4 Undervalued Biotech Stocks To Buy Today

The recent brutal bear market in the biotech sector reminded investors in this lucrative but volatile space the imperative importance of risk management when investing in this industry. From peak to trough, the biotech indices lost more than 40%. Many small cap concerns fell 60%, 70%, or even 80% almost solely based on a change in sentiment on the sector. A recent uptick in M&A activity has led to three straight weeks of gains and looks like it finally broke the back of a nine-month-old bear market.

During rallies in this sector, most investors forget to practice good management techniques as they start seeing green from watching every stock in the sector post gains. Investors then naturally think they are okay because they have 10 to 20 different positions in the sector and that should be enough to protect their portfolios. However, as Mike Tyson famously quipped “everybody has a plan until they get hit in the face.”

Managing risk is not just about having 20 positions that provide solid diversification, it is how those 20 positions are actually allocated. Obviously, an investor does not just want to bet on one area of biotech such as oncology or Alzheimer’s and diversification across disease areas is one key to proper diversification. However, good diversification techniques go way beyond investing in companies that are targeting different disease areas.

I have always found it helpful to think of the biotech sector as consisting of four tiers or types of stocks. Tier 1 stocks are the large cap growth names that should make up the core of your biotech portfolio. These are companies that can constantly churn out earnings and revenue growth even in this challenging global environment. These stocks have reasonable valuations and often pay dividends as well. These companies have deep pipelines, dominate their key markets, and have great balance sheets.

This type of Tier 1 stock should make up 50% to 75% of your overall biotech portfolio depending on your own personal risk preferences.

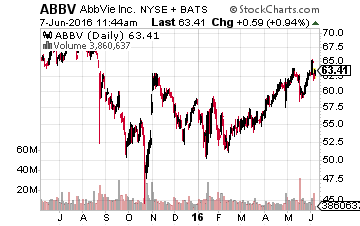

A perfect example of this type of core stock is AbbVie (NYSE: ABBV). Earnings should increase 15% to 20% in both FY2016 and in FY2017 and yet the stock sells for less than 14 times this year’s profits and yields 3.6%. AbbvVie’s recent purchase of privately held Stemcentrix will continue to lessen its dependence on Humira as its late-stage compound Rova-T has billion-dollar potential. Blood cancer drug Imbruvica has also shown stellar growth as well.

The rest of one’s biotech portfolio should be made up of Tier 2, 3, and 4 stocks. Tier 2 are the second least risky part of the sector. These are small or mid-cap concerns that have real earnings and revenues. They don’t have the same extensive pipelines or balance sheets as the industry giants but are solidly profitable. The trouble is there is a dearth of Tier 2 stocks in this sector. Companies that are successful in developing their pipelines can quickly develop to being major concerns or Tier I stocks. In addition, they are often bought out at large premiums and absorbed by the large players in the industry.

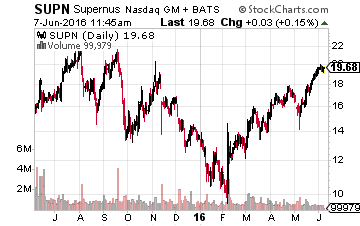

Supernus Pharmaceuticals (Nasdaq: SUPN) is one good example of an attractive Tier 2 stock. Supernus is a specialty pharmaceutical company that focuses on the development and commercialization of products for the treatment of central nervous system diseases in the United States. It has a couple of products approved and on the market including one for epilepsy. The company also possesses a promising pipeline with a couple of drug candidates in late-stage trials. Revenues should grow more than 40% this fiscal year and at least 30% in FY2017. The company is solidly profitable and earnings should more than double this year and do so again next fiscal year. The stock is attractively valued given its growth prospects at under 14 times next year’s consensus earnings forecast.

Next up is Tier 3 biotech stocks. These are primarily small cap concerns that have just started to commercialize their pipelines. They are just starting to have recurring and growing revenues but are not yet profitable. They are prime buyout targets as larger players with established sales forces can exponentially boost sales of these new products.

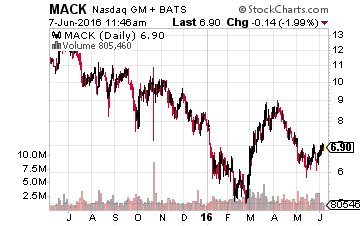

A perfect example is Merrimack Pharmaceuticals (Nasdaq: MACK) whose first compound Onivyde was approved for one indication of pancreatic cancer late in 2015. Onivyde sales should run $70 million to $80 million this year and the compound is in mid-stage trials for other indications of cancer such as breast cancer. The company also has another early stage compound targeting non-small cell lung cancer in development.With a market capitalization of less than $800 million and the focus in M&A on oncology, Merrimack could easily make a logical acquisition for a significant premium but should do well as a standalone entity as well.

Finally, we have Tier 4 stocks which is the highest beta area of biotech. These are small developmental concerns that as of yet have no approved products. Their value is in their pipelines and their stocks are the most vulnerable to any change of investment sentiment on the biotech sector. I tend to prefer companies with late-stage pipelines in this strata.

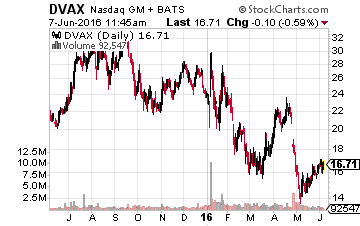

A perfect example of this type of concern that is attractive right now is Dynavax Technologies (Nasdaq: DVAX). Its hepatitis B vaccine has shown to be far superior to anything on the market in trials and should be approved in December. Within a few years, it should be racking up $500 million in annual revenue. Dynavax also has an asthma candidate in Phase II trials that are being run by developmental partner AstraZeneca (NYSE: AZN). Finally, the company has a promising oncology compound “SD-101” in development. In short, Dynavax has a lot of promising assets given a $625 million market capitalization.

The biotech sector looks like it is in the early stages of a rebound. However, the next “hiccup” is never more than 12-24 months away in this volatile area of the market. Practicing good risk management techniques will put you in a stronger position when the next inevitable decline hits the sector while allowing your portfolio to participate fully in the gains ahead.

Disclosure: Positions: more