3 Undervalued Biotech Stocks With Upcoming Catalysts - April 16, 2016

Bret Jensen recommends buying these three cheap biotech stocks because they might not be so cheap once summer is over. Each stock has multiple catalysts coming up in the next few months such as FDA trial decisions and possible buyouts that could send their stock prices soaring.

After being in the deepest and longest bear market since the financial crisis, the biotech sector has started to recover. The area is up some 15% from its recent lows and, so far, has been one of the strongest performing sectors of the market in the second quarter. The derailment of the mega-merger between Allergan (AGN) and Pfizer (PFE) by the Treasury Department has counterintuitively helped boost the sector as well because now that large mergers seem to be off the table, Allergan, Pfizer, and other drug giants will have to plumb the small and mid-cap part of biotech for acquisitions. Speculation has increased over the past week on myriad possible acquisition targets in these parts of the market, boosting the shares of many mid and small cap names within the biotech sector such as Medivation (MDVN) and Relypsa (RLYP) and others.

I never buy a biotech stock based solely on its possibility of being a buyout candidate, but is one of many things I do factor in when doing my research. I look at having an investment that has a good possibility of being bought as one piece of a complex puzzle that I must solve before making a new investment in this lucrative but volatile space of the market. Another item I look for, especially when looking at small cap biotech stocks, are what potential catalysts are on the near-term horizon. These include when important trial results will be announced or Prescription Drug User Fee Act (PDUFA) dates where the FDA will render a decision on whether it will or will not approve a new drug.

Obviously, this is extremely useful information to know in advance of deciding whether to take a stake in a promising but speculative small cap concern. There are a variety of services and free calendars out on the internet one can reference. This is the one I use frequently.

Let’s take a look at a couple of promising small biotech stocks that have some likely positive catalysts on the horizon.

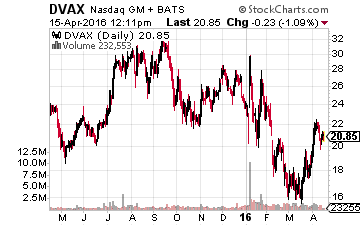

Dynavax Technologies (DVAX) is one of those companies that could easily be acquired by a larger player given its current undervaluation and forthcoming entry into the hepatitis B market. The company’s HEPLISAV-B biologic vaccine to prevent hepatitis B has a PDUFA date of September 15th. I would be shocked if it does not get approved. In an over 8,000 individual Phase III trial, this compound demonstrated better effectiveness (95% vs. 81%) in providing protection compared with the standard vaccine on the market, and can also be effectively administered in just two doses compared with the three doses the current standard needs. This will greatly help compliance in administering the needed regimen and delivering protection.

I expect, upon approval of their vaccine, the company will eventually grab the lion’s share of the over $700 million annual market for hepatitis B vaccines. Let’s say it gets up to $500 million in annual sales, and we value this part of Dynavax’s business at three times annual sales; that equals $1.5 billion. Add in the $200 million for the company’s current net cash and $300 million for the value of a promising Asthma drug as well as an early stage oncology compound that shoes encouraging early trial results. This gets us to a valuation of $2 billion or around $50 a share, approximately 150% above its current price of just over $20 a share.

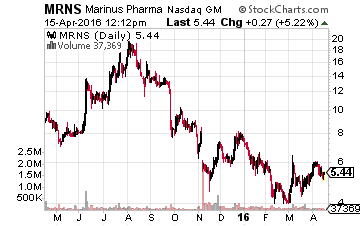

Marinus Pharmaceuticals (MRNS) is a small, promising, if speculative, biotech stock I have built a decent stake in. The company has multiple “shots on goal” within its pipeline, and a busy schedule of events over the next few months. By the end of the first half of the year, the company will have provided results from its primary drug compound Ganaxolone for the treatment of Fragile X as well as female children with epilepsy in two Phase II trials. Perhaps more importantly, it will release results roughly in same time frame for ganaxolone in a Phase III trial for the treatment of adult epilepsy. The company also presents at the 68th American Academy of Neurology (AAN) Annual Meeting in Vancouver Canada on Wednesday which could also move the stock. Although a developmental concern, I like Marinus’ risk/reward profile and it certainly qualifies as having catalysts on the horizon and then some.

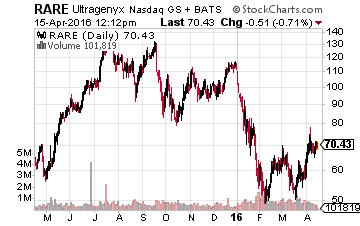

Ultragenyx Pharmaceuticals (RARE) is actually a mid-cap biotech that I don’t own yet but have been thinking about acquiring a small stake in during the next dip in the overall market. The company has over $400 million on the balance sheet, so no immediate funding concerns, and an impressive pipeline of biologic and small molecule drugs. Canaccord Genuity initiated the shares as a Buy earlier this month with a $120 a share price target. The stock currently goes for right around $70 a share.

By the end of June, a couple of important trial results will be known. An interim Phase II status check should be released on its compound KRN23 for the treatment of tumor-induced osteomalecia should be known. More importantly, Phase III trial result for the company’s compound rhGUS for treating mucopolyaccharidosis type 7. That is a mouthful to say but this is a rare disease caused by the lack of an enzyme.

I offer these speculative but very promising biotech stocks with catalysts on the horizon for consideration. If biotech continues to rally and things fall in place for these individual companies, these stocks could be big winners through year end.

Some of the biggest biotech gains – or any gains for that matter – I’ve enjoyed have come from small biotechs like RLYP, EGRX, among others, but my next biggest opportunity is interestingly enough from a bigger name in the industry.

Why? Because this firm is on the verge of solving one of the biggest killers in America: heart disease. Almost one hundred million people are affected by heart disease, and this firm’s powerful new drug will be able to help them in ways that prior treatments have not. And, it could push just about every other treatment off the table as patients dump their existing treatment for this new one.

All of this adds up to a $10 billion dollar a year market just for this one drug. An opportunity like this does not come around often, but when it does, like it did with Gilead’s Harvoni from which I made a ton of money, those that got on board early banked massive profits. This isn’t some high-risk small cap investment either. This company has flourished throughout bear markets, recessions, and worse over the last thirty years and is now tapping into a goldmine that will propel its stock to new highs.

Disclosure: Long ...

more