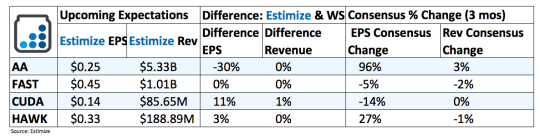

4 Companies To Watch That Report Earnings Tomorrow - October 10, 2016

Alcoa (AA): Alcoa kicks off earnings season, as it usually does, with its earnings report tomorrow afternoon. This will be the company’s last report before it splits its parts business from its legacy metal making operations. The move will create two publicly traded companies, Alcoa and the newly formed Arconic. Alcoa will handle its legacy aluminum business while Arconic will manage the value added business. This includes global rolled products, engineered products and solution and transportations and construction solutions. These segments should continue to grow given their use in aerospace and the tech industry. Companies such as Boeing, Lockheed Martin, and Ford Motors are clients of Alcoa's. Nonetheless, the company’s overall earnings have struggled lately. Alcoa is coming off multiple quarters of negative growth with the stock trending in the same direction. Global market uncertainty and historically weak metal prices should pose near-term headwinds even after the company splits.

(Click on image to enlarge)

Fastenal Company (FAST): Shares of Fastenal are down over 6% after the company delivered weaker than expected earnings and revenue. The quarter ended with a 2.6% increase on the top line and a 4% decline on the bottom. Fastenal provides wholesale distribution services to the manufacturing and non-residential construction markets which have otherwise struggled. This could explain the downturn in earnings the company has been seeing lately. Meanwhile, an unfavorable product mix combined with competitive and pricing pressures are having an adverse impact on margins. One bright spot lately has been in its industrial vending machines business. Last quarter 58,350 machines were installed, reflecting a 15.3% increase from the second quarter of 2015.

Barracuda Networks (CUDA): Barracuda Networks is coming off two consecutive beats that have caused shares to jump 60% in the past 6 months. Prior to that, the company had fallen victim to a common problem hurting the tech space; decelerating revenue and weak margins. The past 2 quarters have put those concerns to rest as they continue to build on the need for cybersecurity. Last quarter the company deployed its NextGen Firewall services and picked up on the momentum in the cloud computing space. More recently they have introduced a new email scanner for Microsoft Office 365 that will detect and eliminate threats as they occur. Analysts’ expectations are rather muted, suggesting we could see a repeat performance from Barracuda tomorrow afternoon.

Blackhawk Network Holdings (HAWK): Blackhawk is best known for providing branded value through gift cards, digital payments and loyalty points worldwide. The company has made steady gains in recent quarters but that hasn’t translated to the stock. Shares are down 27% year to date despite positive growth on the top and bottom line. Last quarter, adjusted operating revenue jumped 10% on strong growth throughout Europe. The delay in implementing EMV technology in the United States has negatively impacted this portion of business. Its U.S. retail segment reported a 10% revenue decline in the second quarter primarily due to these delays. Given how the stock has trended don’t expect much positive movement even if the earnings report is better than expected.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more