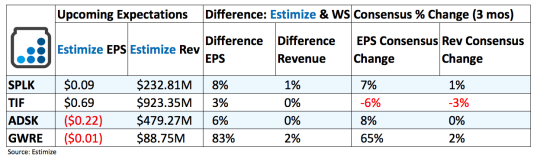

4 Stocks To Watch That Report Earnings Tomorrow - Tuesday, Nov. 29

(Click on image to enlarge)

Splunk (SPLK): Splunk has had its shares of ups and down in recent quarters. The combination of marginal profitability and decelerating growth has consistently overshadowed better than expected financial reports. Shares have bounced off their February lows and are virtually flat for 2016. Splunk continues to see strength in the growing data and analytics market where it is adding the majority of its customers. In the second quarter the company added 500 customers across multiple industries. New product rollouts and strategic partnerships will continue to support wider adoption rates and thereby revenue growth. Greater investments deployed to help reach growth goals will take their toll on margins and profitability. Meanwhile, growing competition from heavy hitters such as IBM, Amazon and MSFT will be a major near term obstacle

Tiffany & Co (TIF): Similar to Splunk, Tiffany has recovered a majority of its losses incurred throughout the year. Shares are actually up 1% heading into its third quarter report tomorrow morning. Consumers propensity for value channels have made analysts cautious with regards to the jeweler despite the recent surge in the stock. Efforts to expand its omni channel capabilities and open new stores should bode well for the top line which has otherwise struggled. Additionally, Signet’s better than expected report last week sets a favorable tone for the remaining jewelers. Investors would be wise to remain cautious before going all in on Tiffany’s prior to its report. An uncertain macroeconomic environment coupled with ongoing currency headwinds and weaker tourist spending will put pressure on both the top and bottom line.

Autodesk (ADSK): Like other enterprise technology companies Autodesk has fallen victim to decelerating revenue and mounting losses. Some of this can be blamed on the switch from a licensed revenue model to a subscription based one that books deferred revenue. Now that this process is complete, Autodesk should see greater support on the both the top and bottom line. Furthermore, efficient cost controls coupled with an aggressive acquisition strategy will help financial performance. Increasing competition still remains the biggest obstacle to Autodesk’s success. The cloud market has become heavily concentrated by a few major players such as Amazon and Microsoft. This will remain a hurdle along the company’s maturation process or until it is acquired.

Guidewire Software (GWRE): Guidewire has history of topping analysts estimates but that has been overshadowed by decelerating top line growth. The bottom line has also contracted recently with expectations of turning negative this upcoming report. Analysts at Estimize have been more bullish than the Street but still forecast a 1 cent loss per share on the bottom line. Despite its financial troubles the stock has remained resilient and is only down 3% in 2016. Historically the stock has done well during earnings season, making its biggest gains immediately following a report.

more