5 Persistent Small Cap Winners

Not only does Value Line provide analysis of 1700 larger more popular stocks but they also offer a Small & Mid Cap Survey offering analysis of 1800 smaller stocks. One of their screens sorts all those stocks into percentiles of price growth persistence over the last 10 year period. Today I used the Value Line screener to sort those smaller stocks by stocks that were in the 80 - 100 percentile range and then used Barchart to see which stock currently had upward momentum as indicated by Barchart's technical buy indicators.

The top 5 were Home Bancshares (NASDAQ:HOMB), Littelfuse (NASDAQ:LFUS), Primerica (NYSE:PRI), First Interstate Bancsystem (NASDAQ:FIBK) and Bank of the Ozarks(NASDAQ:OZRK).

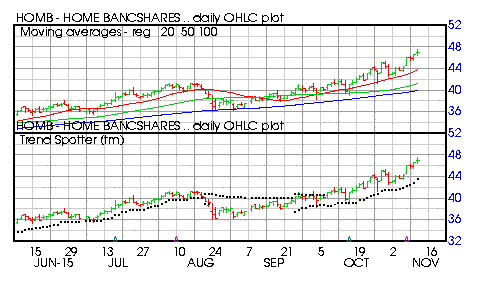

Home Bancshares

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 14.06% in the last month

- Relative Strength Index 69.62%

- Barchart computes a technical support level at 45.17

- Recently traded at 46.85 with a 50 day moving average of 41.21

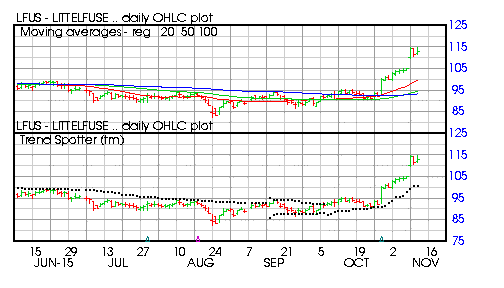

Littelfuse

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 21.91% in the last month

- Relative Strength Index 76.66%

- Barchart computes a technical support level at 108.51

- Recently traded at 113.30 with a 50 day moving average of 94.54

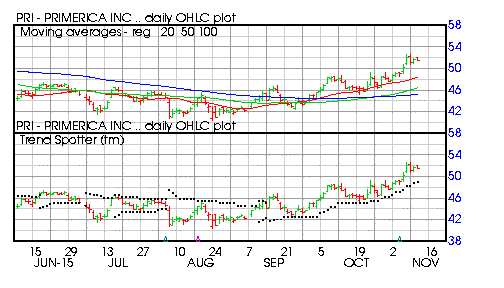

Primerica

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 7.67% in the last month

- Relative Strength Index 66.19%

- Barchart computes a technical support level at 50.71

- Recently traded at 51.52 with a 50 day moving average of 46.40

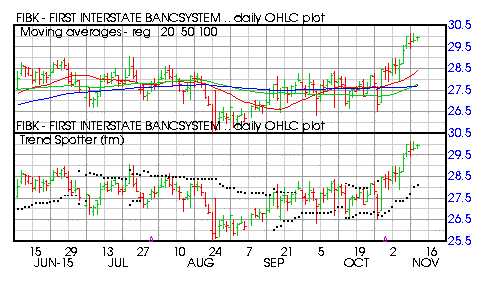

First Interstate Bancsystem

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 7.42% in the last month

- Relative Strength Index 65.88%

- Barchart computes a technical support level at 29.46

- Recently traded at 29.95 with a 50 day moving average of 27.77

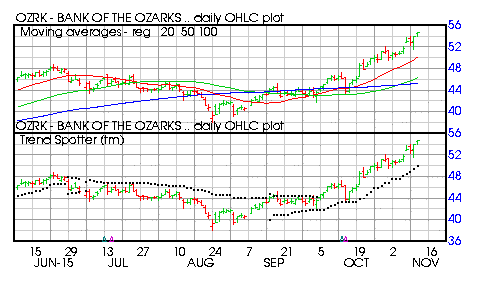

Bank of the Ozarks

Barchart technical indicators:

- 96% Barchart techncial buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 nw hgihs and up 19.00% in the last month

- Relative Strength Index 76.53%

- Barchart computes a technical support level at 50.68

- Recently traded at 54.73 with a 50 day moving average of 46.27

Disclosure:None.