3 MLPs That Will Pop 25% After Announcing Distributions

If you’re looking for one trade to make right now that can book you a 25% or higher return in less than three weeks, look no further. These 3 MLPs’ share prices have been driven down because of fears they won’t be able to keep distributions at desired levels, but Tim Plaehn’s research proves otherwise.

Although the list is small, the group of downstream, refinery-owning master limited partnerships – MLPs – offer very interesting opportunities to invest for high yield or trade on large unit price swings. The three refiner MLPs will declare their 2014 fourth quarter distributions during the first and second weeks of February. If the distributions are higher than currently indicated by the respective unit prices, investors who buy now will see some very nice price gains. I think this is the case and here are my reasons:

A refinery generates its gross operating margin based on three factors: the cost of the crude oil it buys, the prices it receives for fuels and other products produced from refining the crude, and the throughput rate of the refinery. Refiners report an operating margin per barrel, which shows the profit per barrel based on costs and prices of crude and fuels. A refinery generally runs every day, so throughput would be affected by planned or unexpected downtime for maintenance.

Investors can estimate gross margin per barrel by calculating a crack spread using available market prices for crude oil, gasoline, heating oil and diesel fuel. I run a crack spread spreadsheet using West Texas Intermediate crude, New York Harbor regular gasoline, and New York Harbor ultra-low sulphur diesel prices provided by the U.S. Energy Information Agency.

Individual refinery margins can vary from the calculated crack spread, but the market-based pricing calculations allow me to determine if the spread is widening, narrowing, or staying the same. In the volatile fourth quarter, with both crude and fuel prices dropping dramatically, the crack spread stayed surprisingly steady. The fourth quarter spread was within pennies of the spread averages for both the second and third quarters of 2014.

The same crack spread in Q4 vs Q3 means that in a perfect world, the refiners should have generated gross profits in line with their third quarter results. The interesting part will be finding out how the rapidly falling prices affected actual operating margins. None of the three MLPs reported any significant refinery downtime for the quarter, so that issue will not be a factor.

The bottom line is that there is a very high probability that the refiner MLPs will have generated profit levels to pay distributions close to the amounts paid for Q3. Yet unit prices have dropped over the last three months, mirroring the declines in energy prices. Let’s take a look at each of the three MLPs. They should see very nice price pops over the next few weeks based on my expectation of relatively high announced distributions for the last quarter.

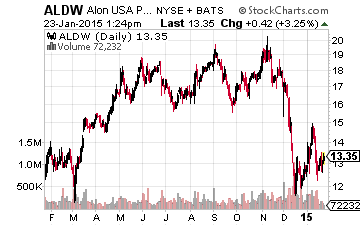

Alon USA Partners LP (NYSE: ALDW) is down 34% since the last distribution announcement in November. ALDW paid $1.02 per unit distribution for Q3, which equates to a 30% annual yield at the current unit price. I expect a distribution of $0.75 to $1.00 to be announced in the second week of February. If the distribution comes in this range, the ALDW unit price could jump by 30% or more.

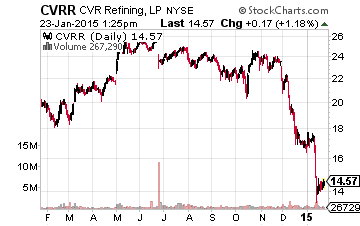

CVR Refining LP (NYSE: CVRR) is down 40% since its last distribution. CVRR paid $0.54 per unit in November. That payout was reduced due to a 3-week shutdown of one of CVR Refining’s two refineries during the third quarter. With a similar gross margin per barrel in Q4 compared to Q3, CVRR could pay $0.70 or more for the fourth quarter. CVRR should announce its distribution in the first week of February. The CVRR unit price is poised to jump by 25% or more.

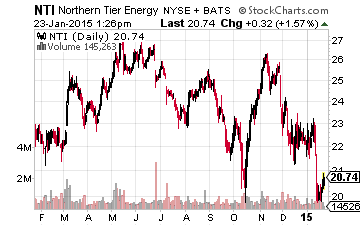

Northern Tier Energy LP (NYSE: NTI) is down 23% from when it paid its last distribution of $1.00 per unit. NTI yields 19% based on the most recent distribution, which I expect NTI to come close to matching for Q4. The unit price should climb 25% from the current $20 range to over $25. NTI is a recent addition to the 30 Day Dividends portfolio.

These variable distribution MLPs can be accumulated when unit prices are down to build long term positions while collecting high yields. Or they can be traded, buying and selling to take advantage of unit prices that can swing 30% from quarter to quarter. I use these swings for recommendations of my dividend-centric trades in my 30 Day Dividends newsletter.

Disclosure: I currently do not have positions in the stocks discussed here. I hold positions in several high yield MLPs as part of the more