5 Stocks To Watch Before The Market Opens October 25

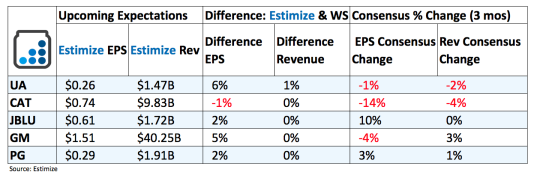

Under Armour (UA): Under Armour has remained focused on building its brand through strategic partnerships, key endorsements, expanding its DTC business, and its most recent foray into wearable technology. Just last week, Under Armour announced a deal with the MLB to outfits its teams with uniforms starting in 2020. Any major sporting license is a huge win for Under Armour, let alone one with America’s greatest pastime. Meanwhile, the company continues to expand its catalog of endorsements which includes Stephen Curry, Tom Brady and Dwayne “the Rock” Johnson.

But no one category has grown faster than international sales. Last quarter the segment jumped 68%, helping to push total revenue over the $1 billion mark for a fourth consecutive quarter. Under Armour spent some time in China this summer to help promote the game of basketball and its star athlete Stephen Curry. As they become more of a household name overseas, expect to see top line growth accelerate.

There still remains several near term headwinds that could impact tomorrow’s report. It’s becoming increasingly accepted that the athletic apparel sector should start to edge down over the next several quarters. The space is becoming saturated which has forced more frequent discounting, thereby compressing margins. The top names like Nike, Under Armour and even Lululemon no longer have pricing power over the consumers, explaining the poor bottom line growth.

Caterpillar (CAT): Caterpillar has watched earnings and revenue steadily decline over the past year despite recording a few better than expected reports along the way. The state of industrials in the country has reached an all time low due to weak commodity prices, waning demand, outsourcing and global uncertainty. Caterpillar, in particular core businesses such as construction equipment, power systems and mining, suffer as a result. Fortunately, expectations have been set so low for the sector that it’s ever so small improvements have pushed the stock higher. Shares are up over 25% this year as the company slowly returns to profitability. Investors are expecting that the ongoing cost controls and global expansion will help propel the stock even if earnings are subpar.

JetBlue (JBLU): Major airlines kicked off earnings season with mixed results. Many of them exceeded expectations on the bottom line but missed on the top due to weak travel demand and increasing competition. The discounters have fared slightly better in this environment given their narrowed focus on offering cheap domestic flights. JetBlue, however, hasn’t been the beneficiary of this ongoing trend. Shares are down 18% this year after multiple quarters of negative growth and falling PRASM. The key PRASM metrics decreased over 10% last quarter, much worse compared to some of the major airlines. According to the company, this metric is expected to decline in the range of 3-4% for the third quarter. JetBlue should receive a boost from low oil prices and the summer travel demand.

General Motors (GM): GM is the first major car maker to report third quarter earnings and will likely set the tone for Ford who reports later this week. The automotive industry, GM included, was on the rise until recently thanks to cheaper gas prices and greater demand. Weakness in the oil industry has helped move high margin vehicles such as trucks and SUVs. This is likely to ease a little as the oil industry and gas prices have started to pick up in the second half of the year. GM should be able to offset some of this with its focus on global expansion and strategic partnerships. The car maker is seeing strong results in China as a part of its focus on emerging market. Meanwhile, its partnerships with Lyft provides the carmaker with a pathway to the sharing economy.

Procter & Gamble (PG): Procter & Gamble has been adversely impacted by the broader pullback in the consumer staples industry. Both earnings and revenue have failed to keep up with market growth rates thanks to ongoing currency headwinds, weak volumes, and weaker demand. Exchange rates and global uncertainty have been the biggest headache seeing as roughly 60% of its business is generated outside North America. As the dollar continues to surge relatively to other major currencies, we can expect to see revenue wind down. Greater cost controls and productivity savings should provide some relief to the bottom line which is forecasted to come in flat compared to a year earlier

How do you think these names will report? Be included in the Estimize consensus by contributing your estimates here!

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more