4 Reasons I Prefer Qualcomm Over Intel

In the semiconductor industry, Intel (INTC) and Qualcomm (QCOM) reign supreme. Both Intel and Qualcomm are large-cap tech companies that manufacture processors and chips.

On the surface, the two stocks look very similar. They operate in the same industry, and both stocks trade for price-to-earnings ratios of 17. And, both stocks have 3% dividend yields.

But underneath the surface, the two stocks are quite different. For example, Qualcomm is a Dividend Achiever, while Intel is not. Qualcomm has increased its dividend for 13 consecutive years. You can see the entire list of all 273 Dividend Achievers here.

And that’s not all. There are a few more major differences between the two, enough that make one of them a better stock than the other for income investors.

Here are three reasons why dividend growth investors should prefer Qualcomm over Intel.

Reason #1: No PC Exposure

Both Qualcomm and Intel are facing stagnation in their respective core focus areas.

For Intel, it is the deterioration of the personal computer. Global PC shipments are still declining, as consumers steadily increase their usage of smartphones and mobile devices. According to technology researcher IDC, global PC shipments declined 3.9% last quarter, and are expected to decline for the full year.

In response, Intel is positioning itself for future growth from other areas.

Source: 2015 Nasdaq Conference, page 4

Intel’s second-largest business segment is data centers. Data center revenue increased 11% in 2015. Data centers now represent approximately 28% of Intel’s total revenue.

However, Intel’s PC and Client Computing businesses still represent more than half of its annual revenue. The growth prospects for the PC moving forward are weak. With such significant exposure, it will be difficult for Intel to grow.

For Qualcomm, its main challenge is a growth slowdown in the smartphone industry. This has been a recent problem over the past few quarters, which has weighed on the company’s bottom line.

At the midpoint of management’s forecast, MSM shipments are expected to decline approximately 10% in 2016.

Source: Q4 Earnings presentation, page 7

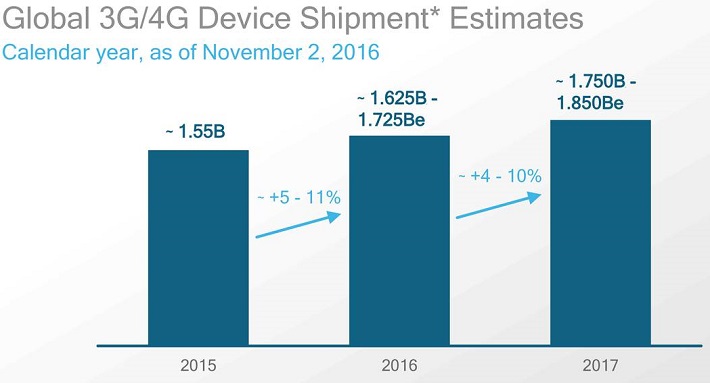

The good news for Qualcomm is that the decline seems to be just a temporary slowdown. Management expects global 3G and 4G shipments to return to growth this year.

Source: Q4 Earnings presentation, page 9

The fundamentals for the global smartphone industry are more favorable than that of the PC.

Going forward, global smartphone sales should continue to rise. New generations of phones will continue to have improved features. One could argue that smartphones have become a must-have for consumers. And, smartphone growth continues to accelerate in emerging markets like India and China.

As a result, I favor Qualcomm because it is not reliant on the PC industry. One could argue that the very reason for Intel’s slowdown—the smartphone boom—is a direct benefit to Qualcomm.

That being said, to expand beyond their core competencies, both Qualcomm and Intel are building businesses outside their core focus areas. Qualcomm seems to have the edge thus far.

Reason #2: A Bigger Internet of Things Business

Qualcomm and Intel are pursuing the same objective. They are each looking elsewhere for future growth. One area they have both targeted is the Internet of Things, or IoT, which involves devices connecting and interacting with one another.

The IoT is one of the most compelling growth catalysts for the technology industry moving forward. It is a huge opportunity for those that take an early lead.

Qualcomm took a major step in the IoT with its $47 billion takeover of NXP Semiconductor, a semiconductor manufacturer with a focus on self-driving vehicles and unmanned drones. Qualcomm has a $100 billion market cap, so the $47 billion NXP deal instantly boosts Qualcomm’s IoT business in a big way.

To be sure, Intel’s IoT business is performing very well. Revenue from IoT products increased 19% last quarter. The disadvantage for Intel is because its IoT business represents just 4% of total revenue.

Intel did acquire Altera for $16.7 billion to further expand its IoT business, but this was a much smaller deal relative to Qualcomm’s acquisition of NXP. Considering Intel has a $174 billion market cap, the Altera deal was more of the bolt-on type.

Reason #3: Stronger Balance Sheet

The third reason why Qualcomm could be a stronger stock pick than Intel is because of Qualcomm’s superior balance sheet.

At the end of last quarter, Qualcomm had $32 billion in cash and investments on its balance sheet. This represents approximately 32% of Qualcomm’s market cap.

By comparison, Intel ended last quarter with $18 billion in combined cash, marketable securities, and long-term investments. This represents 10% of Intel’s market cap. With so much more cash relative to its overall size, Qualcomm enjoys greater financial flexibility than Intel.

This matters because Qualcomm’s cash position allows it to make acquisitions that matter more relative to its size, such as the NXP deal.

Qualcomm’s massive amounts of cash also provide it room to increase its dividend at a faster rate than Intel.

Reason #4: Higher Dividend Growth

The last reason I prefer Qualcomm to Intel is because Qualcomm has exhibited much stronger dividend growth over the past several years.

In the past five years, their compound annual dividend growth rate is as follows:

- Qualcomm: 20%

- Intel: 4%

Both companies also buy back stock, but Qualcomm has had a far more impressive track record of dividend growth.

Source: Q4 Earnings presentation, page 12

Intel has gone long periods without raising its dividend. For example, the dividend was not raised from August 2012-November 2014.

Even though they have similar current dividend yields, investors will grow their yield on cost much faster with Qualcomm than with Intel.

If these dividend growth rates hold, Qualcomm investors buying the stock today will generate an 18% yield on cost in 10 years. By contrast, Intel’s yield on cost would be just 4.5% under this scenario.

With that said, it isn’t likely Qualcomm grows at 20% a year.It is likely that the company’s dividend growth outpaces Intel’s, based on historical trends and future growth expectations.

For these four reasons, Qualcomm appears to be the stronger dividend stock of the two.

Disclosure:

Sure Dividend is published as an information service.It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of ...

more

Thanks for sharing