5 Reasons Ikanos Communications Is An Excellent Short

Summary points:

- Ikanos Communications (IKAN) is severely lagging behind the hypercompetitive telecom and semiconductor business.

- Falling revenue, unending high cash burn and a weak balance sheet have reduced shareholder equity for 5 years in a row, and there seems to be no end in sight.

- Dilution appears to be imminent (again). Its overpaid management has a disturbing history when it comes to diluting shares.

- Despite the stock price at all-time lows, Ikanos still unwarrantedly trades at a premium.

- Given how bad things are going, I believe shares are heading for 0. Ikanos is an easy short, it’s NASDAQ with plenty of borrows available for a low 1.5% fee.

Full thesis:

I believe we are amidst the top, or very near the top, of one of the strongest bullmarkets in history. So, as a contrarian investor, I thought it could be worthwhile exercise to look for overvalued stocks ripe for a profitable short. I recently spotted Ikanos Communications. If my research is correct, this stock sports the ideal features for a short. This brief article outlays 5 reasons why, and a risk section for a balancing bullish perspective.

Reason number 1: Ikanos Communications' DSL business is outdated.

According to their own website, Ikanos Communication designs, develops, markets, and sells semiconductors and integrated firmware products for the digital home worldwide. It offers various digital subscriber line -DSL- processors for a range of power carrier infrastructure and customer premises equipment devices. So far, Ikanos has placed all bets on VDSL, a ultra high speed DSL connection.

However, despite the over-promising stories on their website - talking about the internet of things and all that - the company simply doesn't deliver. Their offer so much (legacy) products that it's unclear what their 'killer product' is. The competition in the telecom and semiconductor is sky high, so where does that leave Ikanos?

Their efforts to innovate has shrunk 15% in 2013, and 10% in 2014, given the decline in R&D related expenses.

Secondly, is VDSL the future of broadband? Not really. DSL will soon be a thing of the past. The future now belongs to a new technology called G.fast. Ikanos understands this, as they are trying to shift to G.fast by teaming up with Alcatel Lucent (NYSE: ALU). But the promised G.fast chips prototype will not be delivered to Alcatel in Q2. As a matter of fact, Ikanos is still in a very early stage of development. As of now, they aim for Q1 2016 to go commercial, but given managements sad history with regards to keeping their promises, this could take much longer, if ever. A competitor called Sckipio says they are the first to come to market.

So in sum, Ikanos' only source of revenue is its declining legacy business, while its effort to catch up with, or even be ahead of, the newest innovations is in serious jeopardy. I personally think they are not going to make it. They failed Alcatel so far (more on this later in the article), so they could decide the terminate the agreement at some point in the future if Ikanos keeps failing.

Reason number 2: Terrible financials.

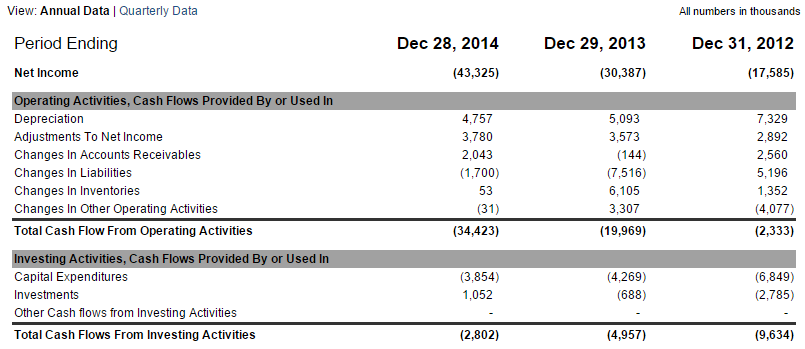

Ikanos is plagued by an unending high net cash burn that increases per year:

Q4 was higher than Q3, and Q3 was higher than Q2. This company is clearly burning through cash like butter, and it worsens every quarter, despite the expenses on R&D going down. Ikanos now almost burns more cash on a yearly basis than its market cap. According to Markit, the consensus earnings estimate - EPS - has worsened too from $-0.45 down to $-0.50 for quarter ending 3/2015.

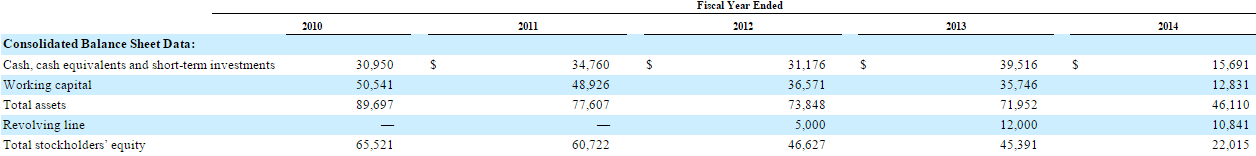

Now let's look at the consolidated balance sheet:

You can see that shareholder equity shrinks per year. Last year, the decline accelerated with -52%. I think shareholder equity is actually much lower, because the company's asset base consists partially of outdated inventory products and equipment with no liquidation value in the market place (this is common in the telco space). If this trend continues, shareholder equity will dip into the negative (probably this year), making shares essentially worthless.

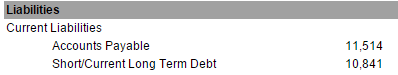

The balance sheet contains debt too, for about half of the market cap (per end of 2014):

The $10.8 million loan is with the Silicon Valley Bank, and needs to fully repaid in time.

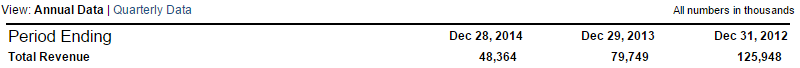

Ikanos' revenue statement raised my eyebrows too:

In just 2 years time, revenue shrunk more than 60%! This sure proves how outdated their legacy business is.

Reason number 3: Ikanos unwarrantedly trades at a premium.

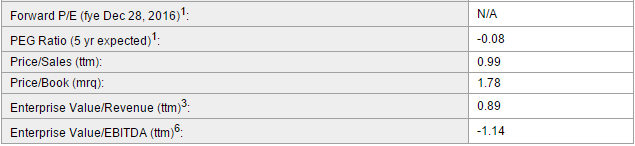

With such poor financials in mind, let's look how this company is valued from a relative viewpoint:

If revenue is falling like a rock, why is the p/s multiple still 1? With such a high cash burn and weak balance sheet, why is the price/book almost 2? In my view, these premiums are unwarranted. This strengthens my call for a short. A fairer value would be

half of these multiples or less.

Reason number 4: Dilution is imminent.

Ikanos is running out of cash fast. Per end of 2014, they had $13 million in cash. But since they burn about $11 million per quarter, they had to conduct an offering in February to keep the boat afloat, raising $12.4 million in the process. However, this will only last them through Q2, which just commenced. So common sense tells me they will have to another raise somewhere in May or June. As a matter, the cash burn is so high, they probably will have do another dilutive offering in Q3 or Q4.

This doesn't surprise me, the company has a disturbing history of diluting shareholders; they have done it so many times. Go look it up, the list is simply too long to post it here.

Reason number 5: Shareholder-unfriendly management.

Apparently management has no qualms diluting shares time after time. Maybe this guarantees their bloated fixed salaries? Why are they getting paid so much if they are doing the exact opposite of creating shareholder value? Shares just hit an all-time low, yet they gave themselves new options at $2.80!

Also, management only owns a very small portion of the company. To their credit, they did participate in the recent rights offering, but their stake in the company remains unimpressive. This link shows they actually have been sellers more often than not throughout time.

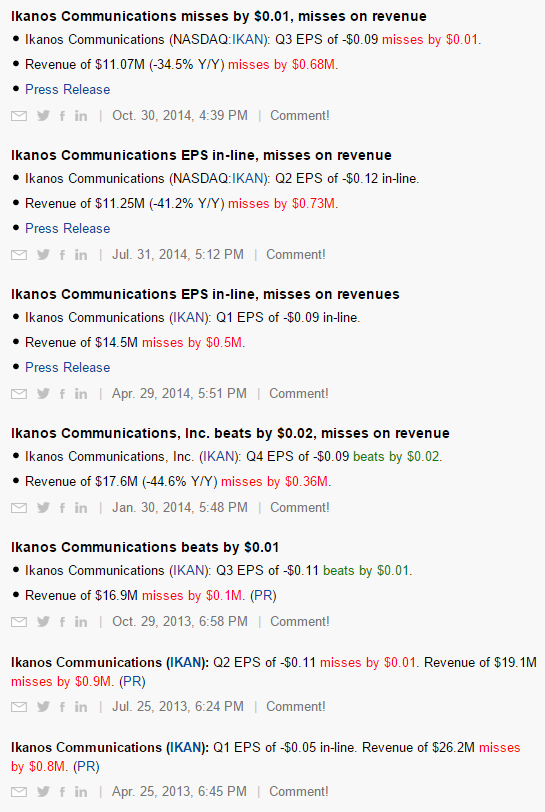

Lastly, they have a nasty habit of disappointing shareholders time after time. Take a look at the next overview, they have been missing revenue estimates 7X in a row (!!).

Adding to my call for a short

- Credit risk with respect to accounts receivable is pretty high given that 80% of it is represented by only 3 customers.

- There was no material impairment recorded in 2014, 2013, or 2012 for its long-lived assets, so there is a chance an impairment will be necessary this year.

- The 10K SEC filing reveals that Alcatal Lucent committed to loan Ikanos up to $10 million following the satisfaction of certain conditions. But as of December 28, 2014, the Company has not satisfied the conditions of the ALU Loan Agreement, and, accordingly, has not drawn on the loan. This begs the question; why didn't Ikanos satisfy the conditions? Doesn't sound positive to me. There is a chance Alcatel could terminate the agreement if Ikanos keeps failing to deliver.

- How will Ikanos repay the $10.8 million loan to Silicon Valley Bank?

- There are lot of unexercised warrants and stock options floating around that could cap the share price.

- In order to regain NASDAQ compliance, the stock recently underwent a reverse split. Studies point out that most companies that resort to these type of trics (although legal) fail in the longer term.

Risk (bullish) section

Shorting stocks is a risky endeavor. With micro-caps, the stock price can suddenly shoot up big. Here a couple of scenario's why this could happen with Ikanos:

- A big telco decides to acquire Ikanos.

- Management initiates a pump PR campaign using stock promoters.

- Shares are thinly traded, so an unforeseen bigger than usual buyer could elevate the share price easily (this goes both ways).

- The company's technology could suddenly turn out to be popular, resulting in new orders from a big telco. This will make the share price go higher.

I regard the odds of each of these scenario's materializing as pretty slim, but they can't be ruled out. And of course, do your own due diligence, use limit orders, and size your position accordingly.

Bottom line

Ikanos Communications sports the ideal features for a short. Shorting individual stocks is often regarded as too risky, but if the opportunity is so asymmetrically skewed to the downside, and given my view that we are very near the top of a multi-year strong bullmarket, I'd say shorting Ikanos is a great bet.

Ikanos simply can't cope with the intense competition in the telecom and semiconductor space. The terrible financials and totally untrustworthy management make this stock almost worthless. Dilution is imminent too, so even though the stock price is at all-time lows, the downside is still 100%.

Disclosure: Short IKAN. Please do your due diligence before investing.