5 Retail Stocks To Watch That Report Earnings Tomorrow - Thursday, Nov. 10

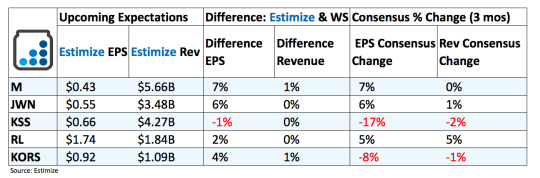

Macy’s (M): Department store retailers rebounded in the second quarter after years of weak consumer spending and dwindling market share to rising e-commerce brands like Amazon. The resurgence started with Macy’s after the retailer beat earnings and revenue estimates by a wide margin. Continued efforts to optimize price, maintain efficient inventory levels, and expand private label offerings are expected to help Macy’s build on its Q2 gains. Additional developments in its e-commerce platform, off-price brand and building out its cosmetics brand, Bluemercury, will have the biggest impact on the top line growth. Nonetheless, the second quarter may have been an anomaly and Macy’s could just as easily fall back into its old ways. A competitive landscape, particularly from the online retailers, are redirecting traffic away from department stores and thereby denting sales. As a result analysts’ expectations have been muted despite the positive traction generated in the second quarter.

Nordstrom’s (JWN): Nordstroms along with Macy’s and the rest of the names mentioned on this list was the beneficiary of better than expected earnings last quarter. The upscale department store was hit hardest by the changes in the retail environment that witnessed a shift away from luxury brands towards value channels. Shares are down 23% in the past 12 months but have since recovered to flat in 2016. Nordstrom’s investments to expand its omnichannel capabilities along with efficient cost controls and store expansions remain driving factors for top line growth. Needless to say, the overall rebound in the retail sector is well off its peaks with overall growth running negative.

Kohls (KSS): Exceedingly low expectations made it easier for Kohl’s to top its quarterly results in the second quarter. Despite topping expectations, the Q2 results included a 1.8% decline in comparable store sales on a 2% decline in total revenue. Sluggish comps could see a boost in the third quarter that includes the pivotal back to school season and tend to drive traffic trends. Continued efforts to improve its base business and maintains its strategic initiatives, Greatness Agenda, should help drive growth through the holiday season. Kohls along with its peers should remain cautious about the weak spending environment and continued the adoption of e-commerce platforms.

Ralph Lauren (RL): Luxury brands have been amongst the worst performers in the broader retail sector as consumers shift their spending towards value channels. Ralph Lauren, in particular, has seen shares drop 28% in the past 12 months on sluggish comparisons, challenging retail trends and numerous store closures. Margins have been hurt from frequent discounting to compete with the value-oriented retailers, negative currency translation, and heavy infrastructure investments. Efficient cost controls may offset some of the losses while a recently applied restructuring strategy will help long term performance.

Michael Kors (KORS ): After weak revenue results from Kate Spade and Coach already this season, luxury brands appear to be unraveling. This doesn’t bode well for Michael Kors who reports its third quarter results on Thursday. With a large exposure to volatile international markets and currency headwinds, both earnings and revenue could see their first downturn in over a year, after just getting by with flat growth in Q2. Estimates are seeing downward revisions activity ahead of its report, typically a sign of a miss on the horizon.

The main focus for KORS will be comped which in the past were driven by new store openings, expanding existing outlets and building out its omnichannel capabilities. But the retail environment is more challenging these days. Luxury brands and longtime status symbols are simply not resonating with consumers like they have in the past. As a result, we have seen a great deal of discounting from key brands including Michael Kors. Discounting may very well drive sales but it also puts pressure on margins.

Disclosure: None.