5 Stocks To Watch Before The Market Opens Friday Morning (October 28, 2016)

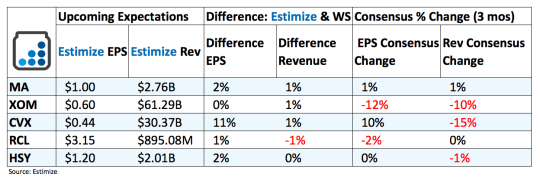

Mastercard (MA): Better than expected earnings from Visa and American Express in all likelihood set the stage for a surprise report from Mastercard tomorrow. Earnings have topped estimates the past 2 quarters despite what experts believe is a weak consumer spending environment. The third quarter is expected to maintain strong volume and transaction growth mainly on the back of recent partnerships and acquisitions. Mastercard recently partnered with PayPal to increase its usage on the online payments platform. A common theme from previous reports were strong international transaction growth supporting an overall uptake in volume coupled with lower loss provisions from less frequent defaulting.

Exxon Mobil (XOM): From a financial standpoint, ExxonMobil is still one of the premier companies to own. Its buyback programs and robust dividends have attracted investors even when the stock was down. Its strength lies in its balanced operations, financial flexibility and efforts to cut costs and improve efficiency. Upstream earnings should show improvements after a modest rise in oil prices, a ramp up of drilling activities, and a production resurgence in key projects. Though those gains might be offset by beaten down commodity prices. Downstream operations, on the other hand, are likely to come in even lower. Earlier this year management indicated slim growth in the medium term but for what it’s worth, this quarter should be better than the last.

Chevron (CVX): Chevron saw some improvement in the second quarter recording a 2% decline on the bottom line and 27% on the top. The slight appreciation in oil prices during the quarter was largely credited with the uptake. Unfortunately crude futures were down during the third quarter which does not bode well for Chevron, one of the most oil weighted majors. This slight downturn can take its toll on upstream segment while its refining business is starting to show signs of weakness. Ongoing asset sales will help save the balance sheet but could put a damper on production during the quarter. Similar to its peer, Chevron also has strong financial flexibility, a strong balance sheet and a track record for rewarding its shareholders.

Royal Caribbean Cruises (RCL): Royal Caribbean generates a majority of its revenue outside of the United States, leaving it prone to macroeconomic uncertainty and currency headwinds. This has played a role in the slowdown delivered in recent quarters and should only become worse as Brexit unravels. Meanwhile higher marketing spend, increased cruise costs and greater competition could dent the quarter’s performance. Nonetheless the cruiseliner has consistently delivered positive revenue growth on the back of strong booking trends, technological innovation and expanding capacity growth. Analysts are confident that that tomorrow’s results will show an improvement from its dismal second quarter report.

Hershey (HSY): In late August, it was rumored that Mondelez was interested in purchasing Hershey for roughly $23 billion. The deal was abandoned almost as soon as it began and now Hershey’s is left to its own devices to jump start growth. Sales have been on a continual trend down from weak category trends, increasing competition and soft international growth. The company has cut guidance twice this year to reflect the ongoing challenges that it faces domestically and worldwide. Management doesn’t expect this to persist through the second half of 2016 but the Estimize community would beg to differ. Analysts are forecasting a 2% increase on the bottom line and 3% on the top, reflecting an evident slowdown from the second quarter.

Disclosure: None.