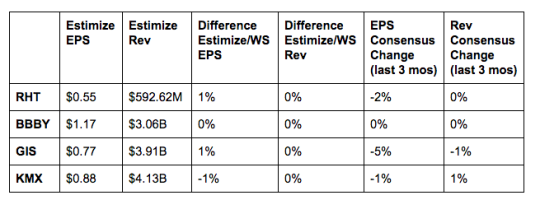

4 Companies To Watch That Report Earnings Tomorrow - September 20, 2016

(Click on image to enlarge)

Red Hat (RHT): Red Hat is one of the few remaining companies left to report second quarter earnings. Expectations have edged down slightly since the company reported mixed first-quarter earnings in June. Until then, Red Hat had consistently topped expectations on both the top and bottom line while growth soared. The company is still seeing upside in its Linux Servers and public cloud segments which should drive top-line growth over the long term. Demand for product offerings like OpenShift and OpenStack have been positive and will also be key to driving sales. Meanwhile, continued investments and key partnerships with IBM, Dell and Intel will be pivotal in propelling adoption rates. However, sluggish IT spending and increasing competition are near-term headwinds. Cloud computing and IT are heavily concentrated industries dominated by heavy hitters like Amazon, IBM, and Microsoft, to name a few.

Bed Bath & Beyond (BBBY): Bed Bath & Beyond has been one of Amazon’s many victims in its historic ascension. As a result, earnings continue to slow down as the company finds new ways to compete through this changing retail environment. Over the past 4 quarters, earnings growth has fallen below zero 3 times while revenue growth has been flat in 2 out of 4 reports. Sluggish mall traffic, currency headwinds and frequent discounting should keep results in the gutter for the quarter to be reported and futures ones. Management remains hopeful that its omnichannel investments and the recent acquisition of One Kings Lane will help drive future growth. Fortunately for BBBY, expectations are set so low, similar to Macy’s and Best Buy, that even the smallest positive surprise tomorrow will send the stock soaring.

General Mills (GIS): General Mills is coming off better than expected fourth quarter that has contributed to the stock’s gains this year. Year-to-date shares are up nearly 13% and 15% in the past 12 months. Historically, the stock makes its biggest gains between 1 day and 30 days following an earnings report. Both earnings and revenues have been soft lately due to weaker demand and changing consumer preferences. Processed foods, which is primarily what General Mills sells, have lost favor to organic foods as consumers become more health focused. Greater distribution and an expanding natural and organic product portfolio will help drive long-term growth.

CarMax (KMX ): Top-line growth has fallen short for the better part of a year and a half. Certain challenges such as high competition and a sluggish used car market have driven this downward trend. CarMax places a large emphasis on the used car market, which differentiates them from competitors. However, used cars have struggled lately as the new car market sees steady growth, putting a damper on CarMax’s overall growth. Management continues to pursue an aggressive store expansion initiative which they believe will drive sales and help penetrate new markets. Shares are up 5% year-to-date but historically remain flat following an earnings report.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

Thanks for sharing