3 Stocks To Watch Before The Market Opens Tomorrow - October 19, 2016

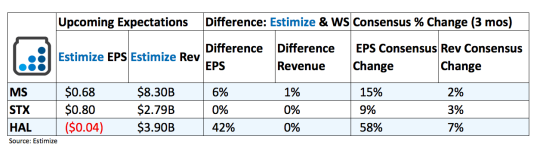

Morgan Stanley (MS): Morgan Stanley can breathe a sigh of relief today after Goldman Sachs’ massive beat on the top and bottom line. The print is a reflection of improving market conditions and trading activity. In particular, Goldman Sach’s saw a boost in fixed income, currency and commodity (FICC) trading revenue. Its widely expected that Morgan Stanley will follow in Goldman’s footsteps and deliver a beat of its own tomorrow. Analysts will be looking for how the company manages weak M&A activity, dismal underwriting fees and a slumping advisory business with booming trading income. This balancing act also includes improving efficiency and tightening cost controls. As the last of the big banks to report this season, all signs are pointing to a massive beat early tomorrow morning.

Seagate Technology (STX): The company recently announced preliminary first quarter results of $2.8 billion in revenue, compared with analysts estimates of $2.7 billion. This incited a free fall in the stock which is down nearly 8% in the past week of trading. Regardless, Seagate is seeing strong demand for its enterprise products which caused the bump in guidance. The company now expects to ship 67 exabytes of HDD products, which translates to 1.7 terabytes per drive for the quarters. High operating costs still remain a significant near term headwind. This coupled with waning PC demand have contributed to negative growth rates for the past handful of quarters.

Halliburton (HAL): By any estimation this quarter is shaping up to be just as devastating as previous reports. Halliburton has seen both earnings and revenue crater from a sluggish energy sector, particularly oil prices. The rebound in the energy market won’t likely reverse these losses but should help instill confidence. Shares are up nearly 40% this year on the back of this ongoing recovery and boom in natural gases. While demand for rigs picked up in the U.S. and Middle East, weakness in Latin America and European markets should put a drag on total count. It’s more important that Halliburton sheds a positive light on future quarters and that this recent recovery is trend rather than a fad.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more