5 Nasdaq 100 Stocks For Momentum Investors - Wednesday, January 25

I wanted to find 5 Nasdaq 100 stock that would be of interest to momentum investors so I used Barchart to sort the Nasdaq 100 Index stocks first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more. Today's watch list includes:

Symantec (Nasdaq: SYMC), 21st Century Fox (Nasdaq: FOX), Adobe Systems (Nasdaq: ADBE), Charter Communication (Nasdaq: CHTR), Tesla Motors (Nasdaq: TSLA)

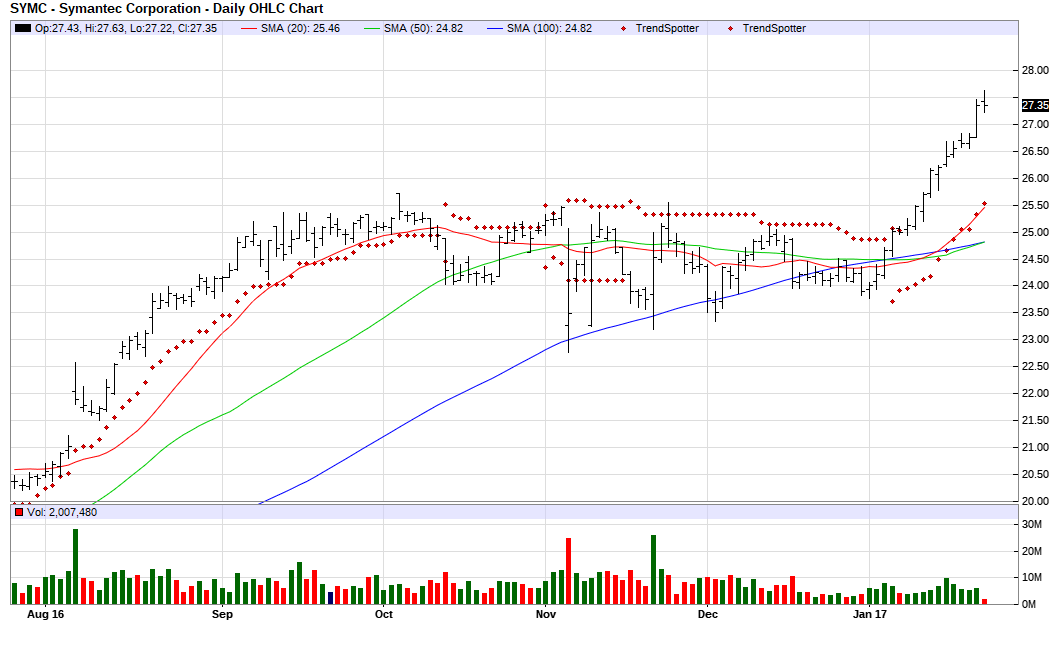

Barchart technical indicators:

- 88% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 13.17% in the last month

- Relative Strength Index 80.73%

- Technical support level at 80.73

- Recently traded at 27.32 with a 50 day moving average of 24.82

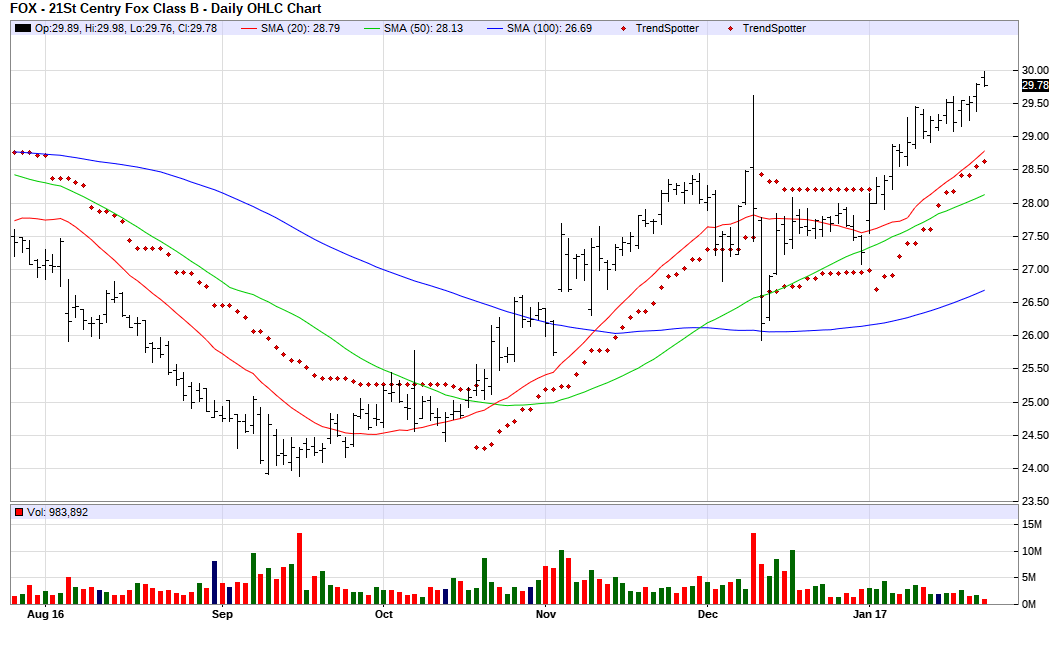

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 7.51% in the last month

- Relative Strength Index 66.63%

- Technical support level at 29.51

- Recently traded at 29.73 with a 50 day moving average of 28.13

Barchart technical indicators:

- 88% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 8.46% in the last month

- Relative Strength Index 76.79%

- Technical support level at 111.98

- Recently traded at 113.98 with a 50 day moving average of 105.58

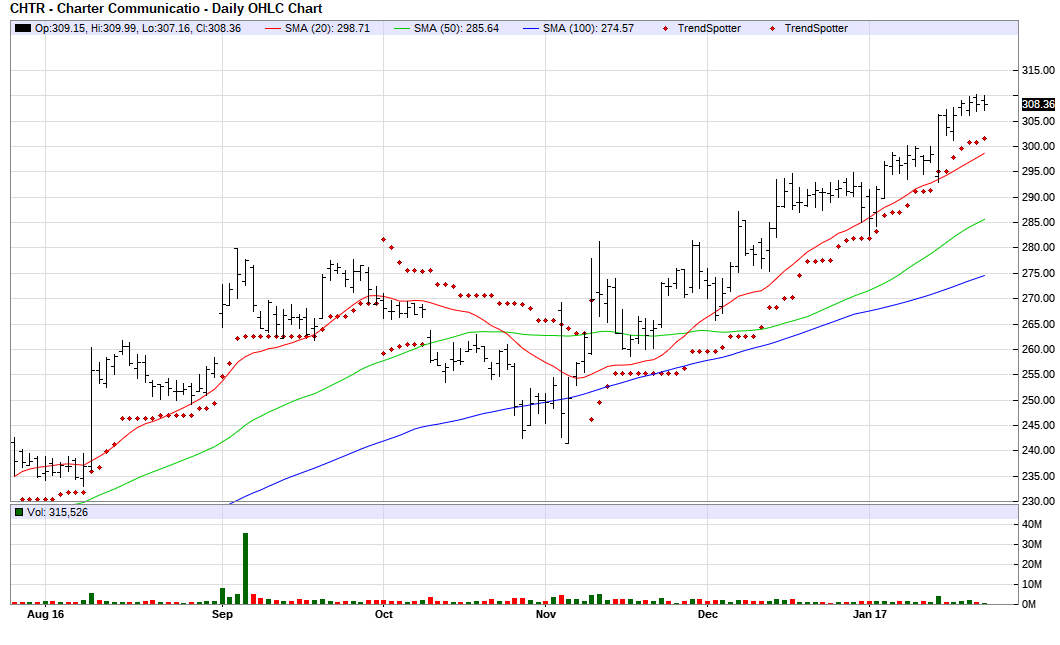

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 6.16% in the last month

- Relative Strength Index 69.64%

- Technical support level at 306.84

- Recently traded at 308.54 with a 50 day moving average of 285.63

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20 50 and 100 day moving averages

- 12 new highs and up 18.93% in the last month

- Relative Strength Index 82.32%

- Technical support level at 251.24

- Recently traded at 252.48 with a 50 day moving average of 208.52

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!