. This particular side of the business focuses on selling products to recruiters. The most important thing for investors heading into the result will be how this segment faired in FQ2 ’15. With a dramatic 5% fall in YoY growth in FQ1, investors will want to see a better result YoY in FQ2. The sentiment following the report will likely be dictated by the talent solutions segment’s performance, investors are advised to watch this number closely and pay attention to management’s outlook for this area of the business.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.