4 Growing Tech Stocks With 20% Upside

The tech sector is hip, it’s edgy, even the word ‘tech’ has a buzz cachet to it – but for investors, the real question is, do tech stocks deliver?

They can and do, despite a general market hit to the tech sector. This past month has been the worst for tech stocks – compared to the overall trading markets – in over a year. But as with any decline, not all the news is bad. David Kostin, from Goldman Sachs, believes that tech stocks are still a compelling buy, and that worries about value are overblown. In a report last week, he said, “Popularity has turned into concerns of overcrowding and outperformance has turned into concerns of overvaluation. We believe these risks are overstated.”

Here, we’re looking at 4 tech stocks with upsides of 20% or higher. This is according to the current price vs the average analyst price target.

Red Hat, Inc. (RHT)

Red Hat Software (RHT – Research Report) is best known for its long-standing commitment to creating open-source programs. You may ask, how does a software company make money when their releases are open to the public, and it’s a fair question. The answer is, Red Hat’s software is free – but the service and support is available by subscription. Since the overwhelming majority of software customers and users are not coding experts, the open source nature of the tools doesn’t matter. They’ll still need help when things don’t work, and the company that first wrote the software is the logical place to turn. Red Hat has been turning that business model into profits since 1993.

Today, the company has a market cap of $21 billion, and while its recent stock performance has been rocky, there is significant reason for a bullish outlook. Writing for RBC Capital last month, top analyst Matthew Hedberg (Track Record & Ratings) says that Red Hat turned in “a solid quarter against negative sentiment,” outperforming in “billings, operating margins, and earnings.” He added that “Red Hat is a long-term opportunity, even though the company is facing short-term headwinds in middleware and portfolio renewals.” He gives RHT a ‘Buy’ rating with a target price of $169.

RHT’s share price closed Monday at $121, after gaining 1.5%. The average price target is $156, for a 28% upside. The analyst consensus on this stock is a ‘Moderate Buy.’ See RHT Price Target and Analyst Ratings Detail.

Salesforce.com, Inc. (CRM)

Launched in 1999, Salesforce.com (CRM – Research Report) has quickly become a cloud computing giant with a massive $105 billion market cap. Salesforce’s main product, an industry leading customer relationship management tool, is reflected in its stock ticker: CRM.

CRM’s market performance has reflected the company’s success. The stock has shown a consistent upward trend over the last five years, gaining 163% over that time.

Deutsche Bank’s Karl Keirstead (Track Record & Ratings) cites Salesforce’s recent acquisition of MuleSoft when he writes, “we were initially mixed about the deal (good company but expensive price tag and it wasn’t clear to us why Salesforce needed to own a partner), but the feedback was encouraging and we’re warming up to the deal.” He gives a price target of $180 per share.

Meanwhile Brian Schwartz (Track Record & Ratings), of Oppenheimer sees strength in Salesforce’s products and business model: “We believe group fundamentals remain strong, and valuations may benefit from better sentiment from a positive earnings season. Importantly, CRM’s valuation is currently in line with the SaaS industry average.”

As we can see the analyst consensus on CRM is very optimistic. Check out the ‘Strong Buy’ rating and $175 average analyst price target (22% upside from the current share price).

(Click on image to enlarge)

See CRM Price Target and Analyst Ratings Detail.

Shopify, Inc. (SHOP)

Shopify (SHOP – Research Report) is a major player in e-commerce, with more than 600,000 merchants using its platform and well over $55 billion in gross merchandise volume annually. The company’s market cap is $12 billion, and the stock, while subject to ups and downs in trading, has shown real long-term gains. SHOP shares currently trade at $134, after tripling in the last three years.

Darren Aftahi (Track Record & Ratings), analyst for Roth Capital, sets the price target at $180, and justifies his confidence here: “We model for top-line growth of 50% y/y … we expect growth in to drive potential outperformance.”

Analysts also see a unique opportunity for Salesforce in light of Canada’s recent legalization of marijuana. “Shopify has established a leading position as the platform underlying the sale of legalized cannabis in Canada. This could benefit both GMV and revenue, and further benefit its business momentum” says top analyst Monika Garg. (Track Record & Ratings) Her price target for CRM is $182. See SHOP Price Target and Analyst Ratings Detail.

Wix.com, Ltd. (WIX)

Wix (WIX – Research Report) is the young company behind the popular website building tool of the same name. The Wix tool allows users to construct a quality site without in-depth knowledge of website coding. The company is built on a ‘freemium’ business model, making the basic product available to all users without charge, while setting fees for premium upgrades.

Investors have been skittish about WIX stock over the years, as the company has seen consistent gains in share price only since mid-2016. Those gains, however, have more than doubled the stock’s value in just two years. Naved Khan (Track Record & Ratings), of SunTrust Robinson, states clearly the case for an upbeat outlook on WIX: “We view Wix’s large and growing user base (131M as of 2Q18), its best-in-class freemium offering and rising brand awareness as competitive advantages, which should allow the company to sustain its above-market growth rates for the foreseeable future.” The five-star analyst has a bullish $145 price target on the stock (49% upside potential).

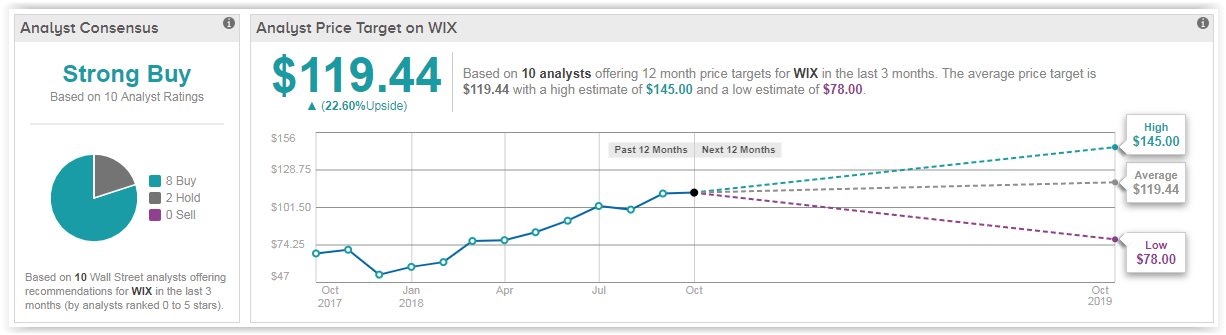

This sanguine outlook is widely shared, as the analyst consensus is a ‘Strong Buy’ with upside potential touching 23%.

(Click on image to enlarge)

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more