4 Retail Stocks To Watch Tomorrow (August 24, 2016)

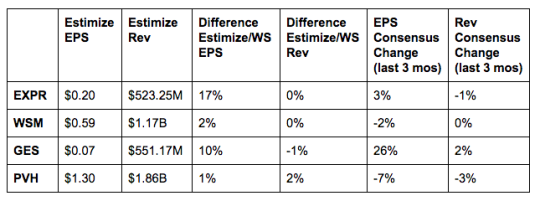

Express (EXPR): Both earnings and revenue have trended down in recent quarters. Last quarter’s miss delivered -2% growth on the bottom line with a 32% decline on the top. This was supported by a 1% decline in ecommerce sales and 3% drop in comparable sales. Increasing competition from fast fashion and online retailers have largely driven the declines in recent quarters. This year the stock is down 8.5% and historically declines 2% through an earnings report. Fortunately the apparel retailers have prospered this quarter, creating the potential for an earnings surprise tomorrow morning.

Williams-Sonoma (WSM): A broader shift toward discounters and value channels can be largely credited with William Sonoma’s downturn. The company’s namesake brand, West Elm and Pottery Barn all cater to high end customers. This simply isn’t translating in the current economic environment. The stock is down nearly 8% year to date and a resounding 37% in the past 12 months. Fortunately, the broader housing recovery and surge in the retail sectors puts William Sonoma in position to surprise investors tomorrow. Downward revisions activity in the last month and decelerating growth projects would suggest otherwise though.

Guess? (GES): The recent bounceback in retail apparel this season bodes well for Guess heading into its report tomorrow afternoon. This is one of the most beaten down companies that could really use a bounce back quarter. Last quarter, GES printed a 675% decline on the bottom line couple with a 6% contraction in revenue. While Guess has made strides in its omni channel strategy, it is still no competition for Amazon or other major online retailers. Strong growth here is unlikely to offset any of its in store losses which will support weaker comps. However, as we have seen this season, even the smallest surprise could send this stock soaring.

PVH Corp (PVH): Solid performance from its Calvin Klein and Tommy Hilfiger brands have helped the company deliver modest gains amid weak retail spending. Last week Deutsche banked increased it price target on shares to $117 and reiterated its buy rating. Ongoing investments in top brands and a focus on global expansion should continue to drive revenue growth. However ,currency headwinds, volatility in consumer spending, increased promotional activity and potential Brexit complications could pressure profitability in future quarters.

Disclosure: None.