5 Stocks To Watch Before The Market Opens Tomorrow (November 1, 2016)

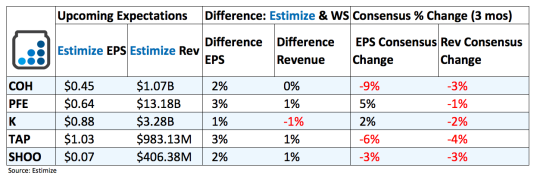

Coach (COH): For the last two quarters, Coach has been able to produce double-digit growth on both the top and bottom-line as it undergoes a major brand revitalization. While revenue growth is expected to slow this season, there are still some bright spots as the luxury goods maker heads into its best quarter of the year, the holiday season. The acquisition of Stuart Weitzman in 2015 has been very positive as the Coach strives to expand its portfolio of brands. New campaigns featuring ‘it girl’ Gigi Hadid have played well with younger millennial consumers, a demographic that Coach has struggled to attract in the last few years. Headwinds for the quarter still include a stronger US dollar as the company expands globally, and a value-conscious consumer that isn’t necessarily spending on high-end items right now.

Pfizer (PFE): Performance in the healthcare sector is often not as cut and dry as in other industries. A large portion the earnings potential is driven by a blockbuster drug introduction and healthy pipeline. Pfizer in particular has one of the deepest drug pipelines, investing about $7 billion annually in R&D to create the next big treatment. Analysts expect its catalogue of new drugs like Xalkori, Xeljanz, Eliquis and Ibrance will help offset the slowdown in its legacy products such as Lyrica. Furthermore, several acquisitions during the period are expected to be important growth drivers. That said, ongoing threats of genericization and frequent R&D investments will continue to hamper performance. These are headwinds that are not likely to blow over given the state of the pharmaceutical industry.

Kellogg Company (K): Kellogg remains a leader in snacks despite the recent health revolution taking place. Its product mix still includes popular brands that many consumers fondly remember such as Special K, Pop Tarts and Rice Krispies, but healthier options now include Smart Start and All Bran. During the quarter, the company took aim at expanding its global presence with the acquisition of a leading Brazilian food group. The acquisition spells out that Kellogg is devoted to improving its position in the snacking industry through acquisitions. Analysts are optimistic that the food brand can return to positive growth, or at least record a significant improvement from past quarters.

Molson Coors Brewing (TAP): Expectations are drifting down lately amid concerns of weak volumes in domestic markets and ongoing macroeconomic uncertainty. The company has struggled in major markets such as the U.S., Canada and Europe over the past few quarters. Lower volume and unfavorable foreign currency are largely expected to drag down growth in the upcoming quarter. Analysts are calling for a 25% decline on the bottom line and 3% on the top. Some of its losses should be offset from efficient cost saving initiatives and ongoing focus on brand building.

Steven Madden (SHOO): Shares are virtually trading sideways in the past 12 months following a number of low growth quarterly reports. In the past 3 quarters, the top line has recorded growth in the range of 0 to 2%, reflecting the challenging consumer spending environment. Last quarter the company delivered promising results in both its wholesale and retail businesses while same store sales increased 5.4%. That still wasn’t enough to jump start total revenue which grew at 1%. Projections for the quarter to be reported are slightly below the recent expectations of negative 3%. Fortunately the stock historically remains flat immediately through the print and only increases in the days and months after.

Disclosure: None.