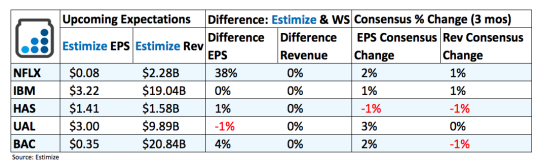

5 Companies To Watch That Report Earnings On Monday (October 17, 2016)

(Click on image to enlarge)

Netflix (NFLX): As is always the case, investors will be closely watching subscription growth numbers for the quarter. In the second quarter, Netflix added 1.7 million subscribers , well below its own expectations of 2.5 million. A majority of the 1.7 million subscribers came internationally, where management has begun to shifts its focus. This large discrepancy between actuals and expected results was blamed on greater churn after monthly rates were raised. Tenured members were also grandfathered from cheaper plans into the new more expensive service. This should continue to be a problem, conceivably until the end of the year. More importantly, Netflix is gaining more attention as a potential takeover target. In early October, new rumors surfaced that both Apple and Disney were thinking about making a bid for the video streaming platform. An acquisition may turn out to be a good thing for Netflix as it tries to stave off competitive headwinds from Amazon and similar platforms.

International Business Machines (IBM): IBM continues to invest heavily in high growth markets including Big Data, business analytics, and cloud computing as its legacy business have struggled. These markets are expected to carry earnings in the future but in the meantime, they are expensive and time-consuming. This transition period coupled with sluggish PC sales and IT spending have amounted to consistently negative growth. IBM is expediting the process through strategic acquisitions. Since the turn of the millennium, the company has purchased over 150 companies that have led to incremental revenue gains. Meanwhile, the relative strength of the dollar and Brexit uncertainty should prove to be another roadblock moving forward. IBM has a large footprint in Europe which leaves them susceptible to any policies that may impact currencies or trade in the region.

Hasbro (HAS): Hasbro’s recent string of success can be credited to movie-themed toys specifically those based on Star Wars and Captain America. Those movies have come and gone and now Hasbro is waiting for the next blockbuster success. In all likelihood, that will be the next Frozen or Star Wars movies expected to debut at the end of the year. Frozen toys will help propel the girl’s segment which has recently seen a marked turnaround. In the past, the boy’s segment and movie related toys were expected to offset the losses posted in the girl’s segment. It was only until this year that the girl’s segment has begun to hold it own. That doesn’t mean all of its girl brands are performing well. Furby and My Little Pony are consistently posting weak growth and should put a dent in the upcoming quarter’s results.

United Continental Holdings (UAL): Major airlines have faced significant headwinds lately from foreign currency pressures, mounting terrorist threats, weaker last minute business flights, and a simple reluctance to fly. United, in particular, has witnessed sharp declines across earnings and revenue with negative growth in the past two-quarters. The second quarter posted a 5% decline in revenue and 6.6% drop in its crucial PRASM measure. Management has already indicated that investors should expect similar declines throughout the third quarter. In its August Traffic reports the company posted marginal increases in consolidated traffic and capacity but also stated that PRASM is expected to decline 5.5-7.5% for the third quarter. Meanwhile, United is expected to see pricing pressure from increasing competition. Low budget airlines such as Southwest and Spirit have captured greater market share through a more consumer-friendly pricing model.

Bank of America (BAC): Bank of America is in a strong position heading into its Monday report. The bank is expected to see improvement across the board from a bounce in trading activity, improving energy sector, and efficient cost controls. The market has been booming since Brexit and should pay off in the form of higher trading revenue and greater investment banking operations. Meanwhile, a bounce in the energy sector should alleviate loan losses for the quarter. Strong reports earlier today from JPMorgan, Wells Fargo, and Citigroup reflect the ongoing improvements in the financial sector with Bank of America next in line.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more