5 Stocks To Buy For Growth, Value, And Yield

These five cheap stocks are part of the small group that beat earnings estimates, and they all have large margins of safety because of their generous dividend yields. These stocks offer value, growth, and income in a market where it remains tough to find anything worth buying.

Stocks have started to slide lower over the past week and a half after big gains since the market hit its nadir for the year on February 11th. Crude rallied off its $25 a barrel low earlier this year which continues to stabilize the high-yield credit market. Worries about a massive default are no longer a headwind right now like it was in January.

Unfortunately, it is quite apparent that the first quarter earnings season is mostly one of disappointment. Not only is it the fourth quarter in a row investors have had to deal with declining profits within the S&P 500 year-over-year, those numbers are accelerating in the wrong direction. This quarter will show the biggest decline in growth since 2009 as anemic global demand continues to take its toll as operating margins drop. There is little fat left to cut across Corporate America seven years into the weakest post-war recovery on record and a paucity of growth opportunities.

Domestically, things are hardly much better. First quarter GDP growth clocked in at just .5%, pretty much at stall speed. The country also faces what appears to be one of the nastiest election seasons in recent memory with both front runners sporting record unfavorable ratings for major candidates and we are not even through the primary season yet.

It also seems that for every major company that delivers great results like Facebook (NYSE: FB), there are two to three Apple (NASDAQ: AAPL), Gilead Sciences (NASDAQ: GILD) or Microsoft (NASDAQ: MSFT) that miss expectations. In addition to raising some cash over the past few weeks in my own portfolio, I am keeping mainly to cheap stocks that not only paid good dividends but also delivered past solid results this quarter, putting them in a distinct minority.

These are stocks that, although they will not be “home runs”, have little downside, will continue to pay dividends every quarter and should continue to be good solid “singles”. In this market, that is more than one can ask for until economic growth prospects improve markedly. Most of these have been seen on these pages before but are worth reiterating.

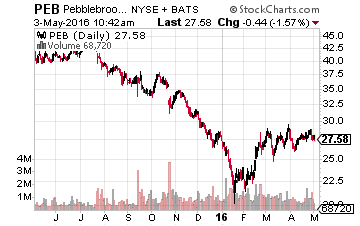

Let’s start with a lodging real estate investment Pebblebrook Hotel Trust (NYSE: PEB) which reported results last week. The company easily beat both the top and bottom line consensus. FFO (Funds from Operations) per share came in at 56 cents, a dime above expectations on better than 20% year-over-year increase in revenue. Same property RevPAR (Revenue per room) was up better than eight percent from the same period a year ago. Same property EBITDA was up more than 15%.

The company did offer a conservative outlook but kept their previous forward guidance intact. Earlier this year this REIT raised its dividend payout by north of 20% and now yields 5.3%. At 10 times this year’s FFO, it is more than a solid bargain in an overbought market.

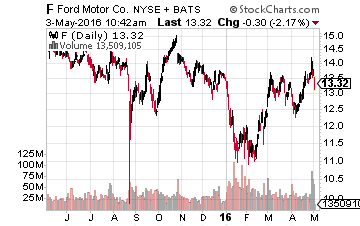

Very few large cap concerns have blown away expectations this quarter than auto manufacturers General Motors (NYSE: GM) and Ford (NYSE: F).

General Motors reported earnings of $1.26 a share, a quarter better than expected as revenues came in almost $2 billion above consensus estimates. Over the last four quarters, earnings have beat the consensus by an average of over 20%.

Ford was no slouch either and reported earnings of 68 cents a share, two dimes above what analysts had estimated. This is the third time in four quarters the company has blown through the consensus. Both automakers are benefiting from low gas prices which are pumping up the sales of high-margin trucks and SUVs which now make up their highest proportion of the overall sales mix since 2005.

Both automakers are also seeing improved results from their European operations and more importantly continue to gain market share through their joint ventures in China, which is now the largest auto market in the world. Both stocks trade at less than 45% of the overall market multiple based on earnings and yield well over four percent as well.

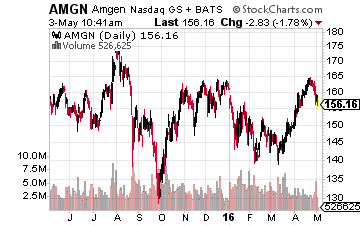

Amgen (NASDAQ: AMGN) delivered better than expected results for the ninth straight quarter in a row. It reported earnings of $2.90 a share, 30 cents over the consensus on better than a nine percent increase in revenue. Analysts consistently underestimate Amgen’s earnings power and it is going to be a major player in the emerging area of biosimilars which should be a $30 billion annual market ten years hence. The stock sells at 15 times this year’s earnings, a slight discount to the overall market despite superior growth. It also yields a solid 2.5%.

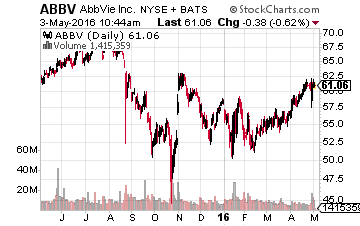

Finally, we have AbbVie (NYSE: ABBV) which beat earnings expectations by a couple of pennies a share and announced a $6 billion acquisitions of a privately held stem cell concern to boot. This will expand AbbVie’s presence into immuno-therapy as the company continues to diversify away from dependence on its blockbuster drug Humira. The is a solid bargain at 13 times this year’s profits with a three and three-quarters percent yield.

All of these names delivered better than expected results last week so expect analysts to continue to reiterate Buy ratings and/or raise price targets in the weeks ahead given the dearth of good earnings news so far in the first quarter.

Positions: Long ABBV, AMGN, F, GM, PEB

Small Cap Gems analyst Bret Jensen has identified his top 3 takeover stocks ...

more