14% Annual Return On Health Net

|

Summary

|

Deal Target Description

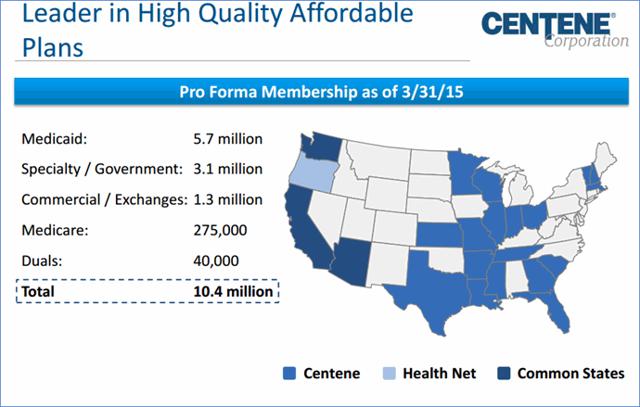

Health Net (NYSE:HNT) provides managed health care services through health plans and government-sponsored managed care plans.

Deal Terms

On July 2, 2015, Centene (NYSE:CNC) and HNT announced a definitive deal in which HNT shareholders will get 0.622 CNC shares and $28.25 in cash for each share of HNT.

Deal Financing

The deal is not conditioned upon receiving financing. HNT worked with JP Morgan (NYSE:JPM) on the deal.

Deal Conditions

The deal is subject to approval by CNC and HNT shareholders, antitrust approval, approvals by relevant state insurance and healthcare regulators and other typical closing conditions. State approvals are needed in Arizona, California, and Oregon.

Deal Price

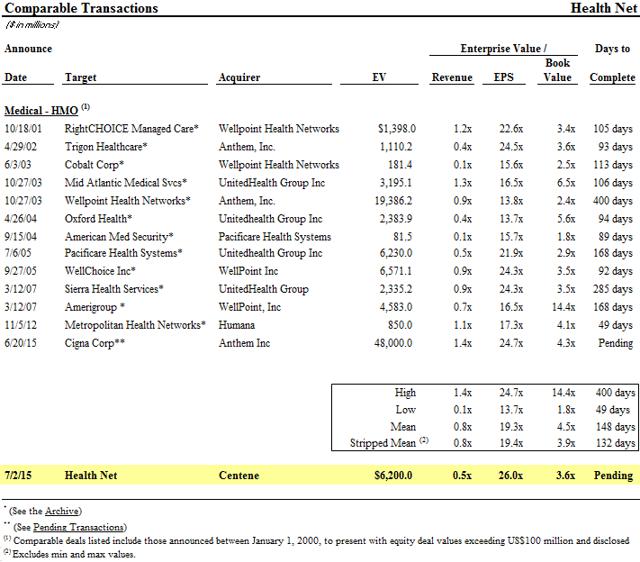

The deal price is within the range of historically comparable transactions.

Assuming that the deal closes around early February of next year, the annualized net return will be around 14%.

Event Driven Investing with Equity Options

This is probably best set up using equity, but one option worth considering writing is the January 15, 2016 $67.50 HNT put. It last traded for $5.10, but has a wide bid/ask spread with a bid of $3.30 and an ask of $7.00.

Conclusion

HNT is an attractive long opportunity.

Disclosure: I am/we ...

more