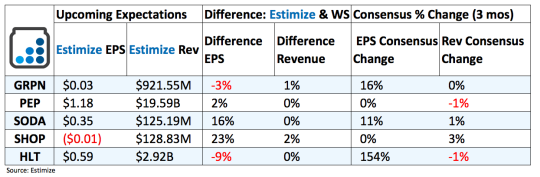

5 Stocks To Watch Before The Market Opens Tomorrow - Wednesday, Feb. 15

(Click on image to enlarge)

Groupon (GRPN): After posting modest improvements in the first half of 2016, the stock slid 34% to cap off 2016. Shares slipped in the final 6 months despite a better than expected third quarter that topped consensus estimates on Wall Street. Nonetheless revenue growth continues to come in virtually flat while earnings posted triple digit declines for three consecutive quarters. Gross billings, a key metric for the online marketplace, fell 2% during the quarter from $1.47 billion to $1.43 billion. The largest drag came from international markets namely EMEA which declined by 10%. Rest of the World declined by 24 while North America gross billings jumped 6%. Analysts expect ongoing restructuring efforts as well as new holiday TV campaigns and marketing promotions to have a positive effect on the quarter to be reported. Moreover the acquisition of LivingSocial should be accretive to financial performance. But Amazon’s dominance in the space plus intensifying competition puts stress on Groupon’s prospects in the coming years.

PepsiCo (PEP): Eating habits greatly changed in the past handful of years to favor healthy options with organic ingredients. As a result soda maker and snacks provider PepsiCo experienced a marked downturn, with revenue comparisons trending south of zero for 8 consecutive quarters. In the third quarter revenue declined by nearly 2% on weakness in foreign markets, particularly Venezuela, while organic revenue maintained a steady climb higher. With regards to tomorrow’s report, investors will be looking for progress on new non carbonated beverage offerings aimed at offsetting weak CSD volumes. Some of those improvements might come from strategic acquisitions to grow its non carbonated beverage portfolio. In late 2017 Pepsi signed a deal to acquire fermented probiotic and kombucha beverage market KeVita, a move expected to carry accretive effects. The snacks business faces a similar battle; consumers are moving in waves to healthy snacks like kale chips in lieu of traditional potato chips.

SodaStream (SODA): After years of flat earnings, SodaStream managed to post one of the biggest turnarounds in 2016. The beverage maker topped analysts expectations in each quarter since FQ4 2015, thanks to a greater focus on healthy water based offerings. SodaStream’s now promotes itself as a seltzer/water beverage dispensary rather than a direct competitor to Coke or Pepsi. In the third quarter sparkling water maker unit sales grew by 23% from a year earlier. Analysts expect this ongoing trend to continue into future quarters and help support top and bottom line growth. As always, weak FX translation and uncertainty in Europe remain near term headwinds to financial performance.

Shopify (SHOP): Shopify ripped through 2016 with stock prices increasing nearly 200% on the back of strong quarterly results. Analysts expect this ongoing trend to continue in 2017 despite the ongoing trouble retailers face from volatile consumer spending and intensifying competition. In the third quarter subscription solutions revenue grew by 69% along with a resounding 114% increase in merchant solution sales. Gross merchandise volume increased by 100% to $3.8 billion, with about $1.5 billion coming by way of Shopify Payments. That said, if customer expansion starts to stall, it won’t be long before share prices and quarterly results follow.

Hilton Worldwide (HLT): Shares of Hilton jumped 50% in the past 12 months as travel trends started to exhibit new signs of growth. But given results from travel stocks this earnings season came in largely mixed, it remains unclear whether the industry is improving or deteriorating. Hilton and the other hotel operators look to set the record straight with robust fourth quarter reports through the week. Hilton’s strong international exposure as well as improving group business trends expect to drive key metrics like RevPAR (revenue per available room) higher. But analysts still expect RevPAR to come in flat compared to a year earlier, largely hampered by weak oil and gas markets, macroeconomic uncertainty and ongoing currency headwinds.

Disclosure: None.