4 Reasons I Prefer Disney Over Netflix

Netflix (NFLX) stock has been on a tear since 2012. Over the past five years, the stock has returned roughly 892% to investors.

Its returns almost seem too-good-to-be-true, but that’s what happens when a company disrupts its industry like Netflix has.

Netflix revolutionized television through Internet streaming.

Now, consumers have access to thousands of television shows and movies at the touch of a button, at a much lower cost than a cable television package.

While Netflix’s performance over the past five years is nothing short of stellar, investors considering buying the stock today should be concerned about what happens moving forward.

For those considering buying Netflix stock, I’d recommend Disney (DIS) instead.

This article will discuss four reasons why I prefer Disney over Netflix.

Reason #1: Brand Strength

The first reason I prefer Disney is because it is one of the most valuable, instantly-recognized brands in the world.

According to Fortune, Disney is the eighth-most valuable brand in the world, worth $39.5 billion.

By contrast, Netflix comes in at No. 79, worth $7.4 billion.

Disney’s incredible brand equity provides the company with a number of benefits. First, Disney has pricing power. Its world-class brands allow it to regularly raise prices, which helps grow revenue each year.

Plus, Disney benefits from economies of scale. The company can effectively manage costs, which keeps margins high.

The below image of Disney’s earnings-per-share growth over the past five years demonstrates the value of a highly profitable business model.

(Click on image to enlarge)

Source: 2016 Annual Report, page 24

Disney’s parks and movie studio are poised to lead its future growth.

To be sure, Netflix has a strong brand as well. But it operates in an increasingly competitive industry. There are several services nearly identical to Netflix, and the number of competitive services is increasing with each passing year.

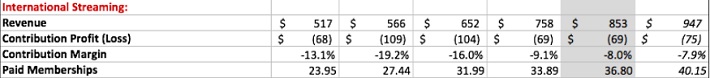

This has caused Netflix’s domestic subscriber growth rate to decline over time. As a result, Netflix’s biggest opportunity for future growth will come from the international markets.

Of course, expanding into new markets is extremely cost-intensive. Netflix is ramping up its subscriber base abroad, but its international business is losing money.

(Click on image to enlarge)

Source: Q3 Shareholder Letter

This will weigh on Netflix’s ability to generate a profit for some time.

Reason #2: Parks and Movie Studio Businesses

The second reason I prefer Disney is because it has a large presence outside media. Disney’s two highest-growth segments are its Parks and Resorts, and Studio Entertainment businesses.

Collectively, these two businesses generate more than $26 billion in annual sales. They represent nearly half of Disney’s revenue.

And, these businesses are doing extremely well. Disney’s Parks and Resort revenue increased 5% in fiscal 2016.

Going forward, Disney investors should be very excited about the new Disney Shanghai resort.

Shanghai Disney cost a whopping $5.5 billion, but it’s likely to be worth every penny. China is a premier emerging market. It has a population above 1 billion, and an expanding consumer class.

According to Disney, there are 330 million people that live within three hours of Shanghai Disney. Disney expects the company to break even in 2018, and generate more $200 million of annual profit by 2019.

Plus, Disney’s booming movie studio will be a major growth driver going forward. The movie studio business grew revenue by 28% in fiscal 2016.

Disney owns several key movie franchises that are hugely successful—specifically, the company raked in billions of dollars from Star Wars: The Force Awakens, Rogue One: A Star Wars Story, and related merchandise.

Not to mention, Disney owns the massively successful Pixar animated studio.

These businesses aren’t just growing revenue, they are highly profitable as well.

Reason #3: Valuation

Netflix’s amazing run has lifted its stock valuation to unfathomable levels. At its current price, Netflix stock has a price-to-earnings ratio of 361. This is because the company barely generates any profit.

Risk-averse investors should consider Disney to be the far safer stock of the two. Disney stock trades for a price-to-earnings ratio of 18.

At this point, growth investors would typically point to the forward price-to-earnings ratio. Netflix bulls would likely contend that the company’s future earnings growth will justify its lofty valuation.

But even when looking at the two stocks based on a forward price-to-earnings ratio, Netflix is egregiously valued.

(Click on image to enlarge)

Source: YCharts

Instead, Netflix is laser-focused on adding content, which is very expensive, particularly when it comes to original content.

The company does not want to pass on those costs to its customers. After all, its low monthly price is the key value proposition to entice subscribers to ‘cut the cord’.

As a result, Netflix has to reinvest virtually all of its cash flow, in order to continue its growth strategy.

Therein lies the problem for investors. If Netflix is unable to turn a stronger profit, its sky-high valuation multiple is likely unsustainable.

However, in order to do that, the company would have to either cut the cost of content and expansion, and/or raise prices. But this would probably result in customers cancelling their subscriptions in droves, and going to one of Netflix’s fierce competitors like Hulu.

And, it’s worth noting that Disney has an equity stake in Hulu, so it is exposed to Internet streaming as well.

Disney’s valuation provides a much better margin of safety. With such a reasonable valuation, investors don’t need the company to generate huge amounts of growth to generate satisfactory returns.

Reason #4: Dividends

Not only does Disney offer a much better margin of safety through its valuation, it also offers investors a dividend payout.

Disney stock certainly isn’t a high yielder; the stock has a 1.5% dividend yield. This is slightly below the 2% average dividend yield in the S&P 500.But, low yielding stocks can add value to a dividend growth portfolio.

That being said, Disney compensates investors for its below-average current yield with high dividend growth rates. It recently hiked its dividend by 10%.

Continued dividend increases in the double-digit range will easily make up for the relatively low starting yield.

Final Thoughts

Netflix brought on the age of streaming—but Disney is catching up. It has hugely valuable television networks of its own, including ABC and ESPN. These networks have developed streaming channels of their own, and they are highly profitable, which Netflix is not.

Netflix stock is the talk of Wall Street right now, but that doesn’t mean it’s right for every investor. Only those investors with a strong stomach and an appetite for risk should consider buying Netflix.

Investors who are looking for margins of safety, a reasonable valuation, and a dividend payout, should buy Disney instead.Disney’s mix of growth, dividends, and reasonable value make it a favorite of The 8 Rules of Dividend Investing.

Disclosure:

Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers ...

more

Thanks for sharing