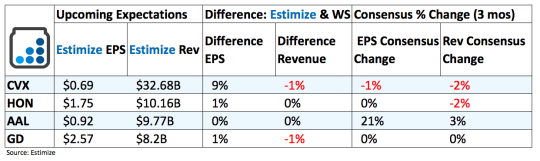

4 Stocks To Watch Before The Market Opens Tomorrow - Friday, Jan. 27

(Click on image to enlarge)

Chevron (CVX): Oil traders experienced a massive rally in 2016 after oil prices bottomed out at $26 per barrel in early February. Since then the price of oil nearly doubled, much to the delight of oil producers. The latest surge helped boost Chevron stock up 45% and pushed the last 2 quarterly reports above analysts expectations. Investors are hopeful that the combination of surging oil prices and a number of new initiatives can help deliver a strong fourth quarter report. Chevron’s ongoing efforts to cut costs through restructuring, streamlining operations and exiting unprofitable market will continue to support bottom line growth. While the latest OPEC deal to cut production and President Trump’s executive order to resume the Keystone Pipeline bode well for sales. Chevron also continues to make strides in its upstream business, which consists of of raw material production and exploration drilling. Between the general improvements in the oil market and Chevron’s healthy balance sheet, the outlook for tomorrow and future reports look promising.

Honeywell (HON): Industrials experienced its shares of ups and downs in 2016 but with President Trump now in office the latest rally seems here to stay. This bodes well for a company like Honeywell that delivered beats and misses in that order for over a year. In its most recent report, management offered lackluster guidance for 2017 owing to macroeconomic uncertainty, currency headwinds and tepid demand in its aerospace division. Of its four biggest reporting segments ( Aerospace, Home & Building, Performance Materials and Safety Productivity), 2 of the 4 posted negative year over comparisons last quarter. Macroeconomic uncertainty that was blamed for its woes include, volatile oil price, sluggish global growth, and a tepid Chinese economy. Although fundamentals remain weak, Honeywell stock took part in the favorable post election Trump Rally. In the past 3 months share trudged higher by 8% and historically perform well around earnings season.

American Airlines (AAL): In December’s traffic report, total revenue passenger miles reported a 0.8% decline along with a 1% drop in load factor. Available seat mile increased .5% for the month and about 1.7% for all of 2016. More importantly, the company expects Q4 total revenue per available seat mile to be flat to up 2% compared to a year earlier. To top it off, management also raised guidance for pretax margins in range of 7-9% from early indications of 6 to 8%.

Like its peer, improving yields contributed to the improved outlook. Meanwhile, American Airlines recently introduced a Basic Economy plan to take advantage of the ongoing trend of low fares. The new service offers customers a stripped-down travel experience identical to discount airlines. American Airlines’ diversified approach that now includes premium and low fare services that appeal to a wider audience and drive traffic higher.

General Dynamics (GD): On multiple occasions the now President Trump alluded to approaching military spending in a more consistent manner to his Republican predecessors. This means increasing government spending and re-arming our forces, both of which bode well for defense stocks like General Dynamics. If Lockheed Martin’s weak 2017 outlook is any indication though, investors might be in for a rude awakening. In 3 of the past 4 quarters revenue came in well below analysts expectations, making a quick turnaround unlikely. Analysts at Estimize are currently forecasting another miss on the bottom line with revenue of $8.2 billion. That estimate includes 3 notable $100+ million deals signed with the U.S. Navy, Coast Guard and a second one with the Navy. Management, on the other hand, expects a strong fourth quarter results on a robust backlog of deals and strong order growth. In the third quarter, General Dynamic’s backlog totaled $62 billion with total potential contract value nearing $87.2 billion. Given that sales have been weak lately, it’s clear that not all of this translated to booked revenue.

Disclosure: None.

Thanks for sharing