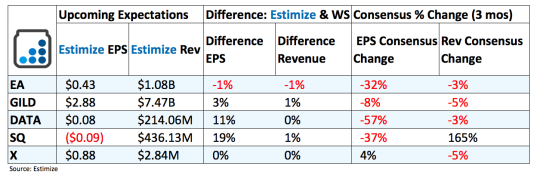

5 Stocks To Watch After The Market Closes Today - 11/1/2016

Electronic Arts (EA): Electronic Arts started the year on a hot streak thanks to the overwhelming success of Star Wars: Battlefront. That has since cooled off and Electronic Arts is coming off a weaker than expected FQ1 2017 printing a 53% decline on the bottom line and 2% on the top. The second quarter unfortunately doesn’t fully cover the annual release of FIFA and Madden video games. These games are often two of highest grossing games year after year and typically carry quarterly results, but investors will have to wait until the third quarter

Meanwhile, smartphone owners can expect to see new versions of FIFA, Madden and even a Star Wars based game. This is a new facet that Electronic Arts had previously never recognized but is now a huge source of revenue. The biggest factor, however, is growth in digital sales and in-game purchases. This new wave of digital offerings are not only convenient they also generate the highest margins. If Electronic Arts can continue to see strong growth in digital offerings then expect to see more favorable price movement.

Gilead Sciences (GILD): Gilead’s rise and now fall have come at the hands of its hepatitis C franchise, which includes Harvoni, Sovaldi and the recently launched Epclusa. The treatments were primarily credited with its double digit gains in 2014-15 and are now being blamed for negative growth in fiscal 2016. In the second quarter, the group of drugs recorded a 18.5% decline primarily due to lower sales of Harvoni. Harvoni sales were down a resounding 29% as new competition, mainly from Merck, seize its market share. Weak performance from the Hep C franchise was not only disappointing in the U.S. but Europe as well.

This sharp downturn caused management to cuts its outlook for the year in the range of $29.5 to $30.5 billion from $30-31 billion. Nevertheless some of these losses should be somewhat offset by its growing HIV business which includes a handful of already established treatments. Also, a robust pipeline positions Gilead for an easy bounce back in the near future. Setbacks from HCV will nonetheless be the primary talking point from this quarterly report.

Tableau (DATA): Win or lose, shares of Tableau have struggled this year. The stock is down 43% in the past 12 months due to an ongoing slowdown on both the top and bottom line. Analysts are projecting this slump to continue in the quarter to be reported. Earnings are forecasted to drop 42% with sales expected to jump 25%, on weaker demand for its business analytics tools. Microsoft (MSFT) has been aggressively divesting its comparable Business Intelligence tools which is a bad sign for Tableau moving forward. Some of this might be offset from its offering in the hybrid data architecture platform and a number of marketing campaigns to boost sales.

Square (SQ): Jack Dorsey may not have figured out a solution for Twitter’s (TWTR) woes but he certainly got Square right thus far. Square is coming off consecutive earnings and revenue beats as it inches closer to profitability. The second quarter, in particular, delivered strong core payments on a 42% increase in gross payment volume. This comes along with continued traction in its chip readers and a catalogue of new software and services. Square is seeing similar success with Square Capital which grew 23% sequentially and 123% YoY during the second quarter. Ongoing progress in the overall mobile payments space bodes well for the outlook of Square.

United States Steel (X): United States Steel has been one of the best performing stocks this year. Shares are up about 140% in 2016 on the back of improving quarterly reports. Analysts are optimistic the company can return to profitability in the upcoming report after years of taking a loss. The largest drivers of its recent success has been improving steel prices, a more efficient cost structure and a solid performance from its European segment. These fundamental changes have led to a broader bounce back in the steel industry which is just starting to hit its stride.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more