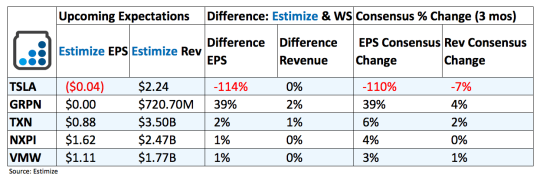

5 Stocks To Watch After The Market Closes Today - 10/26/2016

Tesla (TSLA): Tesla’s third quarter gains consisted of 24,500 deliveries, up 70% sequentially and over 100% on a year over year basis. Production during the quarter also rose to $25,185, reflecting a 27% increase from Q2 production of $18,345. In addition to these marks, about 5,500 vehicles were in transit to customers but not counted in the quarter. These will carry forward to delivery in the fourth quarter. Investors can expect to see production and delivery metrics increase as the company prepares to debut its newest car, the Model 3. The Model 3 will be Tesla’s cheapest car that will introduce customers to electric cars and the Tesla family.

Other aspects the company will be working through this quarter include the SolarCity deal, a new solar rooftop product and any headway on Elon Musk’s Master Plan. Earlier this year Tesla agreed to purchase SolarCity for $2.6 billion, that is being labeled as nepotism and a bailout. Investors are up in arms about the deal and will have their say at a Nov 17 shareholder meeting to vote on it. Additional updates on its new solar rooftop product and whether the company will begin pursuing driverless trucks and busses could also be mentioned during the conference call.

Groupon (GRPN): Groupon continues to see improvement in its customer acquisition and shopping initiatives, aimed at local businesses around the world. In the second quarter, local billings grew 9% on nearly 1.1 million new customers. Most of these gains were recorded in North America which grew double digits in profitability. Recently the company announced it was expanding its on demand food delivery service, called Groupon To Go. The service was first introduced in Chicago and is now making its way to Denver. This is expected to act as a conduit to attract customers to restaurants, thereby opening a new layer of revenue.

Efforts to growth and stimulate growth come at cost though. Groupon has invested heavily in marketing campaigns to stave off competition from eBay (EBAY) and Amazon (AMZN). These efforts, while helpful for boosting revenue, will take their toll on margins, explaining the losses recorded in the past 3 quarters. Investors are still optimistic that Groupon will make gains tomorrow, given its valuation discrepancy compared to its peers.

Texas Instrument (TXN): TXN generates most of its revenue from analog and embedded chips that connect a widespread of devices from consumer electronics to automotive. Recent strength in automotive and industrial segments have offset the weakness in personal electronics and communications equipment. This has led to sales growth near zero in the second quarter with Q3 sales targets nearly identical to a year earlier. Some of the biggest concerns this quarter include currency headwinds, increasing competition and an over-reliance on Apple. TXN’s exposure to Apple (AAPL) include components in iPhone and iPads that will impact its personal electronic segment for better or worse. The automotive business may also face a long term threat if Qualcomm (QCOM) purchases NXP, which will form the largest automotive chip manufacturer.

NXP Semiconductors (NXPI): NXP, like TXN, is finding strength in its core automotive chip business. This has resulted in a steady improvement on both top and bottom line. In the second quarter, earnings contracted by 3%, compared to 16% decline in the prior quarter, while sales jumped 57%. Strong performance is expected to continue into the third quarter on a surge in automotive and other key new technologies. Strong adoption of tablets, smartphones and wearables technologies should all help boost NXP’s third quarter revenue. Analysts are optimistic that NXPI can build on its recent success, but the bigger news will be whether management shines any light on the potential takeover from Qualcomm. Any indication that this is still on table will be enough to send this stock higher.

VMware (VMW): VMware is well positioned to leverage its leading position in the virtualization market to other markets such as data centers, hybrid cloud and mobile devices. These three markets will likely be the fastest growing segments in cloud computing over the next several years. VMware also continues to form strong partnerships with major players such as Google (GOOG) and IBM (IBM). A recent partnership with Amazon might be the most important though. The former foes will now be primary private cloud partners, enabling VMware to leverage Amazon’s robust footprint in the cloud market.

A few major concerns still stand in the way of its success, including stiff competition, soft IT spending and macroeconomic uncertainty in some of its key markets. Additionally, a subpar report from key competitor Citrix last week might be an indication of weakness in the virtualization market.

Disclosure: None.