3 Cult Stocks To Avoid In 2015

These three stocks are defined by innovation and customers who can’t get enough, but the valuations of these stocks just don’t add up. With such sky-high valuations not based on business fundamentals, these stocks can turn sour at a moments notice. It would be wise to avoid these 3 stocks right now.

Writing on a regular basis for Investors Alley, Real Money Pro, and Seeking Alpha as well as an increasingly busy speaking circuit brings me into contact on a consistent basis with readers who have myriad questions about investing. One of most frequent questions I get asked is what I look for when making an investment. Less often someone inquiries about just as an important a question that should be asked more. What kinds of stocks do I avoid?

Every investor wants to find the next Apple (NASDAQ: AAPL) or Starbucks (NASDAQ: SBUX) as one does not have to find one of these great growth companies early in their lifecycle to have a very successful investment performance over the lifetime of one’s portfolio. Just as important is avoiding stocks that might have momentum currently but eventually fall back to earth, blowing a huge hole in your portfolio that takes some time to recover from.

One mistake I have seen investors make over and over is to fall in love with stocks in companies because they adore and use their products or services not because of business fundamentals or reasonable valuation expectations.

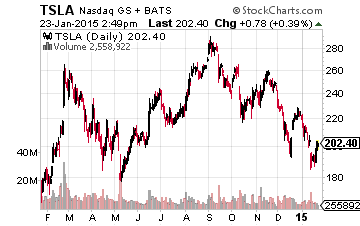

I was at investing conference just over a month ago when someone asked me to name a few companies that this would apply to in the current market. I thought about it a moment and came up with Tesla Motors (NASDAQ: TSLA), Amazon (NASDAQ: AMZN) and GoPro (NASDAQ: GPRO). All of these stocks are down since that conference but further declines could be forthcoming as their business fundamentals do not support their valuations afforded them currently by investors.

All of these are well-run companies that provide great services and products. Tesla makes one of the finest cars I have ever driven. If the stock was valuing the company for its wonderful Model S and the 100,000 vehicles it may sell of that model annually in a few years, I might buy some shares myself.

However, with a market capitalization of $25 billion, investors are giving this niche automaker a lot of credit for building a company capable of selling a couple a million vehicles in a decade’s time, something its CEO has stated as Tesla’s goal.

This will be have be done by making hugely profitable electric car models for the mass market, something that has never been attempted on a large scale. I believed this challenge was immense and unlikely even before the recent plunge in oil brought gasoline down to $2 a gallon, eroding the attractiveness of alternative energy vehicles.

Investors seem willing to give Tesla a huge benefit of the doubt currently even as management recently moved back its target for its first full year profit to FY2020. In addition, it just lost the head of its China efforts; a major blow considering China is a country that is critical to Tesla achieving its production goals over time. With new competitors entering the arena and the lack of a nationwide charging system, Tesla’s goals may be much tougher to realize than its very optimistic outlook. If sentiment fades on this cult stock or if the company hits any manufacturing snafus or other hiccups, shareholders will bail, crushing the remaining investors in this overvalued equity.

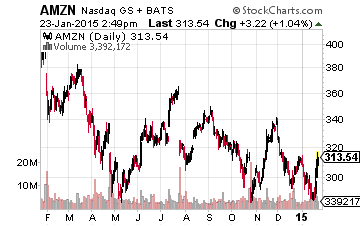

Amazon is another wonderful company with a great service and one I use almost every week. The company is a major player in web services and is becoming a bigger player in streaming video as well. There is no question it is the king of the online retailing space and will remain so for the foreseeable future.

The problem with Amazon is it never makes any profits even as revenues increase 20% to 30% every year. Amazon earned just over $2.50 a share in FY2010 and it has not achieved those levels since then. It is almost as if the company’s motto is “We lose money on every sale but make it up on volume."

Shareholders have been patient as the company made “investments” in its future, but eventually stockholders are going to want free cash flow, earnings and maybe even a dividend. The stocks sells for north of $300 a share even as the company is projected to make less than $1.00 a share in earnings in FY2015. If investors tire of “waiting” for earnings, sentiment could turn on this retailer’s shares very quickly.

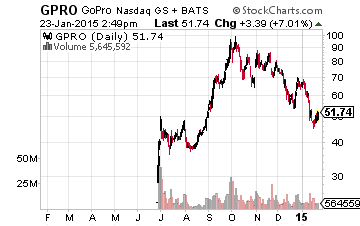

Finally, we have GoPro, a company that came public last year and markets the most popular mobile video camera on the market, which has become a cult classic for the adventure set. The company has had the space mostly to itself but Asian competitors are starting to enter the market.

Earnings should increase around 25% in FY2015 year-over-year on a similar rise in sales. However, the company has an almost $7 billion market capitalization and is priced at over 40 times forward earnings and almost six times trailing revenues; both extreme valuations for a consumer electronic hardware maker. In addition, the lockup from the company’s initial public offering does not fully expire for another five months and the shares could experience some additional downward pressure once insiders can sell their stock on the open market.

All of the selections above have been great momentum plays for some time. However the risks to the downside, given the stock’s valuations, far outweigh the possible upside if these companies manage to exceed the wildly optimistic outlook investors seems to have for these companies.

My own portfolio is weighted primarily to less exciting large cap growth stocks selling at attractive long term valuations. These include names like Gilead Sciences (NASDAQ: GILD). These types of core growth holdings can be found throughout my Blue Chip Gems portfolio. They may not go from 0 to 60 in 4.6 seconds within your portfolio like a Model S from Tesla. However, they should outperform the market nicely over time. Plus, you won’t lose any sleep at night wondering if tomorrow is the day that the market will abandon them like they might with the three mentioned earlier.

Great article and glad to read the reasoning to consider $GILD as a safer investment short, mid and long term.

Look at GPRO puts the lockout from the IPO expires in February - look for selling into that

I'd say this is a minority view, I've seen several others stating that $GILD was a stock to buy this year.

Apologies for the misunderstanding - we removed GILD from the "stocks mentioned in this article" section to eliminate any confusion.

Jensen has been in GILD for two years--since $40. He is still long.

You didn't read to the end. Jensen is bullish on GILD and mentions it as a stock to own in the last paragraph.

Sorry all, thanks for the clarification. My bad! Now that I've read it through, it all makes total sense. $GILD, $BAC, $WFM, and $VA are my plays for 2015.

Thanks. GILD one of the cheapest large cap growth plays in the market right now....