3M For Your Retirement Portfolio

Are you looking for dividend paying stocks with a long history or increasing their dividends, even in recessions? If so, you should take a long, hard look at 3M.

3M For Your Retirement Portfolio

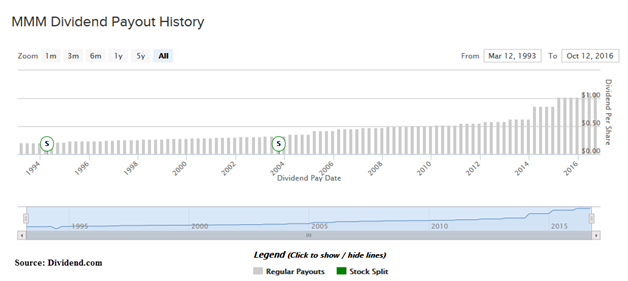

My strategy is to find strong dividend-growth stocks who have shown they will not cut their dividends when times get tough. 3M (MMM) is one of these companies. For 58 years in a row they have increased their dividends. Over the last five years their dividend growth rate has been 14.4%. Their dividend yield is currently 2.5%.

How 3M Can Change Your Retirement Situation

Dividend payers like 3M can vastly improve your retirement situation. Now, don’t get the idea that you should put all of your money into just one stock. We are looking for companies like 3M that have shown they will not cut their dividends. Other companies that fit this bill are Altria (MO), Exxon (XOM), and Procter & Gamble (PG).

Let’s take a look using the WealthTrace Retirement Planner how companies like 3M can improve retirement plans.

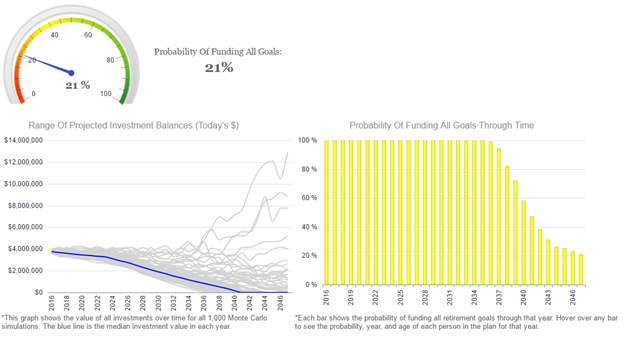

I looked at a 51 year old couple that has saved $450,000 for retirement. They only save money into their IRAs and they have a 60/40 split between stocks and bonds. My assumptions were that their stocks would return 7.5% per year and their bonds would return 2.5% per year. I also assumed inflation of 2.3% per year. This couple wants to retire at age 63.

If we take inflation into consideration, how much money will they have at retirement? The results are below:

|

Beginning Value |

Ending Value |

Ending Value |

Real Annual Return After Taxes |

|

$450,000 |

$899,740 |

$624,110 |

1.50% |

In 12 years they see their portfolio only grow by $174,000 in real terms. Using Monte Carlo simulations, we see they only have about a 20% chance of never running out of money.

What Can They Do?

Let’s save this couple by taking all of their retirement money and moving into solid dividend paying stocks. I assumed our basket of dividend payers mirrors 3M. Here is what I found:

|

Beginning Value |

Ending Value |

Ending Value |

Real Annual Return After Taxes |

|

$450,000 |

$1,300,000 |

$957,000 |

4.5% |

That is more like it. Their real return goes us substantially. You can also see their new Monte Carlo results:

Early Investing Is Key

It pays to invest in strong dividend payers early so the dividend growth can compound over time. Eventually you will be living off of the dividend income with no worries about running out of money in your retirement years.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find ...

more