3 Reasons To Buy Tencent Stock Now

Tencent (OTCPK: TCEHY) stock is under heavy selling pressure, falling by more than 25% from its highs of the year due to macroeconomic uncertainty in China and lower than expected earnings from the company last quarter.

However, recent weakness in financial performance is mostly temporary as opposed to permanent. The big picture in Tencent stock remains intact from a long-term perspective, and current valuation levels are clearly attractive.

1. Underlying Performance Remains Strong

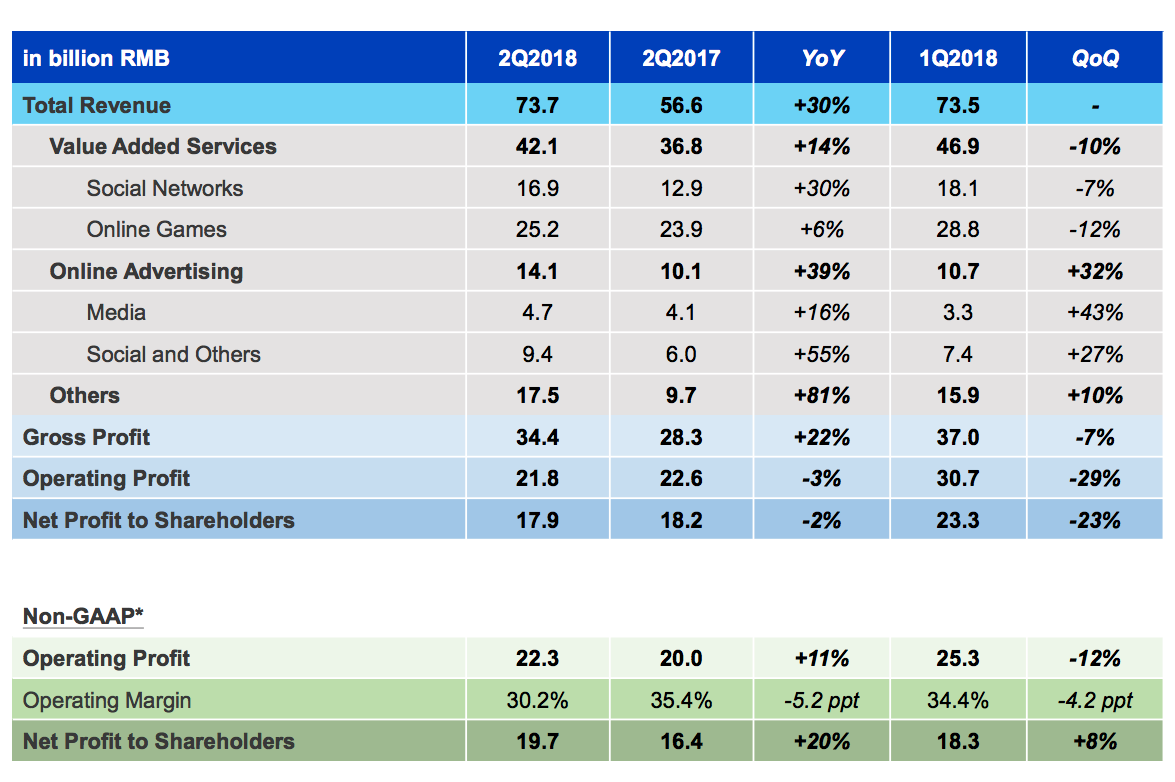

Tencent delivered lower-than-expected revenue and a decline in net profit during the second quarter of 2018. However, this was only due to weakness in the online games segment, since Chinese regulatory authorities have suspended the approval of new online games because of an ongoing restructure of the administrations governing this space.

(Click on image to enlarge)

Source: Tencent

Total company revenue increased by a vigorous 30% year over year, with online advertising growing 39% on the back of an explosive increase of 55% in social media advertising.

This is in spite of the fact that Tencent is barely starting to monetize WeChat. The company is only showing users two ads per day in its WeChat Moments feed. Tencent has enormous room to increasingly monetize WeChat going forward, and this opportunity will probably be a remarkably powerful growth engine in the years ahead.

The company also is growing at full speed in areas such as digital payments, cloud computing, and online video. These smaller businesses currently have thinner margins than online games, but profitability is set to expand as these younger platforms gain size and scale over time.

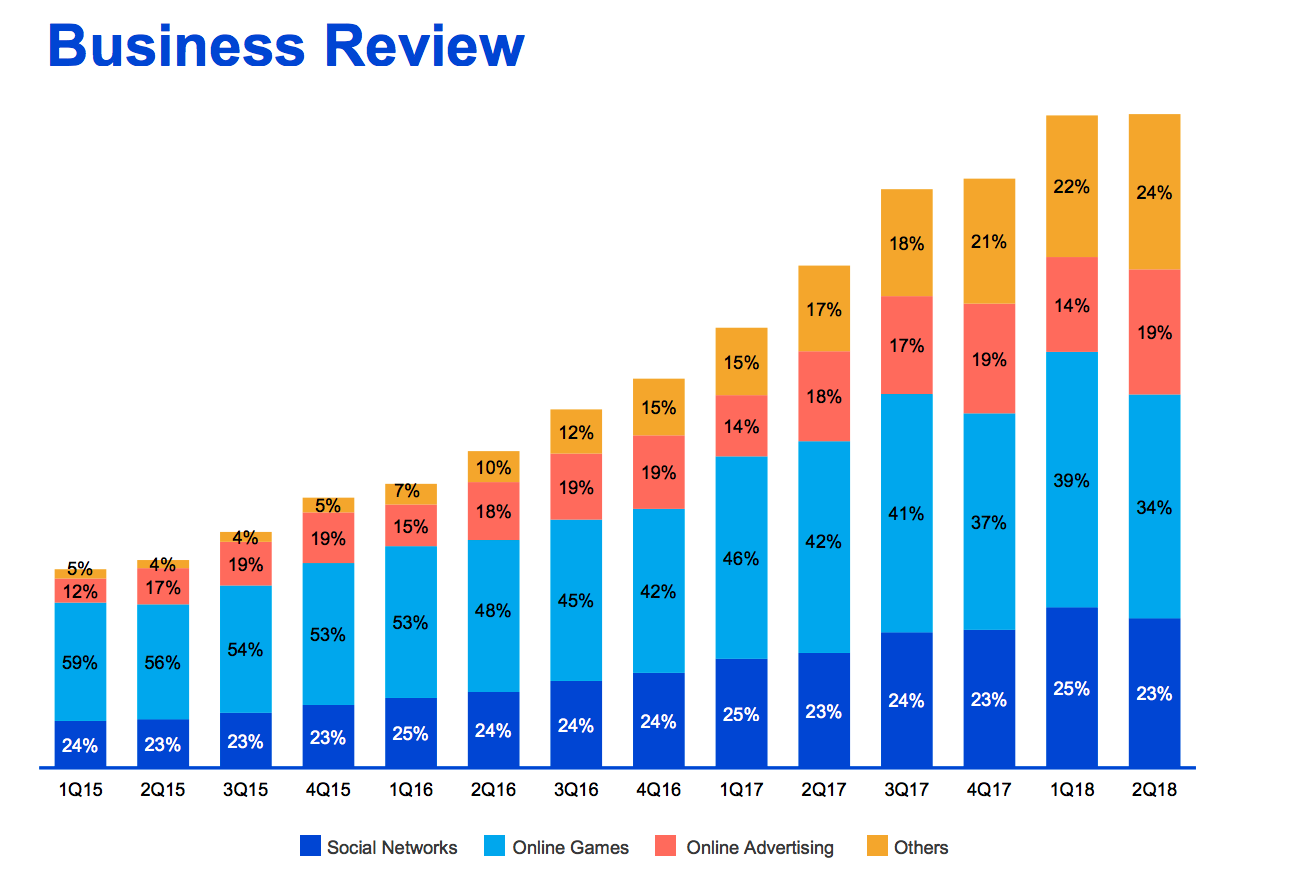

Even if the approval process for new online games in the coming months remains uncertain, Tencent has a pipeline of 15 games already approved for launch. Besides, the company is increasingly diversifying its revenue base over the past several years. Online games are declining as a share of total revenue, from 48% in the second quarter of 2016 to 42% in the second quarter of 2017, and to 34% of revenue in the second quarter of 2018.

Source: Tencent

2. A Unique Growth Business

Tencent is a market leader in industries such as online games, social media, digital payments, online media, e-commerce, and cloud computing, among several others. All those industries together represent a massive addressable market worth more than $1 trillion in the long term.

Source: Tencent

The company benefits from the network effect, meaning that the value of the platform increases as it gains size over time. In businesses such as social networks and digital payments, users attract each other to the leading platforms. The more users a platform has, the more value it provides to such users, which creates a virtuous cycle of growth and increased competitive strength for Tencent in its multiple businesses.

Access to gargantuan amounts of financial resources allows Tencent to make all kinds of investments across the world. The company owns investments in Tesla (TSLA), Snap (SNAP), Spotify (SPOT), and Uber, to name a few high-profile examples of well-known companies in the U.S.

Since the start of 2017 a total of 12 of Tencent's portfolio companies have gone public, and Tencent's aggregate stake in these 12 IPOs was worth more than $20B at the time of exit.

(Click on image to enlarge)

Source: CBSINSIGHTS

Even more important, the whole is worth more than the sum of the parts when it comes to Tencent. The company has access to enormously valuable data across all kids of platforms, and this gives Tencent a tremendously valuable source of strategic advantage.

An excellent article from Steven A. Cohen and. Matthew W. Granade in the Wall Street Journal explains why this model-driven business model is so powerful:

A model-driven business is something beyond a data-driven business. A data-driven business collects and analyzes data to help humans make better business decisions. A model-driven business creates a system built around continuously improving models that define the business. In a data-driven business, the data helps the business; in a model-driven business, the models are the business.

Tencent, the Chinese social-media giant and maker of WeChat, is one of our favorite examples of this new business model. A Tencent executive told us last fall: “We are the only company that has customer data across social media, payments, gaming, messaging, media, and music, and we have this information on (several hundred) million people. Our strategy is to put this data in the hands of several thousand data scientists, who can use it to make our products better and to better target advertising on our platform.” That unique data set powers a model factory that constantly improves user experience and increases profitability - attracting more users, further improving the models and profitability. That’s a model-driven business.

3. Attractive Valuation

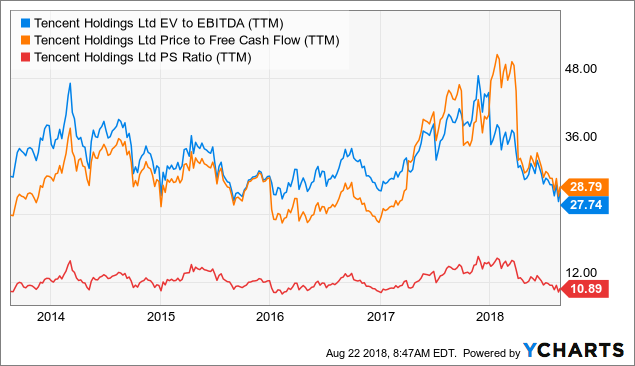

Wall Street analysts are on average expecting Tencent to make $1.66 in earnings per share during 2019. Under this assumption, the stock is trading at a forward price to earnings ratio of 27. This is hardly excessive for a market leader growing revenue at over 30% year over year and generating operating margins in the range of 25%-30% of revenue.

The chart below shoes the evolution of valuation ratios such as enterprise value to EBITDA, price to free cash flow, and price to sales over the past five years. Tencent stock is clearly trading near the low end of its valuation range from a historical perspective.

(Click on image to enlarge)

TCEHY EV to EBITDA (TTM) data by YCharts

Importantly, current numbers should be adjusted to reflect the fact that Tencent is making all kinds of investments in multiple growth projects. These expenses are currently being reflected on both the income statement and the cash flow statement, but investors are not seeing the cash generation from such investments at this stage. More importantly, Tencent is barely making the first moves in terms of monetizing WeChat, arguably its most valuable strategic asset.

The main point is that current earnings are not reflecting the company's true earnings power over the long term, and this makes the long-term bullish case for Tencent stock even more attractive.

Implications For Investors

Investing in China stocks always carries some particular risks. Macroeconomic uncertainty and currency volatility are key considerations, especially with the trade war between China and the U.S. generating plenty of noise on that front lately. Tencent’s recent setback with online games approvals also highlights the fact that the legal and regulatory environment in China is always a major source of risk for investors.

In addition, Tencent operates in dynamic industries prone to innovative disruption. Even if the company has formidable competitive strengths, investors in Tencent stock may want to keep an eye on the competitive environment to make sure that the company remains strategically well positioned to capitalize on its growth opportunities over the years ahead.

Those risks being acknowledged, Tencent is an outstandingly strong business with extraordinary potential for growth in the long term, financial performance remains clearly solid, and current valuation levels are more than reasonable. That's not only one, but three strong reasons to consider a long position in Tencent stock.

Disclosure: I am/we are long TCEHY, SPOT.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more