5 Stocks To Watch After The Market Closes Today, 10/27/16

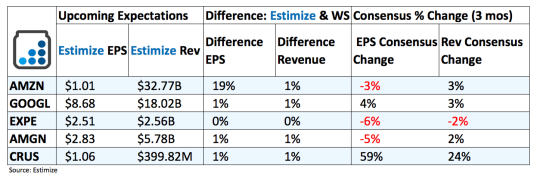

Amazon (AMZN): When Amazon reports tomorrow, many analysts believe that the 29% expected growth in total sales will be driven by double-digit growth in both the e-commerce and AWS divisions. E-commerce same store sales continually increased throughout the quarter, putting up 6.4% in July, 10.4% in August and 11.8% in September.

Amazon’s turn to profitability in the last quarter of 2015 was mostly driven by the success Amazon Web Services. This is what supports many popular websites including Netflix and has been the fastest growing part of the business. AWS has since slowed down slightly while other pieces start to hold their own. Amazon Prime and its hardware, Kindle and Echo, are becoming more widely adopted as efficient tools at modest price points. Meanwhile, new initiatives such as a courier service, fresh delivery and expansion in India will certainly help boost sales moving forward.

Alphabet (GOOGL): Google has been trending higher since the debut of the Google Home and Pixel Smartphone at an event earlier this month. Google Home and Pixel are a slap in the face to Amazon and Apple which both offer comparable products. This week’s earnings report will likely shed some light on projected sales of these two. The report will more importantly let investors know whether its coveted moonshot investments have remained unprofitable. In the second quarter, these projects lost $859 million, up from $660 million in the previous period. Its search business will always be unwavering but these side investments must start holding their own to support rising share prices. Analysts at Estimize have increased estimates lately with new found confidence that Alphabet can make the necessary improvements to reaccelerate growth.

Expedia (EXPE): Results earlier this season from the airlines insist that traffic trends are improving, which means Expedia could be in for a strong third quarter report. The online travel agency has worked tirelessly to expand its market share to effectively compete with Priceline’s international dominance. Many of these initiatives include acquiring competitors and consolidating the markets. Its most recent takeovers include Orbitz and Homeaway, the latter being a gateway into the sharing economy. One of its older deals for Trivago is now preparing a stock market listing of its own. An IPO will help Expedia raise fresh capital to expand the Trivago brand. The company still faces a handful of near term headwinds including FX volatility and weak consumer spending. Either of these factors can put a dent in performance this quarter that is otherwise expected to be more profitable than previous reports.

Amgen (AMGN): Amgen is the third biggest biotech stock to report this week following Biogen yesterday and Celgene this morning. But unlike its peers, expectations are a bit muted amid concerns that the biotech leader can’t sustain its previous growth. Investors will be focused on the performance of its six main drugs. These treatments currently generate 75% of Amgen’s total revenue and have grown at a solid clip. Another focal point will be Amgen’s new cholesterol drug, Repatha, which could ultimately be one of its best sellers. In the second quarter, Repatha recorded a meager $27 million in sales, but any pickup in momentum will be encouraging. A major threat to the drug’s success will be the performance of comparable treatments from Regeneron and Sanofi.

Cirrus Logic (CRUS): Another Apple report is completed and investors are yet again disappointed with the outcome. The fallout of the report is not only isolated to Apple but many of its chipmakers which rely on key iPhone sales. Sales of its flagships product came in at 45.5 million, down 5% from a year earlier, but higher than Wall Street’s forecasts of about 44 million. Unfortunately, investors were optimistic that Apple would post positive iPhone numbers which translated to lofty estimates for some of its suppliers including Cirrus. Shares are now down leading into its report as investors lose confidence that the chipmaker can meet expectations.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

Thanks for sharing