3 Reasons Why Companies Cut Their Dividends

The primary goal of dividend growth investors is to generate a rising stream of dividend income over time. With this in mind, dividend cuts are a dividend growth investor’s worst nightmare.

Fortunately, there are actionable steps that investors can take to reduce their chances of experiencing a dividend reduction. To understand these steps, we must first understand the motivations that cause companies to reduce their dividend payments.

In this article, we explore the three main reasons why companies cut their dividends.

Reason #1: Business Downturn

Perhaps the most common reason why a company cuts its dividend is due to downturns in the underlying business. When a company’s earnings decline to the point where it can no longer cover its dividend, then a dividend cut becomes inevitable for its management team.

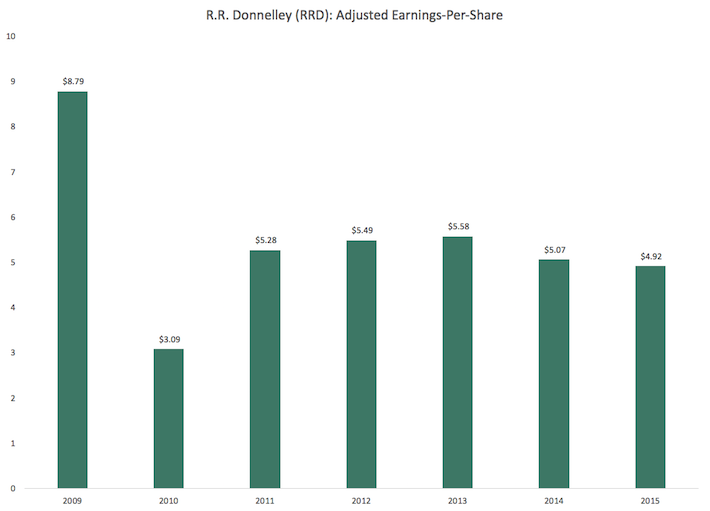

R.R. Donnelley’s (RRD) recent dividend cut is an excellent example of a payout reduction that was caused by an overall business downturn. For those unfamiliar with the company, R.R. Donnelley operates as a direct mail marketing and printing services company. Given the arguably outdated nature of the company’s business model, it does not necessarily seem like a growth company. With that said, the company could still have potentially been a good investment if capital was allocated in an optimal fashion by its management team.

Unfortunately, this was not the case. R.R. Donnelley had failed to generate any meaningful per-share business growth in the years leading up to its dividend cut.

Source: Sure Analysis Research Database

While there were other factors (including business unit spinoffs) that impacted R.R. Donnelley’s financial performance, the overall decline in its core business was the primary reason why the company reduced its payout. Investors looking to avoid a similar situation moving forward should choose to invest only in companies whose fundamental metrics – including earnings and revenues – are growing at satisfactory rates.

Reason #2: Too Much Debt

Taking on too much debt is likely the second most common reason why a company chooses to reduce its dividend. When a company levers up its balance sheet, it increases the proportion of debt that is funding every dollar of assets. The obvious effect of this is to increase the company’s interest payments, but it also creates significant volatility in the company’s book value. If a company’s assets are levered up 10-to-1, than a 10% decline in the value of its assets results in a 100% drop in shareholders’ equity.

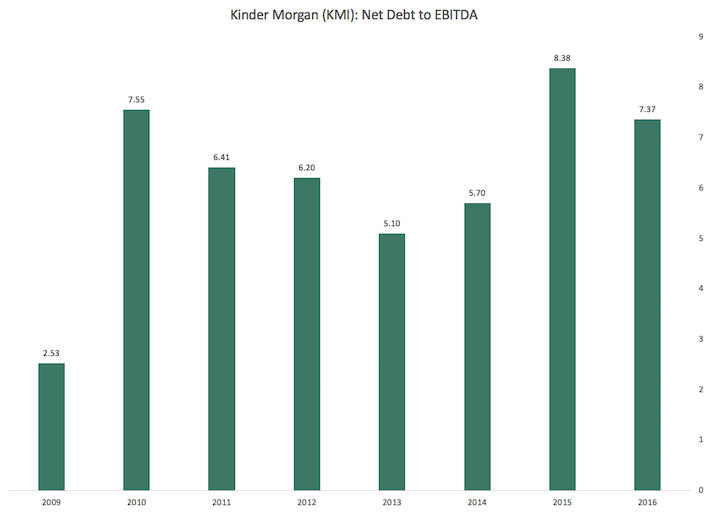

While there are many, Kinder Morgan’s 2016 dividend cut is likely the most prominent example of a debt-related dividend cut. The company reduced its annual dividend from $1.93 per share to $0.50 per share in a move that sent its share price plummeting.

At the same time, Kinder Morgan had to scramble to find additional liquidity to cover near-term liabilities, eventually securing $2 billion of additional dry powder in the form of a term loan and an extension an existing unsecured credit line.

Looking at the company’s leverage levels leading up to the dividend cut, it is no surprise that Kinder Morgan was forced to cut its dividend. The company’s debt levels rose to remarkable heights following its 2011 IPO (note that Kinder Morgan entities had previously been publicly-traded, but this was a re-issuing of the common stock to the public markets).

These rising debt levels resulted in unsustainable debt services charges. At the height of the company’s leverage, Kinder Morgan’s net-debt-to-EBITDA ratio was a remarkable 8.38.

Source: YCharts, Sure Dividend

Another more recent example of a dividend cut caused by overleverage is the dividend reduction of L Brands. In the company’s press release announcing the dividend cut, the company stated the following:

“After extensive review, the Board of Directors plans to reduce the company’s annual ordinary dividend to $1.20 from $2.40 currently, beginning with the quarterly dividend to be paid in March 2019.The planned reduction will result in a dividend payout ratio that is more consistent with the company’s past practice, and a dividend yield in line with relevant comparisons.The approximately $325 million in cash made available from the dividend reduction will be utilized primarily to contribute to the deleveraging of the company’s balance sheet over time. The Board was assisted in its assessment by its financial advisors BridgePark Advisors and PJT Partners.”

While L Brands’ leverage was not quite as remarkable as Kinder Morgan’s (its net-debt-to-EBITDA ratio peaked at 2.5x compared to the 8.4x exhibited by Kinder Morgan), it again shows the perils of investing in dividend stocks with high amounts of balance sheet leverage.

For investors looking to avoid this type of dividend cut, implementing cutoffs with respect to leverage metrics (such as the debt-to-equity ratio or the net-debt-to-EBITDA ratio) is an excellent place to start.

Reason #3: Change in Capital Allocation Policy

The third – and perhaps most inexplicable – reason why a company would choose to reduce its dividend is due to a change in capital allocation policy.

More specifically, sometimes corporations will reduce their dividend not because they are forced to, but because they want to. This is usually because there are other places they would prefer to allocate their capital, such as:

- Share repurchases

- Debt paydown

- Capital expenditures

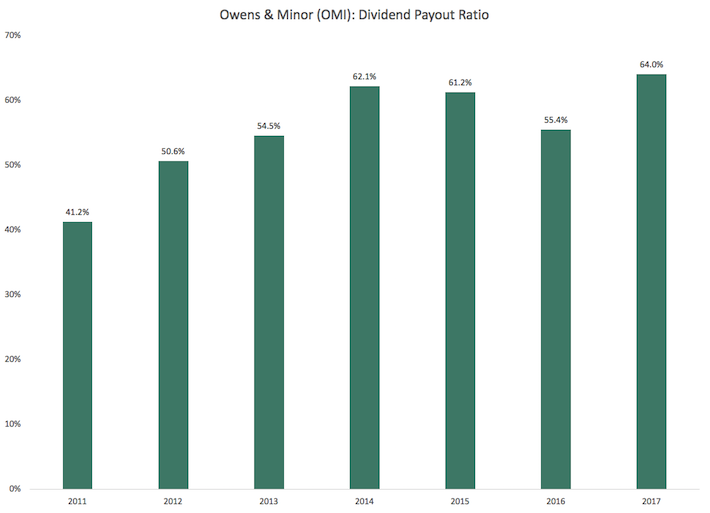

One recent example of this is the dividend cut of Owens & Minor (OMI). The company cut its dividend despite dividend payments that were substantially less than its adjusted earnings-per-share. More specifically, Owens & Minor’s payout ratio in the years leading up to its dividend cut are shown below.

Source: Owens & Minor Press Releases, Sure Dividend calculations

Dividend cuts from companies with sub-65% payout ratios are rare. So why the Owens & Minor reduce its dividend payment?

In the company’s press release following the announcement, the company’s then-CEO (who has since departed the company) stated:

“The new fourth quarter dividend rate achieves a more balanced capital allocation strategy. By right-sizing the dividend, we can continue to provide a reasonable return of capital to shareholders as we transform the business.”

While the company’s corporate speak above leaves much to be desired and can be extremely frustrating for its shareholders, it is not the worst characteristic of this type of dividend cut.

Instead, the worst part of a capital allocation-related dividend cut is that it is unpredictable. In general, it is difficult for shareholders to anticipate how a company will allocate its capital moving forward unless the company provides specific guidance on allocation decisions.

One was to avoid this type of dividend cut is by looking for companies that have long histories of rising dividend payments. This shows that a company’s management team is shareholder-friendly and prioritizes consistently delivering cash payments to shareholders over time.

Investing in these types of companies – those with long and successful dividend growth track records – is an excellent way to avoid dividend cuts from management teams that no longer want to prioritize their dividend payments to shareholders.

Final Thoughts

As dividend growth investors, we want to minimize (or ideally eliminate) the chance that a company in our portfolio cuts its dividend. Understanding why companies choose to do this helps us to achieve this over time.

In this article, we outlined the three mains reasons why companies cut their dividend. The three reasons are:

- Business Downturn

- Overleverage

- Change in Capital Allocation Policy

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more