5 Best Performing Dividend Stocks Of 2014

Dividend stocks have gained popularity and have been on the rise this year on investors’ drive for higher income in the current ultra-low rate environment. Additionally, the dividend paying securities are the major sources of consistent income for investors when returns from equity market are at risk.

While the broad U.S. equity market have hit multiple highs on several occasions, economic turmoil in Russia and Greece, China slowdown, lower oil prices, recession in Japan and disappointing data from Euro-zone have kept returns at check all along this year. This volatility has compelled investors to be defensive and turn their focus on dividend stocks that provide stability in the form of payouts and safety in the form of mature companies that are less vulnerable to the large swings in the stock prices.

The dividend-paying stocks have proven outperformers over the long term and are the safest ways to create wealth. This is especially true as the companies that pay dividends generally act as a hedge against economic uncertainty and provide downside protection by offering outsized payouts or sizable yields on a regular basis.

Dividends Growing in Double Digits

According to the latest quarterly dividend factsheet, dividends per share for the S&P 500 (SPX) companies have risen for the 15th consecutive quarter marking an increase of 11.3% year over year to $37.99 for the 12-month period ending in October. In fact, dividend per share growth exceeds earnings per share growth of 7.6% for the index.

Notably, consumer discretionary led the way higher in the third quarter with a dividend per share gain of 18.8%, followed by 17.6% for financials services, 15.5% for telecom services, 14.6% for energy, 13.6% for information technology and 12.2% for industrials. The dividend payout ratio stands at 32% at the end of the third quarter, the highest since first quarter of 2010 and far above the 10-year average of 29%. Meanwhile, dividend yield is on par with the 10-year average of 1.9%.

In addition to robust yields, most of the dividend paying stocks have generated handsome returns this year as well. Below, we have highlighted five best performing dividend stocks that have at least a Zacks Rank #3 (Hold) or better, and pay a robust dividend yield that exceeds 5%. All of these provide a nice combination of annual dividend growth as well as capital appreciation opportunity irrespective of stock market directions.

Emerge Energy Services LP (EMES - Snapshot Report) – Dividend Yield 9.86%

Based in Southlake, Texas, Emerge Energy Services is a diversified energy services with market capitalization of over $1.3 billion. It is engaged in the owning, operation, acquisition, and development of energy service assets primarily in the United States. The company operates in two segments – Sand, and Fuel Processing and Distribution – and provides products and services to both the upstream and midstream energy segments through its subsidiaries.

The company has raised its dividends every quarter this year, bringing the quarterly dividend to $1.38 per share in the fourth quarter from $1.00 in the first. Overall, it paid a total of $4.68 per share in annual dividends this year, marking a whopping increase of 280.5% over last year.

Dividend yield and payout ratio currently stand at 9.86% and 143.6%, respectively. Emerge Energy has delivered strong returns of 26.3% and has a Zacks Rank #3 (Hold).

Vector Group Ltd. (VGR) – Dividend Yield 7.57%

Based in Miami, Florida, Vector Group is a holding company that indirectly owns Liggett Group LLC, Vector Tobacco Inc. and Zoom E-Cigs LLC and directly owns New Valley LLC. It is engaged in the manufacture and sale of high quality cigarette products in the United States. It has a market capitalization of over $2.3 billion.

The company has been increasing its dividend once every year over the past five years at an annualized growth rate of 5%. Vector Group raised its quarterly dividend by 2 cents to 40 cents for the third quarter of this year, resulting in annual dividend of $1.60 per share, yield of 7.57% and payout ratio of 186.4%. Further, the stock has shown immense strength, surging nearly 36% on the year. VGR has a Zacks Rank #3 (Hold).

Hospitality Properties Trust (HPT - Snapshot Report) – Dividend Yield 6.13%

Based in Newton, Massachusetts, Hospitality Properties is a lodging and travel center real estate investment trust (REIT) engaged in buying, owning, and leasing hotels. It operates under several names: Courtyard by Marriott, Residence Inn by Marriott, Staybridge Suites by Holiday Inn, Candlewood Suites, AmeriSuites, Prime Hotels and Resorts, Homestead Studio Suites, TownePlace Suites by Marriott, and SpringHill Suites by Marriott or Marriott Hotels and Resorts.

With market capitalization of $4.8 billion, the company raised its annual dividend once every year by a penny over the past two years. It currently pays an annual dividend of $1.95 per share, up 3.2% year over year with yield\ of 6.13% and payout ratio of 61.7%. The stock has risen 18.3% so far this year and has a Zacks Rank #2 (Buy).

Frontier Communications Corporation (FTR - Analyst Report) – Dividend Yield 5.89%

Based in Stamford, Connecticut, Frontier Communications provides communication services primarily to rural areas and small and medium-sized towns and cities in the United States. It offers voice, broadband, satellite video, wireless Internet data access, data security solutions, bundled offerings, local and long distance voice services, enhanced services, long distance network services, and packages of communications services. Frontier has a market capitalization of $6 billion.

The company has maintained its annual dividend per share of 40 cents over the past two years, yielding 5.89% with a dividend payout ratio of 181.8%. But it raised annual dividend to 42 cents per share for the first quarter of 2015. The new annual dividend yield comes to 6.20% at the current price. The stock surged 46% in the year and has a Zacks Rank #2 (Buy).

Enbridge Energy Partners L.P. (EEP- Analyst Report) – Dividend Yield 5.77%

Based in Houston, Texas, Enbridge Energy Partners is a leading owner and operator of the world’s longest, most sophisticated crude oil and liquids transportation system in the United States. It has a significant and growing presence in the natural gas transmission and midstream businesses, onshore in Texas and Oklahoma and offshore in the Gulf of Mexico.

With market capitalization of nearly $10 billion, the company has hiked its dividend four times over the past five years, propelling annual dividend per share to $2.24. Dividend yield and payout ratio currently stand at 5.77% and 281.8%, respectively. Enbridge Energy has added nearly 29% so far in the year and has a Zacks Rank #3 (Hold).

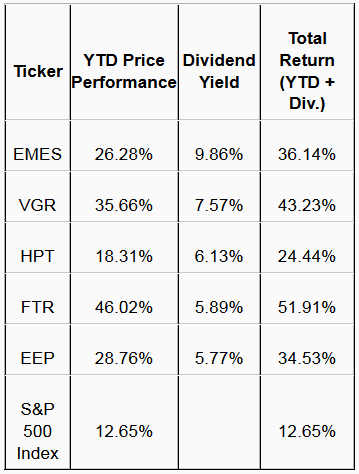

Combined returns of these stocks (including the price performance and dividend yield) can be summarized in the table below:

Bottom Line

Investors should note that the above-mentioned stocks not only pay robust dividends but have also generated above-market returns so far this year. This trend will likely to continue in the coming months given the low interest rate environment at least in the first half of 2015 and solid economic recovery. As such, these stocks seem to be interesting picks for investors looking for high yield in the equity markets.

Disclosure: Want the latest recommendations from Zacks Investment Research? Today, you can ...

more