2 Bottomed Out Stocks To Watch For Explosive Upside

“Patience, persistence and perspiration make an unbeatable combination for success.” – Napolean Hill

The fourth quarter has certainly gotten off to an interesting start. The first two days of trading saw stocks plunge in the early hours only to claw their way back by the close of the market. Friday’s Jobs Report was disappointing to say the least. Not only did the report come in approximately 60,000 jobs short but there were major revisions down from the previous two months’ numbers. It seems the domestic economy cannot escape the effects of weak global demand and a strong dollar. Manufacturing was particularly weak.

On the bright side, the latest punk job numbers in all probability will put the Federal Reserve on the sidelines for raising rates for the first time since 2006 until at least 2016. This should also mean less chance the dollar will rise further against major currencies and might even give back some of its gains this year. On the margin, this should be positive for energy and commodity prices and should lessen pressure on the profits of most of the S&P 500.

After the worst quarter for stocks in four years, I believe it appears equities are trying to find a bottom based on the events of the last three months. Therefore, it might be time to do some bottom fishing. There are several stocks that have gotten way too cheap during the recent downturn in the stock market and look ready to bounce. Here are two that look like good bets going forward.

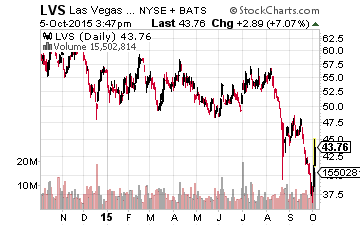

Let’s start with Las Vegas Sands (NYSE: LVS), the American casino operator that gets the vast majority of its revenues and earnings from Asia; primarily the gambling enclave of Macau. Like all casino operators in Macau, the stock has been hit hard by the drop-off in traffic in 2015. Chinese authorities had cracked down on “corruption” which severely affected how many high rollers showed up in Macau.

Let’s start with Las Vegas Sands (NYSE: LVS), the American casino operator that gets the vast majority of its revenues and earnings from Asia; primarily the gambling enclave of Macau. Like all casino operators in Macau, the stock has been hit hard by the drop-off in traffic in 2015. Chinese authorities had cracked down on “corruption” which severely affected how many high rollers showed up in Macau.

The sector got a huge lift last Friday and was one of the best performing areas in the market that day as it appears Chinese leadership is beginning to realize it has overstepped, causing a steep drop in economic activity and job growth in Macau. The stocks of these operators received a huge boost after Beijing’s top official in the region gave a clear sign Friday that support from the government could be on the way.

Even with the rally, the stock is down some 25% from where it began the third quarter. It feels like the floor is in especially in light of the six percent dividend yield the shares pays. In addition, its 3,000 room Parisan Macao will open early in 2016. This will boost revenues and also cause a sharp fall-off in capital expenditure needs over the next few years. Given its recent history, I expect Las Vegas Sands to use the additional free cash flow to raise its dividend and boost its stock buyback authorization as well.

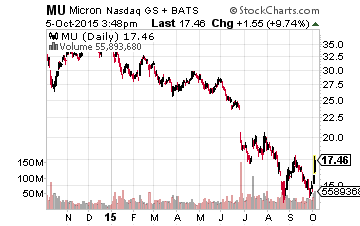

Keeping with the China theme, our next pick is Micron Technologies (NYSE: MU). The company recently was in the news as a giant Chinese chipmaker made an unsolicited buyout offer in the low $20s which was rejected. The acquisition is probably a no go due to national security concerns but it does show others value Micron for more than that where the stock is going for in the market.

Keeping with the China theme, our next pick is Micron Technologies (NYSE: MU). The company recently was in the news as a giant Chinese chipmaker made an unsolicited buyout offer in the low $20s which was rejected. The acquisition is probably a no go due to national security concerns but it does show others value Micron for more than that where the stock is going for in the market.

This chip maker has been cut in half in 2015 due to weak PC demand and tepid DRAM pricing. Micron gets roughly two thirds of its revenues from these sources. Late last week Micron reported results that beat both top and bottom line consensus figures. More importantly, the stock shot up some five percent despite the company giving weak forward guidance. This seems to point to all the bad news currently being priced into the stock.

In addition, results brought a lot of positive analyst commentary. Morgan Stanley, UBS, Deutsche Bank, Jefferies, Needham, Credit Suisse and other analyst firms reiterated “Buy” ratings on Micron after quarterly numbers. Their price targets on the chip stock range from $20.00 a share to $30.00 a share. Micron currently changes hands in the market at just under $16.00 a share.

In addition, the company just launched a new offering into the NAND market with co-developer and partner Intel (NASDAQ: INTC). The company gets around 30% of its overall sales from this part of the chip marker and this new NAND product is revolutionary in several different respects. I believe the product line will significant increase Micron’s market share in this space where it is currently the fourth or fifth biggest player.

Finally, the fourth quarter is a historically strong one for the chip industry thanks to the holiday related boost from myriad consumer products that contain these chips. The stock currently goes for just over five times what the company made in profit in FY2014. Yes, earnings should come in at just over half of last year’s levels but should bounce back up past $2.00 a share in FY2016 making Micron very cheap both on a trailing and forward earnings valuation basis.

Neither of the two profiled firms treated their shareholders very well in 2015. However, it appears both stocks have either bottomed or are in the process of doing so. 2016 could be a very different story. As Wayne Gretsky once famously said it is by “skating to where the puck is going and not to where it has been” that is the key to success.

Disclosure: more