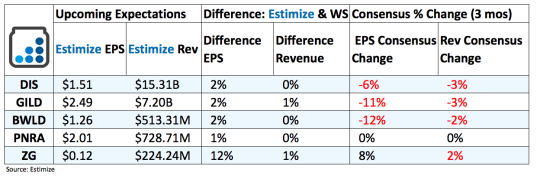

5 Stocks To Watch After The Market Closes Today - Feb. 7

Walt Disney (DIS): As always ESPN subscription numbers fall front and center when Disney announces quarterly results. The multimedia sports network continues to face an uphill battle in light of cord cutting behaviors and wider adoption of skinny bundles. Operating income from Cable Networks decreased $207 million during Q4 due to decreases at ESPN and Disney Channel. Growth at Freeform (formerly ABC Family) helped offset some of these losses through lower programming and production costs, and a decrease in marketing expenses. Income from broadcasting, on the other hand, increased $60 million to $224 million, on greater program sales from shows such as Luke Cage and Quantico. However, the overall performance of media networks is still predicated on the performance of ESPN, which otherwise looks bleak.

Beyond media, performance in Studio Entertainment and Parks and Resorts continues to excel on the back of blockbuster movies that also translate to attractions at the theme parks. Studio entertainment is likely to see a huge uptake in Q1 from the roaring success of Star War Rogue One. And while the economy improves and travel trends start to pick up that plays into the hands of Parks and Resorts. Both divisions posted positive growth in the fourth quarter and remain on track to do so again.

Disney also generates a large portion of total revenue from consumer products and interactive media which includes licensed merchandise. Sales from this division saw considerable pressure last quarter as revenue dropped 15% and income declined 5%. The company quickly pointed to currency headwinds and the discontinuation of the Infinity console game business for the lackluster performance. With the dollar trending close to a short term high, it’s unlikely Disney does a complete 180 this quarter.

Gilead Sciences (GILD): Gilead's report once again highlights the performance of new HIV and HBV products but above all else, the HCV franchise will draw most of the attention. In the third quarter sales of Harvoni, Sovaldi and Epclusa fell to $3.3 billion compared to $4.8 billion from a year earlier. Management blamed the decline in Harvoni and Sovaldi sales on the introduction of Epclusa in key U.S. and European market but the more likely culprit is Merck’s entry into the Hep C market. Merck’s aggressive pricing strategy stole a considerable amount of the Hep C market that Gilead once cornered.

Offsetting some of these losses was a strong performance from HIV and other antiviral products. Sales from the two jumped to $3.5 billion from $2.9 billion a year primarily due to an uptake in tenofovir alafenamide based products. This trend should provide some support in the fourth quarter as well. Gilead also recently launched its first HBV drug, Vemlidy, which should start to contribute meaningfully to the top line.

Besides the question of drug sales, Gilead face the threat that President Trump decimates drug pricing in the biotech and pharmaceutical industry. Any indication that financial performance will be hurt in fiscal 2017 from the new administration could ignite a sharp sell off.

Buffalo Wild Wings (BWLD): Analysts expect Buffalo Wild Wings to extends its streak of positive top and bottom line comparisons, but the main concern remains same store sales. In the third quarter same store sales, a key metric for restaurants, declined 1.8% at company owned locations and 1.6% at franchise ones. In an effort to lift the crucial metric and drive traffic, the company implemented a 15 minute guarantee for lunch deals and promotional offerings. Meanwhile, new digital initiatives, remodeling existing locations, additional marketing and promotional campaigns will also help boost quarterly results. On the downside BWLD recently hiked menu prices in lieu of volatile chicken prices and the consumer spending environment still looks bleak, somewhat offsetting the positive initiatives implemented during the quarter.

Panera (PNRA): Despite a broad downturn for fast casuals in 2016, Panera topped analysts expectations in each of the past 3 quarters. A large portion of the company’s recent success stems from the Panera 2.0 program, menu innovation, new promotion initiatives and remodeling existing locations. The confluence of these factors reignited both revenue and earnings growth. Meanwhile a new and ongoing initiatives to remove artificial and processed ingredients from menu items should appeal to a growing consumer base of health fanatics. However, the company’s strategic efforts along with higher labor costs comes at the cost of profitability, which fell to mid single digits in the third quarter.

Zillow Group (ZG): Each quarter 2 key numbers stand out among the rest; user growth and subscriptions. In the third quarter monthly unique users topped 164 million with nearly 75% of that viewership coming from the mobile platform. Management believes that larger user base will inevitably lead to strong ad revenue and greater support on the top line. As for subscription growth, that includes revenue from its Premier Agent program, a premier service that gives real estate agents access to various tools for their business. In the third quarter the Premier Agent program generated $158.3 million in revenue, reflecting a 33% increase from the same period last year.

Disclosure: None.

Thanks for sharing