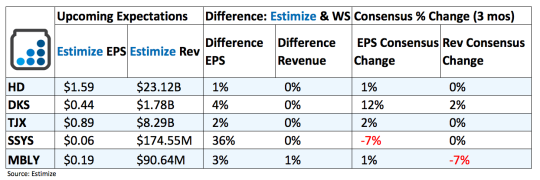

5 Stocks To Watch Before The Market Opens Tomorrow - Tuesday, Nov. 15

Home Depot (HD): Low interest rates and a bounceback in the housing market have led to robust earnings in recent quarters. Not only does Home Depot benefit from an increase in new home sales, but as home prices stay high, consumers tend to invest heavily into their properties. Strong job growth has also supported this ongoing trend, allowing consumers to spend on home improvement projects. In the second quarter, the home improvement retailer posted a 4.7% increase in comparable sales and 5.4% in United States stores. The company should continue to deliver encouraging results but faces a number of near term headwinds including intense competition and significant international exposure. Besides Lowe’s, consumers are starting to look towards online retailers like Amazon for their home improvement needs. This shift to e-commerce could have a lasting impact on Home Depot if it is not taken seriously in the immediate future.

Dick’s Sporting Goods (DKS): Dick’s has been gaining strength in recent quarters despite a pullback from apparel brands like Nike and Under Armour. Its efforts to expand its online capabilities along with strategic marketing and merchandising have helped drive traffic trends and sales. Dick’s has also benefited from a consolidation in the industry following the bankruptcy of Sports Authority stores. Dick’s now owns the intellectual property and much of the branding of the former retailer. Tomorrow’s report is forecasted to maintain its current trajectory but will more importantly shed some light on the pivotal holiday season to be reported in early 2017.

The TJX Companies (TJX): A weak retail environment has greatly benefited value channels like TJX’s catalogue of discount brands including Marshalls and its namesake TJ Maxx stores. The retailer has delivered positive comps for over 4 years on strong discount trends, sound marketing strategies, and expanding its online capabilities. Its loyal and growing customer base should continue to drive comparable sales for the upcoming quarter. During the second quarter conference call management indicated comparable store sales would grow between 2 and 3% but margins could see a setback from higher labor costs and ongoing currency headwinds.

Stratasys (SSYS): 3D printers haven’t become a must have product that many experts predicted it would be, but they have certainly carved out a niche in several industries. Stratasys, in particular, has entered into several strategic partnerships with Boeing, Ford and Siemens to develop 3D printing technology for production applications. Additional efforts to produce affordable consumer products along with these partnerships will help drive revenue growth in the quarter. Of course 3D printing is still an expensive hobby that most consumers are putting off given the current economic environment. Meanwhile competition from 3D Systems will continue to pressure results moving forward.

Mobileye (MBLY): Many experts believe that driverless cars are a near term reality that will revolutionize the automotive industry. This is particularly beneficial for Mobileye which develops driver assistance systems for collision prevention and mitigation. Financial performance has gained traction in the recent years due to this ongoing trend but shares have lagged significantly. The stock is down 5% in the past 12 months and historically decline 1% immediately through the print.

Disclosure: None.