3 Consistent Dividend Growers To Safeguard Your Portfolio

Growing their dividends each and every year for over 100 years means investors in these three stocks have been enjoying consistently growing total returns that won’t stop for any one market blip. All three stocks are great choices to boost the safety and returns of your portfolio.

Broadly speaking, dividend stocks are winners, and they have a long history of outperforming the market. However, some dividends win more than others.

Most investors flock to high dividend yields, and there’s nothing wrong with that, but there’s a key distinction between high-yielding dividends and those that are consistent dividend growers.

A dividend growth strategy is one focused on companies that have a history of increasing their dividends so that essentially you’re getting an automatic raise every time they increase their payouts.

In the short-term, a higher-yielding stock seems more rewarding. When opening your quarterly dividend check, the difference between a 2% dividend yield and a 6% yield will be a few hundred dollars for most investors.

However, studious investors are not into investing for the sexiness of it or the near-term benefits. The goal should be to find outperforming stocks over the long-term. And that’s just what consistent dividend growth stocks do — outperform.

Look at the Vanguard Dividend Appreciation ETF (NYSE: VIG), which invests in dividend growth stocks and compare it to the Vanguard High Dividend Yield Index ETF (NYSE: VYM), which focuses on high-yielding stocks.

Shares of the Dividend Appreciation ETF have outperformed the High Dividend Yield ETF by 21 percentage points over the last five years on a total return basis.

Part of this outperformance comes from the fact that companies that can consistently raise their dividends tend to have competitive advantages and the ability to generate cash flow in various economic environments.

With all that in mind, let’s have a look at 3 of the top dividend growers:

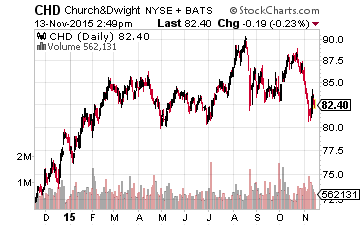

Consistent Dividend Grower No. 1: Church & Dwight Co. (NYSE: CHD)

Paying a 1.6% dividend yield, Church & Dwight might not seem like much; however, this overlooked $11 billion market cap consumer products company has upped its annual dividend for nine straight years. It has managed to grow its dividend payment at an annual rate of 20% for the last three years.

Even with that dividend growth, it’s still paying out just 40% of its earnings via dividends — meaning there is still plenty of potential dividend growth going forward.

Church & Dwight also has an impressively low beta, coming in at 0.33. Thus, when the market falls by $1, shares of Church & Dwight generally only fall by 33 cents.

This comes as its products are resilient against economic cycles. Its brands include Oxiclean, Trojan, Arm & Hammer, Orajel, and more. All items that you won’t suddenly stop buying because the market falls.

It’s still finding ways to grow “old” brands as well, namely by investing in marketing and R&D. Take its Arm & Hammer brand, which was seeing flat growth in the early 2000's, but has managed to grow sales at an average of 5% per year over the last half-decade thanks to marketing initiatives and cost cuts.

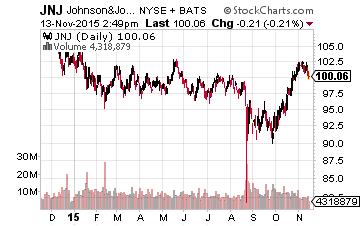

Consistent Dividend Grower No. 2: Johnson & Johnson (NYSE: JNJ)

Now, Johnson & Johnson isn’t an under the radar dividend grower. It has a $280 billion market cap. It pays out a solid 3% dividend yield and has a 52-year streak of annual dividend increases.

It’s also still growing its dividend at an impressive rate — having upped its dividend at an annual rate of 8% over the last three years. Topping dividend growth rates of peers Procter & Gamble (NYSE: PG) and Colgate Palmolive (NYSE: CL).

Compared to those two, Johnson & Johnson also has a much better balance sheet — with a debt-to-capital ratio of just 20%.

Johnson & Johnson does a little bit of everything but is most heavily invested in the healthcare space. This includes pharmaceuticals, medical devices and consumer products. The beauty of this focus is that healthcare spending is less susceptible to downturns in the economy.

One final note on Johnson & Johnson — while other major consumer products companies are trading between 20 and 25 times next year’s earnings, J&J trades at just 16 times. Part of that is because shares have gotten caught up in the pharma and biotech selloff over the last few months. However, only about a third of its revenues are tied to its pharma division.

And amidst the selloff, Johnson & Johnson is one of the few large-caps that’s offering investors the best of both worlds — dividend growth and a juicy dividend yield.

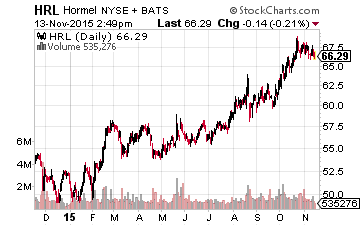

Consistent Dividend Grower No. 3: Hormel Foods Corp. (NYSE: HRL)

Yielding 1.5%, Hormel Foods is another stock that doesn’t look like a sexy income play. But, this is one resilient $18 billion market cap foods company that has upped its dividend for 48 straight years.

Over the last decade it has upped its dividend at an annualized rate of 14%. The payout ratio is still an ultra-low 35%. Balance sheet strength is another key when looking for companies that can consistently up their dividends. Hormel has a debt-to-capital ratio of just 13%.

It has brands with international recognition, like Spam, which should benefit from the growing demand for protein-based foods in emerging markets. But it’s also making the move into health-conscious products, with its Jennie-O brand and the recent Applegate Farms purchase.

In the end, the bull market is getting long-in-the-tooth and investors have to start worrying about how expensive the market is getting. With that, the benefits of owning dividend growers versus high dividends can’t be overstated. The three stocks above have a history of dividend growth and the cash flow to support even higher dividend payments going forward.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more