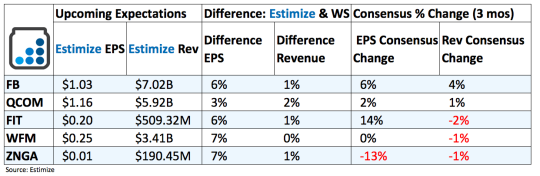

5 Stocks To Watch After The Market Closes Today - 11/2/2016

Facebook (FB): Online and mobile advertising will continue be the focus of the upcoming quarterly release. In particular mobile ad revenue has become the mainstay of each earnings report, accounting for 84% of total ad revenue in the second quarter. Advertising revenue is typically tied to the number of daily and monthly active users recorded during the quarter. In the second quarter the company posted 1.13 billion DAUs and 1.71 billion MAUs, reflecting sharp increases from a year earlier. That number could see some pressure after it was revealed that Facebook was over inflating its video metrics. Meanwhile SnapChat is slowly emerging as a legitimate threat to Facebook’s core business. The Evan Spiegel run company currently boasts 60 million daily users in the U.S. and Canada, about a third of what Facebook has in these markets.

Beyond key ad revenue metrics, the upcoming quarter will highlight the performance of its other ventures. Facebook has only started to monetize Instagram’s ad platform which is expected to be a cash cow for Facebook. Outside of Instagram, investors will be looking at the progress from Messenger & Whatsapp, both of which have over 1 billion users.

Other important initiatives this quarter included the launch of its Marketplace strategy within the Facebook platform along with its new professional networking part of the site. Both are direct blows to companies like Craigslist, Yelp and Linkedin which provide comparable services. This should be a seamless process given its massive and highly engaged user base.

Despite all these catalysts, Facebook faces some near term threats that could hamper performance this quarter. Lofty expectations have been placed on Facebook to blow out its third quarter report that it’s only a matter of time that the company misses.

Qualcomm (QCOM): Performance has started to gain traction after multiple quarters of negative quarter. The fiscal third quarter delivered a 3% increase on the top line and 17% on the bottom, with expectations of capping off its fiscal 2016 on an even stronger note. The chipmaker is gaining significantly in China through a number of new patent licenses with smartphone providers. Its active pursuit of 5G technology is widely believed to drive future growth in IoT and the technology markets. Despite these positive initiatives investors will be focused on any talks surrounding the NXP merger. Qualcomm recently agreed to purchase NXP Semiconductor for nearly $40 billion, making Qualcomm the largest chipmaker in the automotive market.

Fitbit (FIT): Fitbit has been trending higher leading up to its report. The wearables device maker has started to gain significant traction following strong consumer responses to its two new wearable products; Fitbit Blaze and Alta. The two models accounted for 54% of the 5.7 million devices sold in the second quarter and added $3 to average revenue per device. Its most recent devices, the Charge 2 and Flex 2, are expected to do the same for the third quarter. The two products have attracted positive reviews and will be the backbone of this pivotal report before the holiday season.

The company is still expected see pressure on the bottom line from increased spend on research and development along with marketing campaigns to support top line growth. However, margins and profitability are still expected to show signs of improvement from previous quarters.

Whole Foods (WFM): Shares are down 15% in 2016 on a string of flat revenue growth and decelerating profitability. Whole Foods is in the process of shifting towards more value oriented offerings. Its new Whole Foods 365 chains are aimed at attracting millennials who traditionally avoided the overpriced shelves of Whole Foods. The move should support top line growth in future quarters but will have an adverse impact on margins. Whole Food’s may have to lean on these stores as more companies are entering in the organic and natural food business. Management is expecting another soft quarter with comparable sales forecasted to decline by 2.4%.

Zynga (ZNGA): Without a hit sensation on the market Zynga has seen sales and earnings continue to struggle. The top line has been partially supported by older games like Words With Friends and Poker but its recent titles haven’t gained enough traction to reverse this ongoing slowdown. Meanwhile intensifying competition from Glu Mobile (GLU), Electronic Arts (EA), Activision (ATVI) and Nintendo’s Pokemon Go remain ongoing concerns. Unless Zynga can release a new blockbuster app there won’t be too much to look forward to in upcoming quarters.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more