10 Stocks To Soar In 2018

The market is currently trading at record highs, boosted by the prospect of business-friendly tax reforms. And according to Bank of America, this bull market still has plenty of ‘gas in the tank’. Technical analysts from BoA say the S&P 500 could hit 3,000 by the end of 2018. They compare the chart for 2018 to the one from 2014, when the market gained 11%.

In light of this bullish analysis, we turned to TipRanks’ Top Stocks tool to see which stocks are primed for a strong performance over the next 12 months. Top recommended stocks are based on a TipRanks developed formula, factoring in ratings made by the best performing analysts. Using this nifty tool, we selected the following criteria:

Crucially we sorted the stocks by upside potential to quickly pinpoint stocks primed for growth. We also extracted companies that had an ‘artificially’ high upside potential due to plummeting share prices.

![]()

The result: 10 top stocks with big support from the Street’s best analysts. These are the analysts that consistently crush the market. Here we look at five of these top stocks- and we will publish five more in our next blog post.

So now let’s dive in and take a closer look at these five stocks- all of which share a ‘Strong Buy’ analyst consensus:

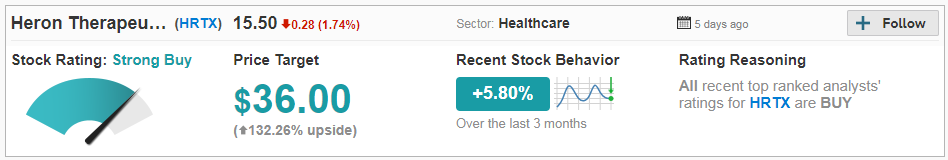

1. Heron Therapeutics (Nasdaq: HRTX)

This innovative biopharma has huge upside potential of 130% according to the Street. And this year HRTX has received only buy ratings from analysts and top analysts alike. Heron specializes in post-surgical pain management and drug delivery.

Cowen & Co analyst Boris Peaker calls Heron the Best Idea for 2018. He believes the stock has room to grow with several catalysts in 2018 that can provide significant upside. This includes HTX-011 Phase 3 data in 1H18 and commercial progress with Sustol and Civanti. According to Peaker, HTX-011 has a shot at becoming the best-in-class opioid alternative for post-surgical-pain. He has a $40 price target on the stock (158% upside). Note that you can click on the Top Stocks screenshot below for further stock insights.

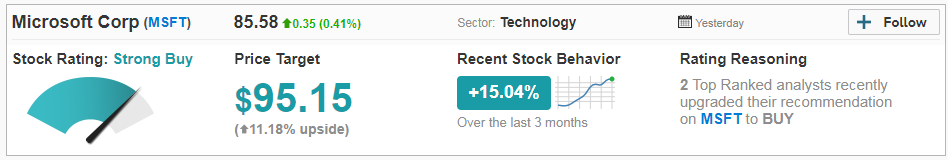

2. Microsoft (Nasdaq: MSFT)

Microsoft, the world’s largest software company, is set up for a very strong 2018. The stock has 100% Street support with 15 consecutive buy ratings in the last three months. These top analysts are anticipating just over 11% upside potential for the next 12 months.

Top Evercore analyst Kirk Materne says he sees a “visible path” to Microsoft reaching a market capitalization of $1 trillion, or $128 per share, by 2020, if not sooner. Azure, Microsoft’s fast-growing cloud platform, and office 365 can power this growth says Materne. He currently has a $106 price target on MSFT (24% upside).

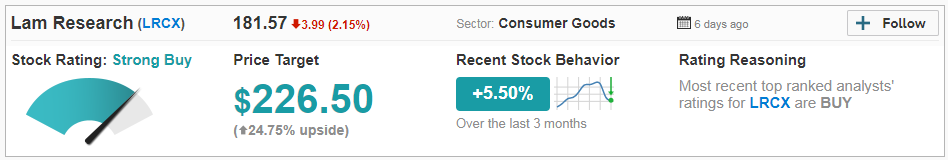

3. Lam Research (Nasdaq: LRCX)

On December 7, five-star Nomura analyst Romit Shah upgraded semiconductor stock LRCX from Hold to Buy. He calls the recent pullback in shares from $220 to $180 an “early Christmas gift.” Shah believes Lam will be the biggest beneficiary in his coverage of the US repatriation tax plan. He says memory fundamentals are strong and expects revenue outperformance for the first half of 2018. Note that Shah is ranked #180 out of over 4,700 analysts tracked by TipRanks. In the last three months, 11 out of 12 top analysts have published buy ratings on LRCX. Given the current share price, these analysts are predicting (on average) almost 25% upside potential.

4. Broadcom (Nasdaq: AVGO)

Semiconductor leader Broadcom has one of the best outlooks from the Street. In the last three months, this stock has scored 24 straight buy ratings from top analysts. With strong Q4 results in mind, these analysts are projecting further growth for AVGO of 23%.

Raymond James’ Chris Caso has just added AVGO to the firm’s Analyst Current Favorites list. He says: “We continue to see a number of tangible catalysts over the next 18 months, including potential revenue upside from iPhone content gains, increasing cash flow from declining capex and the pending Brocade acquisition, and a sizeable return of that cash flow to investors through an increased dividend.” He believes that even though the stock is an analyst favorite, valuation still doesn’t fully reflect this sentiment. Caso has a $335 price target on AVGO (30% upside).

5. Global Blood Therapeutics (Nasdaq: GBT)

GBT is a clinical-stage biopharma that focuses on treating blood-based disorders. The company has just released data from a study using its drug voxelotor for severe sickle cell disease. And as a result, six analysts have reiterated their buy ratings on the stock in the last couple of days. Top analysts are now looking at an average of 80% upside potential for GBT to $70.

Four-star Nomura analyst Christopher Marai ramped up his price target from $50 all the way to $91 on December 11. He says the data presented confirmed prior expectations for voxelotor. He now sees the ongoing Hope Phase 3 trial as further derisked and recommends buying the stock ahead of the study readout in the first half of 2019.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more