5 Small Caps For Momentum Investors - Wednesday, March 8

I wanted to find 5 Small Cap stocks that might be of interest to Momentum Investors so I used Barchart to sort the S&P 600 Small Cap Index stocks first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more. Today's Watch List includes: Masimo (MASI), Select Comfort (SCSS), Ebix (EBIX), Integer (ITGR) and Nutrisystem (NTRI)

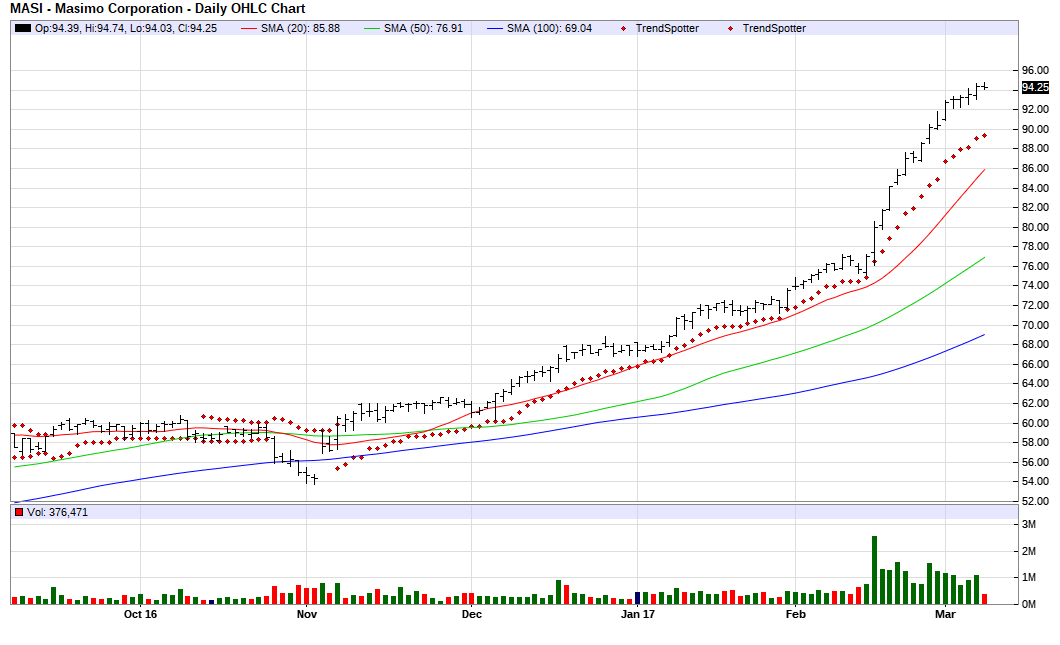

Masimo

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 24.59% in the last month

- Relative Strength Index 92.87%

- Technical support level at 93.33

- Recently traded at 94.19 with a 50 day moving average of 76.91

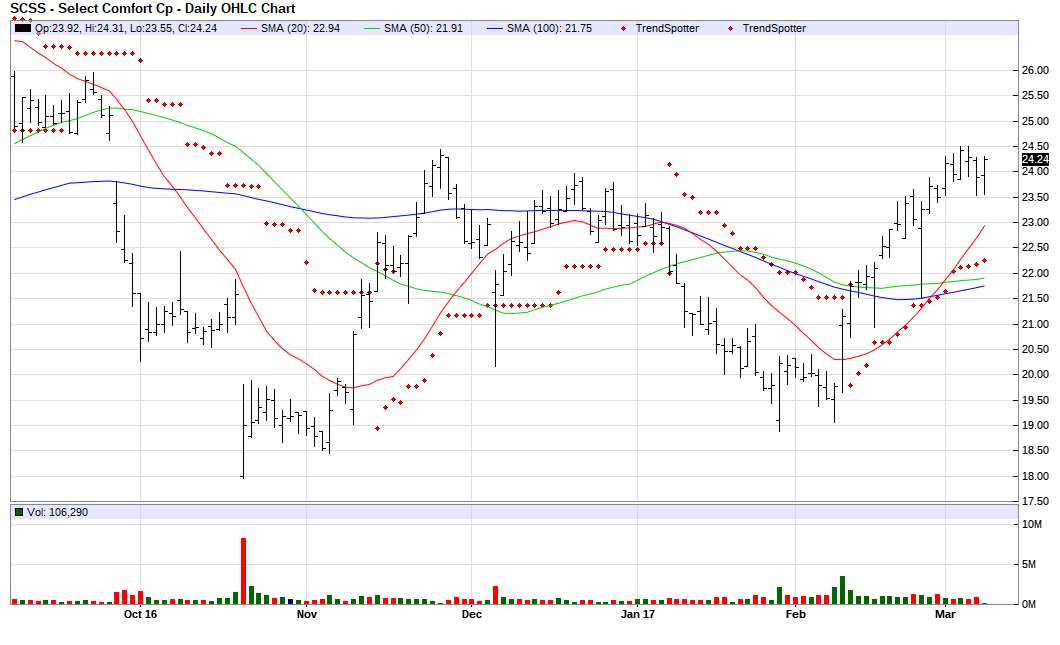

Select Comfort

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 22.71% in the last month

- Relative Strength Index 66.25%

- Technical support level at 23.52

- Recently traded at 24.20 with a 50 day moving average of 21.91

Ebix

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 12.78% in the last month

- Relative Strength Index 74.85%

- Technical support level at 63.37

- Recently traded at 64.00 with a 50 day moving average of 58.52

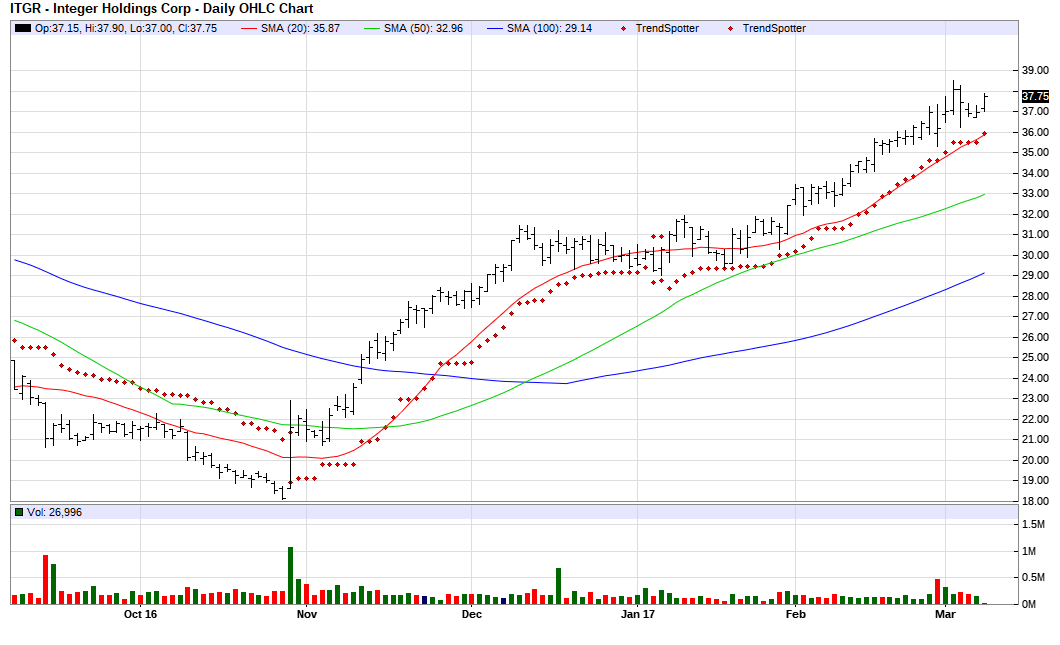

Integer

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 14.74% in the last month

- Relative Strength Index 68.59%

- Technical support level at 36.67

- Recently traded at 37.75 with a 50 day moving average of 32.96

Nutrisystem

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 45.16% in the last month

- Relative Strength Index 84.86%

- Technical support level at 48.37

- Recently traded at 48.50 with a 50 day moving average of 36.80

Disclosure: None.

Thanks @[Jim Van Meerten](user:4654), when is the split going to be put back on the table?